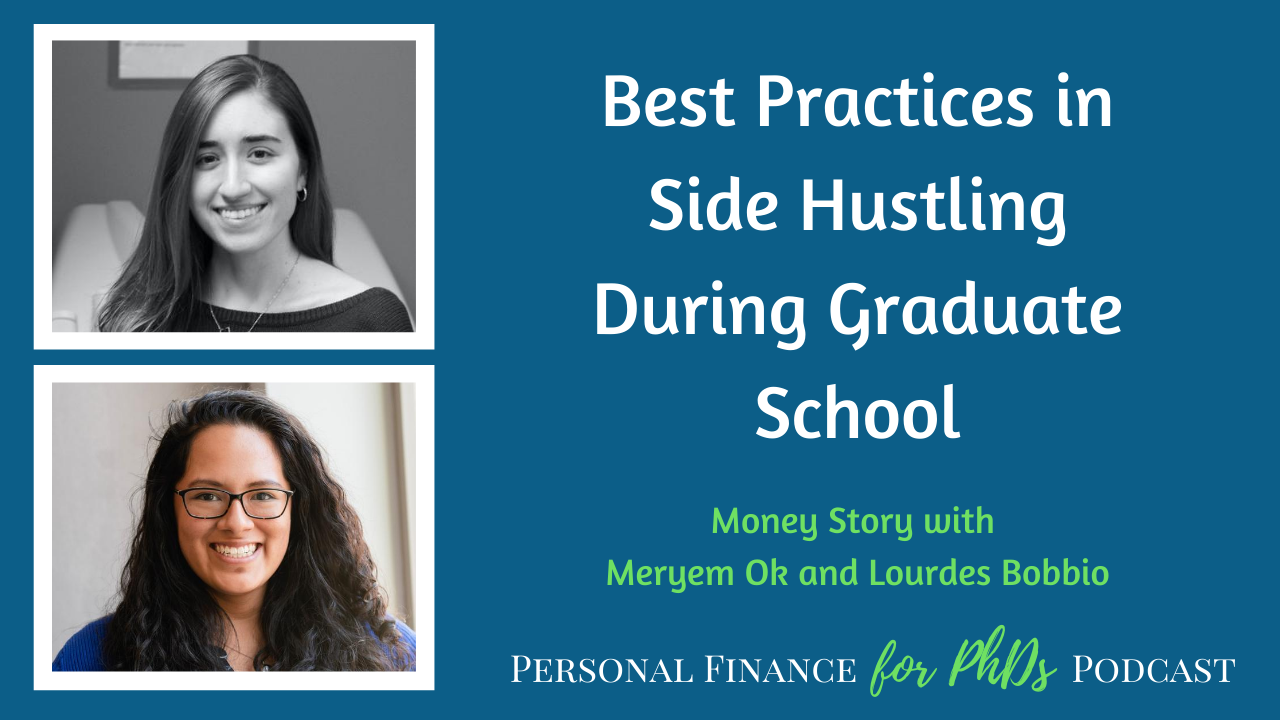

In this episode, Emily interviews Lourdes Bobbio and Meryem Ok, two PhD students who work on this podcast as virtual assistants. Today’s conversation is all about side hustling! Lourdes and Meryem each give their perspectives on why and how they started side hustling, how they manage their time, and how they handle their self-employment income with respect to taxes and budgeting. Throughout the interview, you’ll get a behind-the-scenes perspective on how this podcast is produced. The end of the interview is a discussion of the unexpected benefits Lourdes and Meryem have experience from working on the podcast.

Links Mentioned in the Episode

- Find Lourdes Bobbio on Twitter @lourdesb1012 and Meryem Ok on Twitter @Meryem_T_Ok

- Related Episode: This NDSEG Fellow Prioritizes Housing and Saving for Mid- and Long-Term Goals

- Related Episode: This PhD Student in Texas Side Hustles to Overcome Her Unique Financial Challenges

- Personal Finance for PhDs: Financial Coaching

- Personal Finance for PhDs: Podcast Hub

- Personal Finance for PhDs: Subscribe to the mailing list

Teaser

00:00 Meryem: Every once in a while, if I need to make an extra purchase or a gift, I will kind of rationalize with myself, “Okay, I was able to make some extra income this month with the side hustle so it’s okay to spend that extra money.” And essentially that’s not a super cut and dry method, but it sort of helps me at least to rationalize my additional expenses and not get too anxious about finances during grad school, which is really, really nice to have that cushion outside of my usual budget.

