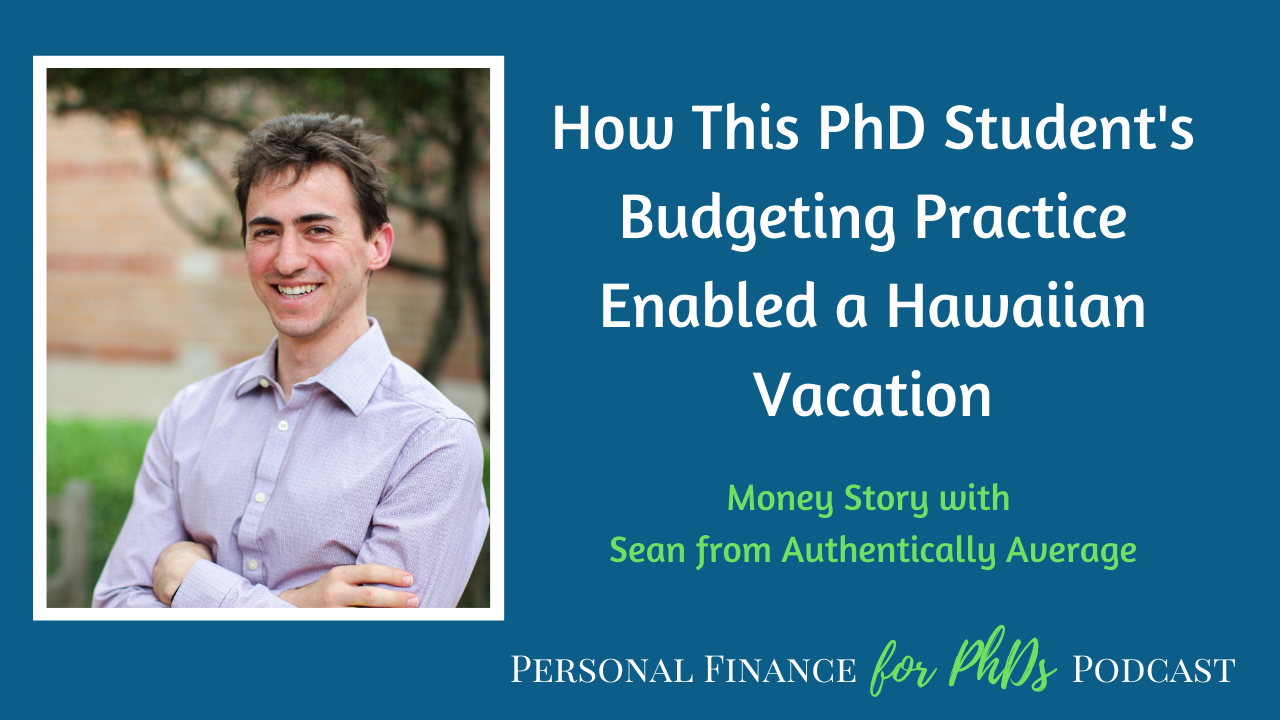

In this episode, Emily interviews Sean from Authentically Average, a fourth-year PhD student at a university in Houston, TX. Sean and his wife have very intentionally set up their budget to reflect their values, and now live and die by their budget. Their top three budget priorities are retirement savings, tithing, and travel. Sean’s budget helps him say “no” to certain areas of spending or opportunities for spending so that he can say “yes” to his travel aspirations. Sean describes a wellness vacation he and his wife took to Hawaii and why travel is such a high priority right now.

Links Mentioned

- Find Sean on his blog, Authentically Average, and on Twitter, Instagram, and Pinterest

- Find out more about Sean’s leadership coaching

- Blog Post: Put Your Money In What You Value

- Blog Post: Travaasa Hana Highlight Reel

- Personal Finance for PhDs: Financial Coaching

- Personal Finance for PhDs: Podcast Hub

- Personal Finance for PhDs: Subscribe to the mailing list

Teaser

00:00 Sean: If you aren’t budgeting yet, try to get there as soon as possible. Tracking expenses is great and it’s helpful to get you in the right mindset. But until you are, I think, front end saying this is the money I will have coming in, here are the places it’s going to go, you can’t really capture your values fully and where to invest unless you’re doing it upfront.

Introduction

00:26 Emily: Welcome to the Personal Finance for PhDs podcast, a higher education in personal finance. I’m your host, Dr. Emily Roberts. This is season six, episode 12. And today my guest is Sean from Authentically Average, a fourth year PhD student at a university in Houston, Texas. Sean, and his wife live and die by their budget. And they have put a lot of effort into making sure that their budget reflects their values. Their top three budget priorities are retirement savings, timing, and travel. Sean describes a vacation they took to Hawaii and the ways they minimize spending in lower priority areas of their life so that they can spend more on vacations and other types of experiential living. By the way, we recorded this interview in September, 2019. Without further ado, here’s my interview with Sean from authentically average.