Introduction

00:36 Emily: Welcome to the Personal Finance for PhDs podcast and higher education in personal finance. I’m your host, Dr. Emily Roberts. This is season six, episode 18 and today my guests are Lourdes Bobbio and Meryem Ok, who are both PhD students and work with me as virtual assistants on this podcast. Today’s conversation is all things side hustling. Lourdes and Meryem each give their perspectives on why and how they started side hustling, how they manage their time, and how they handle their self employment income with respect to taxes and budgeting. Throughout the interview, you’ll get a behind the scenes perspective on how we produce this podcast. We close the interview discussing the unexpected benefits. Lourdes and Meryem have experienced from working on the podcast. Without further ado, here’s my interview with Lourdes Bobbio and Meryem Ok.

Will You Please Introduce Yourselves Further?

01:31 Emily: I’m bringing you a little bit of a different interview today. This is the first time on the PF for PhDs podcast. We have had three people on the call at once, that is two guests interviewees, and it’s really special to me because the people I’m interviewing today are my virtual assistants who work on the podcast with me, Lourdes Bobbio and Meryem Ok, and they’re both PhD students. We’re going to get into more about side hustling today, like the side hustle that they do with me and their experience with that, maybe their experiences side hustling with other people. So yeah, we’re talking side hustling today and I have my two guests with me. I’ll have you introduce yourselves, so Lourdes, why don’t you go first?

02:10 Lourdes: Hi everyone. My name Lourdes Bobbio. I’m a fifth year PhD candidate at Penn State University in the Department of Materials Science, and I work on additive manufacturing of metallic materials.

02:23 Emily: Yeah. Lourdes was actually a guest on a previous podcast episode and we will link that from the show notes. We did a budget breakdown with Lourdes, so we talked through her budget there in State College and Meryem, please introduce yourself.

02:35 Meryem: Hi, my name is Meryem. In 2016 I started the MD PhD program at the University of North Carolina at Chapel Hill — go Heels. After completing the first two years of med school in 2018, I started my PhD in UNC-NC State’s joint Department of Biomedical Engineering. Currently I am working in the Magnus Lab, developing tools to better understand human intestinal STEM cell fate. And I’m happy to say that I’m officially a PhD candidate as of two days ago.

03:05 Emily: Yes. Congratulations! We will record and release this in August 2020, so it’ll still be fresh news by the time this episode comes out. I’m just delighted to have you both on.

Why Side Hustle In Grad School?

03:17 Emily: First question here is why did you decide to start side hustling in graduate school? Why don’t we still go with Lourdes first?

03:25 Lourdes: Financially, I was doing actually pretty okay with my stipend. As Emily mentioned, I was previously on an episode where I discussed my NDSEG fellowship, and so I generally have a somewhat higher stipend than my peers and State College has a generally low cost of living. So financially I was doing, in terms of I had enough money to live on and for extras and to save, but the reason that I got into side hustling was so that I could have money to contribute to a Roth IRA. I think Emily has done an episode on this earlier in the year, but as of this current year 2020, fellowship recipients are now eligible to contribute to a Roth IRA, but previously they were not. I started one before I was being paid on fellowship and I wanted to try to contribute at least a little bit of money monthly to that, so having that side hustle, self employment income helped me to be able to do that and continue to contribute, even though I couldn’t with my general fellowship income.

04:32 Emily: That’s so strategic. I love that. It is the advice that I was giving out for people who had multi-year fellowships, is to consider that self-employment side hustle. Meryem, why’d you decide to start that side hustling.

04:44 Meryem: For me, I guess coming into medical school, I had actually taken a gap year and was able to transfer a lot of those funds into starting an IRA, so for me, it was less of a strategic approach and more just that I’ve really always had a lot of interests in gaining new skills and collaborating with other people outside of my primary career interests. I think specifically, actually, as far as video and podcast editing, I was inspired by my dad who is always the one recording all of our family memories and making home videos. And he actually founded and produced a public access TV show called Turkish American TV. That’s been going on for 15 years, completely as a passion, volunteer project. I remember many times he’d rope me into his projects and show me how to use video and editing software, and I really just felt lucky to have his guidance. I feel like I inherited his eye for detail since that’s helped me be more confident in marketing myself as a freelancer who just really genuinely enjoys editing. I guess for me, just as someone who needs to have hobbies and tasks outside of work, I wanted to try something new and also make a little extra income in line with my career development goals.

06:03 Emily: Maybe we should say what you all actually do for me with the podcast, to give you credit where credit is due. As the listeners know, I conduct the interviews for the podcast, but kind of everything that happens after that, I hand off to you two. So you do all the video and audio editing of the interviews, and you compile the show notes, which are actually full transcripts. It’s more work than it sounds actually. We use an automated tool to generate the first transcript, but then you go through with a careful listen and make it actually readable, which I really appreciate. And you also write the social media posts that we do for each episode, and you schedule things. There’s a few other tasks in there too, but those are the major pieces of work. It’s been an amazing help for me.

How did you find your current and previous side hustles?

06:44 Emily: I know how you two landed this side hustle, which is that I reached out to my mailing list when my last VA decided to leave the position. Thankfully, she gave me a lot of notice. I reached out to my mailing list and said, “Hey, podcast listeners, do you want to work on the show?” And you two both volunteered to do a trial episode and ultimately your work was great, so I hired both of you. But I don’t know if that’s the first side hustle you’ve had in graduate school, or whether you were even particularly looking for that kind of side hustle, or really how it came about kind of from your end, so why don’t you tell us. Lourdes?

07:19 Lourdes: I had done a couple of side hustles through freelancing websites. There was actually one particular one that was captioning and transcription of usually short audio files through this company called Rev. It’s basically just pick and choose these audio files and you get paid. It’s a very low paying job, but it was something that I did just sort of in my spare time. When I heard about the opening on this podcast, I was like, “Hey, this is perfect. This is like what I was doing before, but on sort of like another level and sort of a next step up.” It seemed like a perfect fit for what I like to do in general anyway, just on a higher level.

08:07 Emily: Yeah. Meryem, how about you?

08:09 Meryem: Yeah, that’s so funny, because actually that’s the first time I’m hearing this. For those who don’t know Lourdes and I actually went to undergrad together, so the fact that we serendipitously ended up as virtual assistants for the same podcast and kind of working together was phenomenal to experience and to find out. For me, I also was trying to look into doing these things independently through similar websites, but it was not really a sustainable effort or something that was really worth the rate that they were paying. And I felt like it’s so much more useful to be able to use these skills and also benefit from all of the knowledge that I’m gaining as I’m editing these episodes, which is relevant to us as graduate students trying to better our personal finances. Really it was a no brainer when I saw that email from Emily and reached out and I’m just so glad that it worked out and that we were able to take turns, Lourdes, and still have an activity shared together despite the distance and the years since college.

09:15 Emily: Yeah, that’s why I reached out to my list first, to try to hire for this position. I hoped that there would be people who would actually be interested in the material as well as having the skill set to work on the episode, instead of going with an independent agency or something, which I could have done, maybe if it hadn’t worked out, initially. I wanted to go to people who I sort of had a relationship with, and actually it happens to be the fact that I had corresponded with both of you over the years before that — we mentioned Lourdes had been on the podcast and Meryem has been on my mailing list for a long time, so we had exchanged emails and I think had call or two in that time. It was really helpful that I knew your names at least, when it came time for people to apply for that position. Meryem you have, since we started working together, taken on another podcast editing position, why don’t you talk about how that came about?

10:08 Meryem: Yeah, that’s right. Actually, I owe it to you, Emily, for alerting me to another side hustle opportunity in podcast editing with the AcaDames podcast, which is another awesome podcast focusing on women in academia. Earlier this year, I remember Emily sent an email to us, letting us know that AcaDames was looking for help since their previous student executive producer was graduating soon, and they wanted to have somebody to overlap during that period of transition. I reached out to them about that position and thankfully we were a good fit. Now I just feel really lucky that I get to work with these two amazing podcasts. My work with them partially involves editing, but also involves a little bit more of administrative and social media management work. I’ve just learned so much from both podcasts and I’m excited to be involved. And also again, benefit from all of the career development advice that I’ve been receiving just by working with both of them.