Will You Please Introduce Yourself Further?

01:18 Emily: I am delighted to have joined me on the podcast day Sean, from Authentically Average. Authentically Average is the name of his blog. And Sean, I’ll just let you introduce yourself to the listeners.

01:28 Sean: Sure. Thanks Emily for having me. My name is Sean. I run the authentically average blog. I characterize myself as a PhD student, husband, chef, pretty much all of the above kind of general life stuff, and that’s the focus of the blogs, every day kind of living. I’m a PhD student in the 3D printing space. I just started my fourth year, so I’m hopefully approaching the light at the end of the tunnel. I live in Houston with my wife, Allie. We have nine children, and by children, I mean plants and most of them are still alive. I’m doing a PhD in 3D printing space. I got my bachelor’s in chemical engineering before that, went directly to grad school, and still trying to figure out what I’m looking for afterwards. I’m thinking like medical device route. That’s a really interesting space for me and the community in Houston is really kind of exploding right now, so I’m really passionate about trying to see that grow.

02:36 Emily: Yeah. Sounds really good. And I understand that your wife is a graduate student as well.

02:41 Sean: She is. My wife is getting her MBA currently. She’s super woman. She’s working full time and getting her MBA on the weekends. A lot of school at our house.

02:50 Emily: Yeah, that’s a full plate. I guess you might not be the busiest one in the household.

02:57 Sean: I think it goes both ways. The nicety of being a PhD student, sometimes, is depending on your advisor, the work schedule is not necessarily lighter, but more flexible. I tend to do a lot more of the, I talked about this briefly on my blog, but like, I tend to do a lot more of the household activities, like the cleaning and cooking and stuff, just because I’m the one that has the time for it. It’s like not always super sexy to talk about sometimes, but if I don’t cook, we don’t eat. Somebody’s got to do it. But we like to share. I mean, she’s got a lot on her plate right now from a professional capacity, so I’m happy to take on those other roles.

Translating Life Values to Your Budget

03:45 Emily: Yeah. And I guess that’s one of those things that you can talk about on a blog that is named Authentically Average. You can talk about your everyday experiences. And money of course, is among those. You recently published a post that was kind of talking about your financial values, which is something that I love to talk about. It’s the foundational concept in personal finance, yet not one that gets a lot of airtime, I feel like, unfortunately, so why don’t you go ahead and tell us about how your values inform how you use your money.

04:20 Sean: Sure. Thank you for that. A couple of weeks ago, the focus of that post was, and we can talk about this in a little bit, but I had gone on a vacation and some people were like, “Oh wow, this is great” and some people were kind of like, “okay, great, you went on this really nice vacation, but your blog is authentically average, how do you reconcile those?” I started thinking about it. I said, okay, I should probably take a step back. The value focus, like you said, is I think central to personal finance and making “smart” decisions with money, but not one that’s talked about a lot. Primarily the goal for that was “here are my values, here’s what I try to invest my money in, and by extension a little bit my time.”

Retirement Savings

05:10 Sean: For me and my wife, we have three top tier values, and then beyond that, everything kind of falls into place. The first one is financial security, so saving for retirement, making sure that we are doing the things we need to do now so that we can live comfortably later. I think that sometimes people get really caught up in this concept of like, I’m doing what I gotta do right now, and that’s fine. And sometimes they are not saving for retirement because they feel like they can’t and that there’s a lot there to kind of go through. And sometimes because they simply don’t think about it. The first time that I kind of understood the concept of like retirement savings and compounding interest and all of that, I started to notice, Oh, wow, there’s a lot of ground that I can make up here in my late twenties and set the stage for how my thirties and forties are going to go. That’s the first piece. The second piece is —

06:14 Emily: Actually, I want to make one offshoot comment to that because of course, saving for retirement is something that I love to talk about. One point that I really like to make when I’m speaking with graduate students or other sort of people on the younger side, younger and lower income side of things, is that if you look at those compound interest calculators, the time is what matters. I mean the time and the amount of money you save, of course they both matter, but the time — you wouldn’t believe what a little bit of extra time will get you in terms of increased returns. And so I always say, whatever amount…like if you feel like you can’t save anything okay, maybe that’s true, but if you can even find like $10, $50 a month that you can start putting away for that purpose, it’s unbelievable what a huge difference that makes on the back end of things, just to have those few extra years. Don’t be discouraged if you can’t save like a thousand dollars a month. That is a very large and unreasonable amount of money for a graduate student level of income, but a smaller amount of money makes a really, really big difference too.

07:18 Sean: Yeah, definitely. And just to kind of keep going on that thread, the stereotypical thing that people give of why you should start investing as early as possible is they talk about if you invest for 10 years from 20 to 30, the amount of money that you make during that time, by the time you retire, will outpace starting from 30 and moving forward. You can’t possibly catch up. Just like you said, sometimes I think people get like, Oh no, I can’t do that much., and that’s okay, but if you can do something, that’s great.