11:09 Emily: Yeah. I think it’s kind of interesting that for these positions, this podcast virtual assisting position and the AcaDames one, it sounds like we’re looking for someone who’s going to be doing a multiplicity of different things and you come in with maybe some subset of the skills, like Lourdes, you had the transcription type experience, but then we’re asking you to learn a bunch of other stuff which expands your skillset overall, even if you’re not going to be career podcast editors. I assume you’re going to do something with your PhDs, but it’s nice to have that kind of side work, I think.

Balancing Side Hustles, Grad School, and Personal Life

11:36 Emily: Between the side hustle, your graduate work, everything else that’s going on in your life. I know you two are both in relationships — Meryem, you recently got married. Lourdes, you’re engaged. You have a lot of stuff going on in your lives. And so how do you fit in this side work that you’re doing, along with everything else? Lourdes?

11:55 Lourdes: I guess for me, what attracted me to the side hustle specifically was that it’s something that I can work on from home. I don’t have to go anywhere to do anything, and I can kind of fit it into my schedule. It’s very flexible. Emily is super nice, in that she gets us a lot of heads up time between when we get audio files and when they’re going to be released. So there’s a lot of flexibility in the position, which is definitely something that I was initially looking for in side hustles, as well, when I was doing the more freelance, low paying transcription job, it’s something I could do just in my own time, so that’s been helpful in terms of being able to work it into my schedule, work my schedule around it.

12:38 Lourdes: Also, like Emily mentioned, I’m engaged, but for the last year I’ve also been long distance, and so I’ve had a little bit more free time. It’s also been really great during this work from home time, to have something else to do. Now that you’re pretty much primarily at home, we’ve all been at home, things can get a little bit stale, but having a lot of different activities to do has been really helpful in managing my own mental health. I don’t feel like I’m only at home to do work and I get to sort of have some variety in my day, so that’s been nice.

13:22 Emily: How about you Meryem? How do you do the time management aspect?

13:25 Meryem: Yeah, I want to echo everything that Lourdes said. I think it’s really nice, even without a pandemic, but especially during a pandemic, to just have something else to turn to when you need a break from grad school or just want to use a different skill set for a bit, or just kind of escape from the world. And right now, especially because of COVID, I tend to work a later shift in lab, and my understanding is Lourdes does as well, so the rest of our work is pretty much done remotely, which makes it easier, but also I have to be a little bit more diligent about priority setting and setting boundaries, because it is so easy to kind of just switch between projects both between my main job as a grad student and then my side hustles and leaving room for my personal life.

14:07 Meryem: Usually I’ll try to do this by reserving chunks of time to work on the podcast editing, either in the mornings or late in the evenings after my shift and maybe the weekends to kind of catch up, which is very useful for particularly busy weeks. I think just like setting deadlines and trying to stay organized to prioritize all the things that are going on is helpful. I will say that I recognize that it’s probably easier for me to manage everything that I have to do given that I don’t have too many responsibilities outside of my work and extracurriculars right now. I don’t have any human babies, but I do have a fur baby named Sabine, but she’s pretty self sufficient. I think overall it is pretty much managing expectations with myself and now with my husband, but overall I think, much like Lourdes said, you get into a workflow and we do have a lot more time at home so that does help a lot.

15:06 Emily: I’m just thinking how I would answer if I asked this question of myself, of how do I manage my time? Because I do have two human babies and no childcare in a pandemic and it is definitely more challenging now than it was a few months back to be handling my schedule. But I think what Lourdes brought up initially, the fact that in our schedule we have basically a two week cycle from when I get the raw interview to you two and then we have a two week process before publication, and Ithink that really helps. I know a lot of side hustle jobs are really quick turnaround, like super short deadlines, and it’s not even really so much on your end, like I’m giving you guys a lot of time. I need a lot of time to do my part of the process as well, because I can’t necessarily jump on a response right away, because it’s just a busy long day every day right now.

Commercial

16:00 Emily: Hey, social distancers, Emily here. I hope you’re doing okay. It took a few weeks, but I think I have my bearings about me in my new normal. There is a lot of uncertainty and fear right now about our public and personal health and our economy. I would like to help you feel more secure in your personal finances and plan and prepare for whatever financial future may come. You can schedule a free 15 minute call with me at PFforPhDs.com/coaching to determine if financial coaching with me is right for you at this time, I hope you will reach out, if only to speak with someone new for a few minutes. Take care. Now back to our interview.

Budgeting Side Hustle Income

16:46 Emily: Okay, so personal financial show — let’s talk about the money that’s associated with the side hustle income. What are you doing with the money from your income? Does it have a particular job to do in your budget or how are you handling it generally? Lourdes, why don’t you go first?

17:01 Lourdes: In general, I put most of my side hustle income into savings, whether that be more long-term savings or shorter term savings, kind of depends. If I have an upcoming trip, it might go a little bit towards that. In general, how I work my budget is that, I pay myself first, in that I put money aside for savings first, and then any money leftover is my money that I get to spend for the month.

17:31 Lourdes: One of the tips I learned from the first episodes I edited was a side hustle episode, I think it was Allie Judge, and she mentioned how she holds off on paying herself her side hustle income until the month after she’s earned it. So sort of working on a delayed schedule, in terms of using the money that she’s earned. After I heard that, I’m like, that’s a great idea, so ever since then, I’ve been doing the same thing, where I count basically any money I earn in August goes towards my September monthly budget. That helps me in terms of planning and not using the money before I’ve actually earned it. That’s how I mainly handle it in terms of budgeting.

18:22 Emily: Yeah. Thank you. Meryem, how does it work in your budget?

18:26 Meryem: I’ll be totally transparent in that I don’t necessarily have a specific allocation for my side hustle income, because for me it was primarily a chance to essentially have a hobby and use a different skillset. But I kind of do try to visualize it in a way that permits me to have those extra side expenses during the course of the month that you might not otherwise be able to do. For me, it’s kind of a mental exercise, and I do have the money go straight into a savings account that I don’t really touch, but every once in a while, if I need to kind of make an extra purchase or a gift, I will kind of, I guess, rationalize with myself like, okay, I was able to make some extra income this month with the side hustle, so it’s okay to spend that extra money and think of my extra purchases outside of my needs in terms of how much of my work and effort that is worth. And essentially that’s not a super cut and dry method, but it helps me at least to rationalize my additional expenses and not get too anxious about finances during grad school, which is really, really nice to have that cushion outside of my usual budget.

19:41 Emily: Yeah. That trick, that mental framework of translating the cost of a purchase into your time, or maybe number of episodes, or however you want to structure it, is a really powerful one, a really common one for people sort of were advanced in their personal finance skills to think about really carefully, like whether they want to make a purchase and how they want to spend and so forth to translate into time. That’s a really good tip.

20:07 Emily: I’m particularly thinking about this question of how to handle your irregular income with respect to your budget because, so in August 2020, I launched a community PFforPhDs.com/community, if you want to find out more about that, but every month I’m creating new content for it. Right now I’m working on the September content, which is on how do you handle your irregular income with respect to your budget?

20:28 Emily: Lourdes, the tip that you gave is basically the first one that I’ve already put into this, which is count up your income from one month and put it towards the next month budget, that you got from Allie. It’s absolutely perfect, because you never know when something could go wrong with your side-hustle income. Like if one of you became ill, for example, maybe you need to skip an episode. That’s not a problem for us, but it would be a problem for your budget if you’d already spent the money that you expected to come in. That’s number one, baseline tip for handling side hustle income is give it a delay. Meryem, you’re doing a similar thing by putting it directly into savings, and then later on thinking about, well, how do I want to spend it, or do I want to keep it here? Different articulation, but kind of the same principle there. I’m really glad to hear that.