07:55 Emily: Yeah. I think one of the really difficult things that people run into early on is that they’re dealing with debt loads and they might have to clear those first before they can even touch the investing for retirement side of things. But since you’re already starting to invest retirement, I take it you’re either debt-free or you have debt that does not concern you.

08:14 Sean: We are debt free. I would say that my wife and I are very blessed, lucky, strategic, however you want to look at it, I guess. We paid our last debt off last year. I had an outstanding car note that I paid off. We again are very fortunate, I think, to be able to cash flow her MBA. That’s something that I think is a challenge, especially in higher education. I know that the finances for PhDs vary pretty drastically depending on field. In my PhD program, it’s tuition free, and we collect a stipend for working here. When I think about my PhD, I think about it more as job than I think an education of being a student. And I think collecting a paycheck helps me keep that association clear. So yeah, we are debt free. We are investing some. I’d like to be investing more, but also, you know, like you just said, there are different things that we’re trying to take care of and trying to keep all the balls in the air at the same time.

09:23 Sean: Yeah, definitely. Okay. So that is one of your top priorities, is saving for retirement. What’s the next one?

Experiential Living

09:30 Sean: So there’s two more. The second one would be, we have a really big focus on, I call it experiential living, but in the current case it’s travel. I joked about having plant children. Allie and I don’t have any kids yet. We have plans to have kids, but we just don’t have them right now. We have this focus on like, if there are things that would either be impossible or significantly more difficult to do when we have kids and when we’re older, we’d love to do them now. That post that you mentioned earlier about our travel, we went to Maui for a week over the summer. That was born out of like, “Hey, this is a great time to just go and spend a week in Hawaii and just, you know, live it up.” I mean, responsibly, but this is great. After saving for retirement, our next focus is, Hey, we want to have a good time, and for us having a good time looks like going out and exploring.

10:33 Emily: So I was really curious about this term, you just used — experiential living. Right now you said it looks like travel. What are the other things that might fall under that category for you?

10:42 Sean: I guess one thing is I know that some people, their focus is they want this nice X or Y. I think Allie and I, we would much rather save up money for a few pay periods and go to a nice concert or go see a play or a musical or something than buy a new TV or buy something else for the house. We do live in a nice apartment and we’ve decorated and all of that, but we would much rather do something that’s I think a little bit more like out and active. There’s not anything good or bad about that, or any other way. That’s just our preference.

11:24 Emily: Okay. So is this basically boiling down to the personal finance experiences versus stuff debate where everyone has kind of come down to the side of experiences? Is that what I’m hearing

11:36 Sean: Somewhat, yeah. I think that the stuff thing, depending on what the stuff is, is very valuable, in terms of having stuff and, and that’s all fine. But also I know just from, we did the like whole KonMari thing a couple months ago and realized, Oh, I have a lot of stuff. It was nice at the time, but in hindsight I would rather, I think have spent the money that I spent on that stuff on doing something.

12:06 Emily: Yeah. I actually heard this really great thing on a podcast recently. It was on the ChooseFI podcast and the, one of the people that they were interviewing, I can’t remember who the guest was said, something like he strives to have one memorable moment per month, some new thing that he’s never tried before. Travel would certainly fall under that, but it could be like a cooking class or like just doing something different out of your routine, once per month, he has that goal to make a memory, basically, with his wife. And actually it can be the same moment or they can have two different moments, one that each one prefers more per month, but that was his goal. And I thought that was amazing, and I really want to implement it in my life now, because I do feel like months can go by where it’s like, yeah, what happened that was great or notable or important, I’m not even sure.

12:59 Emily: Okay. So experiences, concerts, travel, that kind of stuff. And so right now your focus is doing the things that you would have a harder time doing once you have children. And I will have to say that when I read your post about your vacation, I was like, how do I get rid of my kids for a week, so I can do this. It sounds awesome. What is your third top priority?

Tithing

13:20 Sean: Again, so saving for retirement, travel and experiential living. The third one, honestly, is giving back and tithing. My wife and I tithe every pay period. I know sometimes as graduate students that can seem like a tumultous topic. We already do not make all that much money —

13:45 Emily: Actually, Sean, let’s pause there because some of the listeners might not be familiar with the term “tithe”, could you define that?

13:51 Sean: Sure. In a traditional tithe you would be giving, donating a 10th or some amounts. I mean, tithe literally is “10th”, but giving some amount back to your church family. My wife and I are Catholic. We give back to, we split between the church that we currently go to and then we also support a couple of students through the FOCUS program. They do ministry on college campuses throughout the United States. Good clarification. We give back to our church. For us, we do a traditional 10% tithe. That’s just, I think how we have decided that that’s where we want to put that value at. Does that kind of answer that?

14:39 Emily: Yeah. It’s not something that’s come up on the podcast hardly at all, but we also tithe and have for throughout graduate school, a long time. And it definitely, while I knew other graduate students from our church who also did that practice, it wasn’t something that I felt like was really widespread or something that graduate students could really get a handle on that large percentage. The 10% is a very, very large chunk of your income, but, I feel like tithing for me in terms of like the budget actually pushed us towards what I call percentage-based budgeting. If a 10th of your gross income is going towards that, we also did a certain percentage, it changed over time, starting at 10%, for like saving for retirement and then now we’re up to like 20%, so we’ve increased that over time. And I’m trying to remember, well, taxes are also sort of, not exactly a percentage, but you can convert them to a percentage of your income, so for us, it was like these different goals scale with the amount of money that we make, which I really liked that there was like this flexible percentage. The percentage is fixed, but the amount of money is changes depending on what your income is.

15:51 Emily: I really liked that way of thinking about budgeting, that you should have percentages going towards different things. And it actually goes pretty well with the balanced money formula. I don’t know if you’re familiar with this at all. It basically says that you should keep your necessary expenses below half of your take home pay. And I really liked that as well because, I think for graduate students, there’s this phrase that Dave Ramsey uses that I really like, not for graduate schools, but for people in general, which is something like “act your wage”, something along those lines. I think this percentage-based budgeting, I think, is really appropriate for people who have incomes that they expect to change a lot, like graduate school. Hopefully it’ll be going up alive later on, but if you have those percentages it can keep you really grounded and something can be consistent through those fluctuations in income basically.

16:44 Sean: Right. Definitely. Yeah. We do a similar thing in terms of trying to make sure that we’re doing a percentage breakdown on our budget. One small detail, we do typically everything on net pay, and then also when we get a tax return, I mean, ideally our tax return is zero, right. But if we do get a tax return, then we’ll do the same thing on whatever the return is. But I think it basically shakes out to be the same thing. I have found that to be really helpful. I feel like it helps us recognize where are we essentially overspending in our lives, and conversely, where could we be giving more attention, certainly.

Living and Dying By Your Budget

17:32 Emily: A phrase that I read in your recent post was we live and die by our budget, and that really stuck out because you talked about, I guess, that your budget is a plan for how you’re going to spend your money. And if opportunities arise after you’ve made the, you oftentimes say no to those opportunities, you stick with your original plan. I just wanted to ask you about that. How did you guys put together your budget, and how do you find the fortitude to stick with it?

18:02 Sean: I mentioned this very briefly before, disclaimer, this is not an ad, wish it was an ad, but it’s not, my wife and I use it’s called YNAB, or You Need A Budget. It’s a budgeting tool online that you use, to keep everything in order. One of the, I think, nice things about living and dying by your budget is it tells you how much money you’ve budgeted and allocated to every, whatever category you want to put it in. And if you overspend, the color of the money bar goes from a nice, pretty green to a very angry red color. And that’s just like, I think, maybe potentially a little bit of an immature way, but it’s really reinforcing for me of like, Hey, you made your money angry because you spent more than you allocated.

18:56 Sean: I joke about that sometimes living and dying by our budget. Really, it’s taken a lot of discipline to get to the point that we are now and give yourself grace and patience to get there as you’re working through things and things come up, of course. But we’re in a space right now where we have a set of goals, like I talked about, and a set of values. Sometimes things come up that don’t align with those, or potentially detract a little bit from them and we have to make a mature decision on like, Hey, is it worth us to do this? So one of the things I talk about in that post is, a friend of ours came to us and said, Hey, we want to go to this football game, last minute. Allie and I are huge college football fans, I went to a big football school for undergrad. Great, right, in terms of an interest standpoint, I think that’s great.

19:55 Sean: We started to look at the finances and said man, this is going to be like a thousand dollar trip just out of the blue. And I think at the beginning of the year, had we started the year and said, Hey, we want this to come up and we want to plan for this — great, okay, we’ll budget for it. But a few weeks out, we had to say, no. I mean, first of all, based on our budget, we literally did not have the money to do it without taking money from other standpoints. I really struggle with the idea of pulling money that we had saved for retirement out of retirement to go to a football game. But more than that, I think it’s sometimes difficult when you…This is always a challenge when you have very diverse friend groups is like, everybody has their own different set of values. And I want those people to understand, like friends of mine, that sometimes I to turn things down. Like, hey, I love you guys. You’re great, I appreciate everything about you, and I appreciate our relationship, but just understand that me not wanting to come out, or me not wanting to do this last minute, isn’t a reflection on like our relationship and is a reflection on I just don’t have the money for it according to what my wife and I decided it was important to us.