Side Hustle Income and Taxes

21:13 Emily: Now we come to one of my favorite subjects within personal finance, which is taxes. So you two are both self-employed, you are contractors for me, and Meryem, now you have this other contractor, essentially you’re like a real true contractor working for multiple people with the same skillset. Self employment taxes are kind of a whole other ball of wax. You’ve been doing this for a year, do you have any systems that you’ve put in place or just what are you doing with it, with respect to your taxes? Lourdes?

21:40 Lourdes: For me, it’s a little bit of two different things. I generally set aside about 30% of my self employment income for taxes. That’s taking into account the about 15% self employment tax and then income tax being around 12%. But also, I am on a fellowship that requires me to pay estimated taxes quarterly, and so at the beginning of every year, I basically estimate how much — well, I know how much I’m going to earn from my fellowship, and then I basically estimated how much I anticipate earning from doing this virtual assistant for the podcast. Basically, I have ahead of time, I know how much I have to set aside each month for both my fellowship income and this side hustle income. I immediately put that into savings and I just don’t touch that money. It’s not even money that I think about. And then I tend to over save just a little bit in terms of taxes, just because I’d rather have a cushion. Last year, I think I was off by like $150 just because of other things. I also have some investments that will change throughout the year and change my tax situation, but I do tend to oversave just so I have that little extra cushion and I don’t have to take it out of other pockets of my savings. Then if I have extra money left over, I kind of use it as my own personal tax refund. So the government isn’t giving me any, but I have some extra money left over in my tax pot. I use that and just reallocate it usually to different savings categories.

23:23 Emily: Yeah. I handle my income from my business exactly the same way, so it sounds like you’re just incorporating the self employment tax issue into your existing structure for paying quarterly estimated tax. Meryem, I want to give you a chance to answer that one as well, because I know this is shifting for you right now,

23:39 Meryem: Actually I’m absorbing all of Lourdes’ tips because for me, I just, in the month also started receiving fellowship non-W-2 income. Prior to that, I wasn’t really thinking about estimated quarterly taxes as much because I didn’t have to deal with all of that. But now moving forward for tax year 2020 into next year, I will have to kind of be thinking about that. Even though the actual amount of taxes that I’ll from the side hustle income will be less than the amount that is necessary to be able to pay estimated quarterly taxes — so my original strategy was just to collect all of the receipts that I’ll receive from PayPal and then make sure that I back calculate the amount that I have to pay for the self employment tax and pay that come tax season. That original plan is fine if you know that you’re not going to owe the amount that you would need to, to not have to pay fees for not paying estimated quarterly taxes, but I like the strategy of kind of building it in so that by the time tax season does roll around, you’ve already paid everything.

24:45 Meryem: I actually think that I’m going to adopt that policy rather than shifting it and waiting until tax season. And as for my other side hustle with AcaDames, their structure is also changing since they’re recently going through the process of incorporating and becoming an LLC. Previously, and currently during the transition, I’m being paid through W2 income because it’s very easy to me to be able to do that as a UNC student and the cohost, or at least one of the coasts now is based at UNC, so it was really easy to deal with that through payroll and not have to worry about freelancing or independent contracting. But I imagine that that will also shift within the next year as they’re making this transition into becoming an LLC. So having all of these strategies in place now will probably be really useful moving forward.

25:38 Emily: Yeah, that’s good for me to know. Interesting. I should mention also, I just brought up the Personal Finance for PhDs Community, but for the last several years, I’ve had a workshop available for individuals on quarterly estimated tax and helping them fill out their estimated tax worksheet and form 1040. That workshop is now coming under the umbrella of the community. So anyone who’s wondering about how do I file quarterly estimated tax on my fellowship, that’s where to go for that particular workshop PFforPhSs.com/community. And I just told you, I’m thinking about in September, the training that I’m going to release on handling your irregular income with respect to your budget. Later on this fall, I’m planning on doing another full workshop on the self-employment side hustle that is so common for graduate students and PhDs, and how to handle that for your taxes, so a whole other tax workshop just on this topic of self employment taxes. That’ll be available if anyone needs help with that sort of thing. I’m really excited about creating because I’ve been doing my own taxes as a self employed person for a number of years, so I have a basic familiarity with it and I’m excited to do a bit more research to figure out how it works for other kinds of businesses as well. That’s where to find out more info there.