21:11 Emily: Yeah. There’s another blogger, content creator in the personal finance space, Paula and her brand is Afford Anything. And so her tagline is kind of like, “you can afford anything, but you can’t afford everything.” She’s really, like you were just saying, you have to get really clear about what’s important to you because you want to be able to say yes to the things that are at the top of your list. And that does mean saying no to the things that fall further down and that’s hard. But you can’t say yes to everything. If you say yes to everything, you’ll end up saying no to the things that are most important to you, if you accept every opportunity that comes your way.

21:52 Emily: I have to say though, your story reminded me of when I was in graduate school. I went to Duke and Duke won two championships while I was there 2010 and 2015. 2015 was technically after I defended, but I was still enrolled as a student and I still had tickets to games and stuff. So anyway, in 2010, of course you never know, going in to the tournament, how it’s going to turn out. And at the last second, we had an opportunity to go to the Final Four. Duke went, and my husband and I had the opportunity to attend. They were giving away tickets for students. It was actually free. The tickets were free. All you had to do was get there and stay there. And we really deliberated, and I don’t know that it came down to mostly a financial decision. There were other time reasons why we decided not to go. We had already traveled actually the previous year to see them play and they hadn’t advanced, and so we already had like, kind of that disappointment. So we decided against going, and of course in 2010, they ended up winning, same story in 2015. That’s just one of my major regrets from when I was in graduate school, because I was a fan, that I let anything stand in the way of like attending those events. So I do think that my main regrets from graduate school, in terms of my personal life were things that I didn’t do that money played into why I didn’t do it. It probably wasn’t the whole situation, but yeah, there’s two times I can point to an opportunity came my way and I said no to it, a very reasoned decision, and I really think that was the wrong way to go.

23:27 Sean: Yeah. And sometimes I think that that’s a struggle because we’ve done a couple of things too, where it’s like, Oh, this is such a good opportunity to do this thing. Sometimes, and I say this with a mountain of salt, occasionally we will not live and die by the budget. And the only way that that works is to have intentionally over allocated somewhere else, so that the total amount of money is still there, like the money to cover a different decision is still there. It’s not like we’re living outside of our means, but we do give ourselves a little bit of grace. Sometimes I’m like, this is a really big deal. That trip to Hawaii was pretty much entirely planned for, but there were a couple of things once we got there, that was like, you know what, we’re here, I think we’ll regret this thing if we don’t do it, let’s do it and we’ll figure it out.

24:27 Emily: Yeah. I think that strategy of over saving or just saving for things that you don’t know quite what you’re saving for — at some point a friend will invite you to do something, at some point you’ll have an opportunity to come your way that you’ll want to say yes to at the last second. And I think the way that most people who are not on top of their finances would handle it would just say, okay, I’m going to put it on a credit card, I’ll worry about how to pay for it later, which is not a great strategy. But if you save in advance and you’re just not totally sure what that money is going to go for, but you’re pretty sure something’s going to pique your fancy along the way then you can be able to say yes again to those opportunities, knowing that it’s still within everything you’ve allocated for an advance,

25:08 Sean: Just a small insight, we have a category in our budget called “stuff we forgot to budget for”, and we put a small amount, however much, in there every pay period just because inevitably something comes up. Now, if it’s an emergency, we have separate money set aside. You mentioned Dave Ramsey earlier — we have a separate emergency fund set aside for that kind of thing. This is more like your friend asked you to do something, you have an opportunity to go watch Duke win a championship, whatever.

25:44 Emily: Yeah, exactly.

Commercial

25:48 Emily: Hey, social distancers, Emily here. I hope you’re doing okay. It took a few weeks, but I think I have my bearings about me in my new normal. There is a lot of uncertainty and fear right now about our public and personal health and our economy. I would like to help you feel more secure in your personal finances and plan and prepare for whatever financial future may come. You can schedule a free 15 minute call with me at PFforPhDs.com/coaching to determine if financial coaching with me is right for you at this time, I hope you will reach out, if only to speak with someone new for a few minutes. Take care. Now back to our interview.

Frugal Tips for Experiential Living

26:34 Emily: So I’m wondering if you have any ways, any sort of frugal things that you’ve done in your life that help you have these experiences that you want have. Either minimizing the money that it takes to do those things or minimizing other areas in your budget so that you can free up more money for your top priority. Are there any like really good strategies you use in that vein?