Unexpected Benefits from Side Hustling

26:54 Emily: As a second to last question here, have there been any benefits to doing a side hustle that you didn’t anticipate when you first took on the position? Lourdes?

27:05 Lourdes: Specifically for this podcast, Emily interviews a wide range of guests and a lot of them also have social media that they promote. I’ve been able to connect with some of the different guests on social media, just as a result of sometimes promoting the episode. They’ll see that I promote it, and then we connect, we end up talking, following each other on Twitter. That’s been like something I didn’t really expect to happen, but it’s been really cool because q lot of them are fellow grad students, and then just getting into that academic sphere of Twitter has been really interesting just to see all these different graduate experiences from people all over the country and all over the world. That’s been one of the most unanticipated benefit from this particular side hustle.

27:57 Lourdes: And then also, as has been brought up multiple times, I think Meryem brought this up, just learning a different skillset that’s something very different from what I do in my normal day to day graduate work. And I, in particular, am starting to figure out what I want to do after grad school. I’m a fifth year student going into my sixth year, so I’ve been leaning towards maybe some more like alt-academic jobs, and being able to have this completely different skill set is definitely something that I think adds to my resume and adds to potential job options and sort of also gives me ideas of what other type of work is out there. Along with what I was mentioning before Emily does have so many different types of guests on the podcast, just seeing what opportunities are available to graduate students after they’ve defended and after they graduated, has been really interesting and something that I hadn’t even considered or even thought of prior to really getting to know some of these guests through the podcast.

29:04 Emily: Yeah. That’s really great for me to hear. I know that this too was an unexpected benefit for me of doing the podcast is I didn’t expect it to be such good networking. I knew some things that would happen from it, but not the networking aspect, so I’m really glad that you’ve been able to tap into that as well. So Meryem, how about you?

29:24 Meryem: Yeah, I agree completely with the networking component as this amazing side benefit of being involved with editing the podcast. And I think for me also, I just find it inspiring how relevant the episodes have been in my own personal journey as a student, often in real time. In fact, I’ll never forget that the very first trial episode that I edited was with Dr. Katie Wedemeyer-Strombel about her decision to change labs and how to prepare for the unexpected in grad school. And it just so happened that that exact same week that I was editing that episode, my former PhD advisor surprised that our lab with an announcement that she would be leaving UNC and moving across the country, and all of this was happening while I was trying to plan a wedding with my fiance, and now husband, who had just moved down to Chapel Hill to start a new job, to be with me after we’d been long distance for so many years. And anyways, it ended up working out and I was able to switch into an amazing collaborating lab and stay at UNC, but unbeknownst to Katie, her advice at that time was so timely for me and helpful for me as I was going through that transition. So I always rave about the podcast to pretty much every grad student I come across and I try to send along helpful episodes and resources to them if it sort of just happens to come across in conversation. It’s just amazing to me how many times that, that has just happened, where I’m editing an episode and realizing, wait, I really need to pay attention. This is really relevant to my life right now.

31:00 Emily: That’s really good to hear. Of course you told me at the time that that episode was striking you in that way and I’m so glad that I could help. I think that, as Lourdes, as I was saying earlier, I’ve been doing this podcast for about two years now and I have quite a few interviews under my belt and it’s not always the same type of person, as you were saying. It’s a lot of different kinds of personal finance stories coming from a lot of different sorts of people who have been in academia for a time at least. There is a good trove of episodes there, that you might find something useful to your current situation, if you do a little diving into the archives.

Best Financial Advice for Early Career PhDs

31:34 Emily: Last question here, which, you know, I ask of pretty much all the guests who come on the podcast. I’ll give you a chance to give your answers as well. What is your best financial advice for another early career PhD? And we’ll go to Lourdes first again.