26:58 Sean: I think the stereotypical student might fight this a little bit. I’ll start with the like ways of like daily life first. We cook 99% of our meals. That’s just the way it is. For me that’s two reasons. That post that I wrote is primarily about investing your money in what you value, but there’s also a small segment on investing your time in what you value and no question about it, cooking for yourself takes it takes time. It costs money to go buy groceries and it takes time to cook those meals. I think it’s easier to go out to eat, from a time perspective or pick up quick ready meals and that kind of thing, but from a time perspective, like at that point, I’m investing in my health. It’s almost exclusively healthier for you to cook for yourself than it is to go out to eat, and it’s almost exclusively less expensive to cook for yourself too. In that post I talk about, Allie and I have been discussing potentially giving ourselves a little bit more room on this and kind of grace on this for when we want to go out. We don’t go out to eat ever. Like once every couple of weeks and the reasoning for that is, whatever amount of money I would spend on going out to eat a couple nights a week is better suited towards saving for Hawaii, or, we’ve been married for just over a year, for our honeymoon we went to Italy. We spent two weeks there. That’s not an inconsequential trip size, and the only way that that works is you’re making cuts, so to speak, elsewhere in your life.

28:37 Sean: The other thing for us has been we’re busy people. She’s in school part time, well, no she’s in school full time and working full time, and I’m working full time and doing things at home. And so it’s really important for us to invest in our marriage. Regular date nights are important, but it doesn’t always have to be this five star restaurant. Those types of things are nicem, but I think I also get 90 plus percent of the relationship building component from that type of date from going to somewhere kind of casual, hole-in-the-wall, or going on an experience. We talked about this this morning, actually. It’s been a couple weeks since we had a formal date, and one thing that we’re going to do next week is we’re going clothes shopping and we’re going to Marshall’s-hop. There’s like seven of them within a 10 mile radius of us and we’re just gonna — we found that when we hit, we really hit there, but they’re very hit and miss, but there’s a lot of them, so we can kind of hop between and see. I think that that might sound somewhat silly to some people, but for us, we like investing in clothes that makes us feel good and feel professional, but also not breaking the bank and this “adventuring”, so to speak, and helping each other try things on — that I think is a fun relationship building activity that literally the travel aspect only costs the gas, and then we would have budgeted for the clothes. There’s that aspect on like life-hacking.

30:11 Sean: From a travel hacking standpoint, honestly, it’s just time. You have to decide how much your time is worth, but we always look for great deals on hotels and flights. Google has a flight tracker that you can use. It’ll send you alerts when your flights fall. I do the same thing for a lot of the hotels. A lot of third party websites are great. For Italy, actually this, this is a great story. For Italy, the flights were going to be like, I don’t remember like $1800 a piece or something, like a lot of money. We went in May, so like the beginning of high season, I get it. Then, the day before I was going to buy, because they weren’t falling, I said, “Oh, let me just look on another website.” I went on, I think it was Priceline or one of the third party website and it was like half that, together. I was like, “Yes, I’m absolutely doing this. We’ll take a weird layover to save half the cost. You could write a book about that, but that’s the things that I think of.

31:15 Emily: Yeah. I think when your goal is to have experiences and make memories and so forth, I guess there’s been research on this that like the anticipation of the experience is a big component of your satisfaction with it. And so taking the time to plan, and do whatever travel hacking and price comparisons and all of that, it actually enhances like your ultimate experience when you put a lot of effort into it upfront. I don’t know, to me it’s a little bit counter-intuitive, but yeah. So pursuing these travel hacking strategies, um, in addition to saving money can actually make you feel better about the whole thing. I guess what I was thinking about when you’re talking, especially about like the food and not spending so much money on eating out and so forth. That was a strategy that we used also. We cut out basically all kinds of convenience food, in favor of cooking for ourselves. And that is like a little bit of a sacrifice because yeah, you have to plan it a little bit more and all that, that goes into cooking. But for us, like for you, the money that we were not spending on convenience eating went towards our travel fund. And so when we knew exactly where the money that we would’ve spent on one thing was going to go, if we didn’t actually carry through with the eating out or whatever it was, that makes the whole thing a lot more palatable. It makes the whole thing go down easier if you know, okay, yeah, I’m sacrificing a little bit in this moment right here, but that is going to enable something really fantastic later on.

32:43 Sean: Right, right, right, right.

32:45 Emily: Any other frugal strategies around those things, either minimizing expenses on things you really want to do or cutting expenses and things that are not such a high priority?

32:54 Sean: I think the only additional thing that I’ll add is — it’s especially common, I think because like I, as a PhD understand or PhD student, rather, my time is limited. I think that my time is a little bit larger than some other people’s because I just try to make a point of, I’m only working X hours this week. Like this is my job and I’m putting this much into it. And that sometimes works for people and sometimes doesn’t. But I see a lot of, because we have such little free time, convenience buying and convenience spending somewhat to kind of what you, you mentioned earlier. And I think in some ways you do have to give yourself a little bit of that because the amount that you stress over not making convenient spend is also a use of resources, maybe not for the best. Just watch it. I always go back to “live and die by the budget”. Until I had a budget that I like actually did religiously every week and every pay period, I didn’t have a clue. And I started to look at my spending habits and said, man, I didn’t realize I was spending this much on snacks, or this much on cable and this other thing that I don’t even use. It just, it never occurred to me because I was always tracking my spending after the fact that never really looking forward any further than the next couple of weeks.