31:48 Lourdes: For me, I think one of the best things for me is having a yearly budget. At the beginning of the year, and I’ve been doing this for quite a few years now, I lay out my plan for the year financially on a spreadsheet, and it really helps to be able to see a longer term plan for my money for the year. I think, especially with self employment income, side hustling, it kind of gives you an idea of…Maybe I have a trip planned later in the year, or I have some big event that I’m going to need to save up money for, and being able to more strategically allocate your money on a larger scale rather than just month to month. I think that’s been one of like a strategy that I’ve been employing for a couple of years now, and it’s just been super helpful for me, and it’s something that I will see myself doing like far into the future

32:44 Emily: That is, I think, typically a good piece of advice, but I want to know how it’s going in 2020.

32:50 Lourdes: It’s been interesting to say the least. There have been a lot of…I had some trips planned that have gotten canceled, so I have this extra money, but also different expenses that I didn’t anticipate come up. And it’s been a little bit of am eye-opener in terms of plans change as the year goes on, but I think sort of having that framework to begin with helps me realize that even if…I go back to this budget every month, it’s the same spreadsheet I use for my monthly budgeting, so it changes and updates and it’s a very fluid document, but just having that outline there to begin with has also been something that provides some structure, especially when the year got so different than what everyone anticipated.

33:43 Emily: Yeah, I also use the year as the sort of standard timeframe when I talk about irregular expenses, so expenses that come up non monthly, and you and I talked about this in our interview from a year or so ago. I think it’s a great strategy to think about what budgetarily is coming up for you — trips, as you mentioned earlier, or maybe some other kinds of irregular expenses, so you can anticipate them over the course of about a year. So yeah, I like that time frame as well. Meryem, how about you? What’s your best advice?

34:12 Meryem: Yeah, so my best advice is probably to be honest with yourself and keep an open mind about your personal finances. A wise friend once told me that disappointment happens when our expectations don’t match up with our reality, which was really helpful for me to hear at the time, as an optimist, because I used to feel a lot of guilt or disappointment if I couldn’t maintain an unrealistic budget, or if I couldn’t resist making an impulse purchase on something that maybe wasn’t necessary, but made me or someone else really happy. But I also think it’s really important for our mental and physical wellbeing to work towards a healthy relationship with money, which I know can be particularly challenging on a grad student’s stipend. So with that in mind still, I think as best as you can try to be honest with yourself and set realistic goals for yourself, not based on anybody else’s priorities or spending habits, but whatever matches your needs. That being said, if something really isn’t working for you, that’s probably a good time to have an open mind and try to adapt, effective strategies from others. I guess I would say it’s okay to experiment and even take calculated risks, while figuring out what works best for you, but being honest yourself and keeping an open mind is probably my best financial advice and general life advice as well.

35:44 Emily: I love that as well. I often think about the mismatch between expectations and reality, and how that provokes us, so I try to keep my expectations low, basically. I really love that advice and I think that’s unique. I don’t think we’ve heard that on the podcast before, but I think it’s perfect. And something that graduate students can sometimes be discouraged around their finances because they are working with such a low income, it’s for such a long period of time, and I talk a lot about investing and saving stuff and that’s just out of reach for a lot of graduate students, but they can implement your advice, Meryem. They can like learn to just figure out what’s going to work for them in managing their own finances right now and carry that skill set and that habit, whatever it is that they determined as the right system or whatever, forward into their career and post-PhD income, and hopefully have a lot of financial success at that time, having been honest with themselves and really using the time in graduate school to get to know what their preferences are with respect to managing their finances. That’s good advice for anybody, anytime. You can always implement it.

36:46 Emily: I’m so glad to have had you two on the podcast and thank you so much for volunteering to do this. Thanks for coming on.

36:53 Lourdes: Thank you, Emily.

36:54 Meryem: Thanks Emily.

Outtro

36:56 Emily: Listeners, thank you for joining me for this episode. PFforPhDs.com/podcast is the hub for the personal finance for PhDs podcast. There you can find links to all the episode show notes, and a form to volunteer to be interviewed. I’d love for you to check it out and get more involved. If you’ve been enjoying the podcast, please consider joining my mailing list for my behind the scenes commentary about each episode. Register at PFforPhDs.com/subscribe. See you in the next episode, and remember, you don’t have to have a PhD to succeed with personal finance, but it helps. The music is stages of awakening by Poddington Bear from the Free Music Archive and is shared under CC by NC. Podcast editing and show notes creation by Lourdes Bobbio.