34:20 Emily: Yeah. I mean, tracking your spending is an amazing thing to do as like a first step. It actually does start to change your behavior in many cases. But if you’re just tracking it as a passive activity and it’s not actually balancing, okay, well, where do I want my money to go? And do I prefer it here? Or do I prefer it there? That’s what you have to do with your budgeting. They’re both really useful, um, activities, but I guess once the shock of the tracking wears off and you make whatever sort of subconscious changes you’re going to want to make from that, you need to start budgeting to get that further of value add from the activity.

When Budgeting Pays Off: Sean’s Trip to Hawaii

34:54 Emily: So we’ve teased this enough. Tell us about your trip to Hawaii, that made me so jealous.

35:01 Sean: We went to Maui specifically. We went to Hana, which is a very small town on the East coast of Maui. Allie was really into this idea of like a wellness retreat. And I did, I think the stereotypical husband thing that I hate and I was like, what are you talking about? No. And then I started to look into it. I was like, Oh, this actually sounds pretty awesome. So I was like, okay, yeah, let’s go for it, sure. There was a resort there called the Travaasa, just right in the town. Hana is not really the type of place that you go to and stay at unless you go to this hotel. There’s not a city center. It’s people that live there and this hotel and that’s it.

35:45 Sean: So we went and we said, okay, you know, let’s do it. This sounds great, let’s go. The only thing I’ll say about traveling to Hana is getting to the airports, great, but there’s a very famous road there called the road to Hana and it’s like 90 degree turns the whole way. It’s 40 or 50 miles and it took us three hours. You’re crawling and it’s crazy. But scenery is amazing and beautiful. The little food stops on the way are great. And then once we actually got there, it was just like paradise. It’s still the States, so there is cell service, but there’s no wifi available. The cell service is kind of shaky, we turned our work phones off, and just lived, and it was awesome.

36:34 Sean: There’s there was a lot to do there. They have a spa on site. I’m not a huge massage/spa person, but I was the most relaxed I’ve ever been in my whole life that week. The food was awesome. There was waterfront yoga and like paddle boarding and horseback riding and just like all of this stuff that we don’t ever do in our daily lives. It was really awesome to just for once I think go and just exist. My wife and I, in particular, but I think more generally PhD students and other graduate students, you’re just going nonstop all the time, and there’s not really any moment where you kind of just sit back and you’re like, “Hey, I’m not thinking about anything about tomorrow, except whether I want to do this cool thing or that cool thing.” I don’t know, I think that was a nice refresher for us.

37:34 Sean: Everything about it was super chill. The only not super chill thing about it is, there was actually a wildfire on the West side of the island while we were there. We went back to catch our flight and all the planes are delayed because they’re trying to get people that live there, like out of danger. Things are, I don’t want to say fine because you know, wildfires are extremely dangerous and there was a lot of damage there. People are generally fine. There were a lot of people that got helped. Everybody was safe. I don’t recall seeing any reports of fatalities, which is incredible. But for us, we’re literally there with our bags in a very small airport on Maui and we’re just like, “all right, guess we’ll chill.” I think a small price to pay, obviously relative to potentially losing your home in a fire, of course. But for us, nobody told us anything. Our airline didn’t give us any updates. We just got there and they were like, we’ll see what happens. Like I said, there’s a much longer post about it with pictures that are describing it way better than I can tell it, but highly recommend. Would definitely do it again. It was great.

38:54 Emily: What really struck me about the, your description of this vacation was that I didn’t do anything like that when I was in graduate school, except for my honeymoon. The honeymoon was relaxing. I mentioned that we saved a lot for travel before, but it was all obligation travel, all of it. We were usually traveling domestically to either see our families, or go to weddings, or attend reunions. Other stuff where somebody else was dictating the schedule, the timing, the place, all of that. I’m not trying to say that was a…We wanted to do it. We wanted to do all that obligation travel. Going to weddings is really important to us. That’s a high value for us, but it just kind of squeezed out any other possibility of taking a vacation that was just for us and just for the purposes of recuperation. There were always other purposes for the trips — seeing certain people, or witnessing certain events. Looking back on it, I did not give myself a proper amount of rest, throughout that process. And it’s still something that I struggle with, so I’m really glad that you guys, made it a priority, made the time for it. Hopefully you’ll do it a few more, maybe not the same vacation, but something similar, a few more times during graduate school so you guys can finish strong and finish healthy. So that sounds amazing, and yeah, we can point people to the post from the show notes.

Financial Advice for Early Career PhDs

40:23 Emily: As we finish up here Sean standard question that I ask all my guests — what is your best financial advice for another early career PhD? And that could be something related to what we’ve talked about today, or it could be something entirely different.

40:36 Sean: Sure. Just because we’re towards the end, I’ll give two quick ones, because I think they’re both very important. The first one we’ve touched about a few times is if you aren’t budgeting yet, try to get there as soon as possible. Like you said, tracking expenses is great and it’s helpful to get you in the right mindset. But until you are, I think front end, saying this is the money I will have coming in, here are the places it’s going to go, you can’t really capture your values fully in like where to invest unless you’re doing it on the front end. So that’s the first thing that I recommend.

41:12 Sean: The other thing is, depending on your program, especially for PhD students on grants and fellowships, so kind of take that with a very specific niche market in mind, sometimes you will be allowed to pursue other things outside of your degree and have side jobs and side hustles. I know, recently talked to another student, here in Houston who, I think was baby-sitting or dog-sitting. Am I remembering that right?

41:39 Emily: Pet-sitting.

41:39 Sean: Pet-sitting, right. And like, okay, great. So she had a side hustle and that’s awesome. Sometimes you can and look around for what things are available because the extra cash is really useful. Sometimes you can’t, on paper. They expect you to be in the lab, and if you have time that you could be giving to another job, you should be spending it in the lab. And I think my recommendation for that is more of a career-related one. You’re a graduate student and you’re contributing to the academic space. That’s beneficial to the field. It should also be beneficial to you, and so I think that I always recommend that students take opportunities that they find, when they become available, in stride, because it may be a value add to their career or to their finances, that isn’t necessarily a value add to their academic education. And that’s okay. I think sometimes we get this feeling of guilt of like, I’m not working hard enough in the lab. And if that’s true, okay, work harder in the lab, but if it’s not true and you can be doing other things that are beneficial for you, it’s okay to do things outside of lab. And I really struggled with that when I first got to graduate school, and I see that as a common struggle now.

42:55 Emily: Yeah, I guess, so I’ve been reading a lot about like time management, recently, to work on my own time management practices, and I guess one thing I’ve learned, I’ve been reading and listening to a lot of Laura Vanderkam’s stuff, and so she references research that’s on…First of all, that people don’t work as much as they say they do. Like people who are reporting that they work 80 hour weeks, almost always are never working more than like 55 hours a week. They may be at work for 80 hours a week, and that’s not a good return on your investment of time, is just to be around more. You should be resting or doing other things instead of that. But another part of that is that there’s sort of an optimal amount of work that you can put into something in a given week, and once you start going beyond that, your returns for the amount of time you’re putting in decrease and decrease and decrease. After 40 or 45 hours, you may be putting in more time, but you’re not necessarily getting that much more of it. It’s kind of this like 80/20 principle.

43:51 Sean: Yup, definitely.

43:52 Emily: Yeah. So I’ll just say like on that time management component, that it can really be beneficial for you if you don’t consider research to be like a black hole, you just throw more and more and more and more time into, that’s not necessarily the best way to approach it, but rather more like managing your energy and managing your time as well. And if that gives you time to pivot to a side hustle or hobby or, you know, exercise or whatever it is you want to do, that’s probably going to end up giving you more energy rather than taking away from your work. Do you know what I mean?

44:22 Sean: Right, definitely.

44:22 Emily: Just like taking vacations, you don’t do it necessarily for the reason of being more productive, but you probably are more productive when you come back from it.

44:29 Sean: Absolutely.

Where to Find Sean Online

44:33 Emily: Where can people find you if they want to read your blog or follow up with you elsewhere?

44:37 Sean: Sure. I’ll send these over so you can put them on the show notes as well. The name of the blog is Authentically Average. It’s authenticallyaverage.com. No hyphens or spaces. On Instagram and Pinterest I’m @AuthenticallyAverage, one word. Twitter was a little weird and I have @AuthenticAvg. That’s where you can find all of the different ways to connect with me. The two posts that we talked about today are up as pins on Pinterest. I can send those over and people can look at them if they want to. I love using Pinterest, just as a side note, I think it’s been really fun. If you are in the 3D-printing space and see me at an academic conference, come and say hey. I’m not shy. If you happen to recognize me, I’m happy to talk and all of that.

43:33 Emily: Yeah. Well, thank you so much for coming on the podcast and having this great discussion with me, Sean.

45:37 Sean: Yeah. Thank you for having me

Outtro

45:39 Emily: Listeners, thank you for joining me for this episode. PFforPhDs.com/podcast is the hub for the personal finance for PhDs podcast. There you can find links to all the episode show notes, and a form to volunteer to be interviewed. I’d love for you to check it out and get more involved. If you’ve been enjoying the podcast, please consider joining my mailing list for my behind the scenes commentary about each episode. Register at PFforPhDs.com/subscribe. See you in the next episode, and remember, you don’t have to have a PhD to succeed with personal finance, but it helps. The music is stages of awakening by Poddington Bear from the Free Music Archive and is shared under CC by NC. Podcast editing and show notes creation by Lourdes Bobbio.