Good news for you investors: The calendar may say 2021, but you can contribute to your 2020 Roth IRA up until Tax Day (May 17, 2021)! Why is this good news? Because you can continue to contribute to your Roth IRA (if you have contribution room) without taking up contribution room in 2021. In this way, you can roll forward some of your contribution room, even over multiple years. This is particularly useful for those of you expecting income increases in 2022 or so.

The IRS’s Retirement Account Contribution Window Extends until Tax Day

Every calendar year from January 1 to December 31, you can contribute to your retirement account for the current year. This applies to IRAs (Roth and traditional), 401(k)s, 403(b)s, etc. You can also contribute to last year’s retirement account in the subsequent calendar year up through Tax Day. You can even open and fund an IRA for the previous year!

Right now, between January 1, 2021 and May 17, 2021 (Tax Day), you have the choice of contributing to your 2020 IRA or your 2021 IRA assuming you are eligible and have contribution room in both years. In fact, you should contribute as much as you can to your prior year IRA before switching over to the current year IRA.

Receive Your Tax "Cheat Sheet"

Subscribe to the Personal Finance for PhDs mailing list for essential information to help funded US graduate students (citizens/residents) with their federal tax returns

Eligibility and Contribution Limits

I’m going to clear up the caveats I’ve been making right here.

Eligibility: You need “taxable compensation” in a calendar year to contribute to that year’s IRA. Employee (W-2) and self-employment income are both taxable compensation. Fellowship income, if not reported on a W-2, was not considered taxable compensation in 2019. However, the definition of taxable compensation was changed for 2020 and following to include taxable fellowship and scholarship income for graduate students and postdocs.

Further listening: Fellowship Income Is Now Eligible to Be Contributed to an IRA!

Contribution limit: The contribution limits on IRAs are pretty low, at least in comparison with workplace-based retirement accounts like 403(b)s and 401(k)s. For 2020, you can only contribute a maximum of $6,000 ($7,000 for those over age 50) or the amount of taxable compensation you had in the calendar year, whichever is lower. You do not have to contribute the entire $6,000 in a year; it’s fine to contribute $1,000 or $3,000 or whatever you can. When I say contribution room throughout this post, I mean the difference between your contribution limit, e.g., $6,000, and the amount you’ve already contributed.

Why Is Contributing to an IRA So Important?

You may be asking yourself why I’m writing about Roth IRA contributions in particular. After all, once you’re out of graduate school and actually able to save more money, don’t you have a reasonable expectation of receiving a 401(k) or similar employee benefit?

1) Yes, you probably will work somewhere that provides you with a 403(b) or 401(k) or other type of workplace-based retirement account (or you’ll be self-employed and have self-employment retirement accounts available to you). Exception: Some postdoc positions (and adjunct!) might not offer a 403(b). But you don’t know the future, so I think it’s better to be cautious and roll forward as much contribution room as you can.

2) Even if you have a workplace-based retirement account available to you, the rule of thumb for retirement contribution priority is: workplace up to the match, IRA, then workplace again. This is because you can buy just about any fund you want through any brokerage firm in your IRA, whereas your options in your workplace based account will be severely limited. It is assumed that you can find better quality (read: cheaper) investment options through your IRA, so that should be prioritized. However, you should definitely check out your options through your workplace account before assuming this is true for you; some universities offer good, low-cost institutional investment options that might be even better than what you can buy as an individual.

3) Your workplace might only offer a traditional retirement account, so an IRA will give you the option of using a Roth, which you could take if you think it’s the better choice for you in a given year.

Why Am I Specifying a Roth IRA?

As far as your taxes go, if you’re contributing to a Roth IRA in both calendar years, it doesn’t matter which one you choose during the overlapping period. If you were contributing to a traditional IRA instead, it would matter: Your contributions to last year’s IRA would count for a tax deduction on last year’s tax return (hence being able to contribute up until Tax Day). But with a Roth IRA, you aren’t taking a tax deduction, so you’ll pay your full tax on the contribution no matter in which year you make it.

Always Contribute to Last Year’s IRA First

Now we come to my suggestion to contribute as much as you can to last year’s IRA before switching to this year’s (aka roll forward contribution room), either because you have reached your contribution limit or because Tax Day has passed.

The advantage is most clearly seen in the year that you experience an increased ability to contribute to your IRA (as long as you haven’t been maxing out your contribution room). This could happen because:

- You decrease your expenses so that you can save more

- You start earning a side income

- You finish your PhD and take a higher-paying position (postdoc or Real Job)

- You finish your postdoc and get a Real Job

In these cases, you may be able and want to contribute more than $6,000 to your IRA in one calendar year, and you are only able to do that if you split the contribution between your prior year IRA and your current year IRA.

But you should practice this every year, not just in a year when you expect an increased ability to contribute because:

- You don’t know what will happen throughout the whole next calendar year, and your ability to contribute to an IRA could increase unexpectedly (e.g., you receive a windfall, a side income presents itself, you decide to leave grad school/your postdoc early for a better-paying job, you combine finances with a higher-earning person).

- You can roll forward your contribution room into future years. For instance, if you can contribute $5,000 each calendar year to an IRA, you can carry forward some or all of your $1,000 excess contribution room, so that in the year that you are able to contribute more, for example, you can contribute $6,000 to your current year IRA and perhaps $1,000 to your prior year IRA.

An Illustration (with Numbers!)

The advantage of this strategy is more easily understood with an example.

Let’s say you’re a graduate student in 2020 and 2021, earning $30,000 per year. You are a superstar saver, so you contribute 12% of your gross income to your Roth IRA every month. In 2020, your total contribution to your 2020 Roth IRA was $3,600.

In the first five months of 2021, you continue to contribute to your 2020 Roth IRA, which brings your 2020 Roth IRA contributions up to $5,100. In the seven remaining calendar months of 2021, you contribute $2,100 to your 2021 Roth IRA. Your remaining contribution room for 2021 is $3,900.

January 2022 hits and you start a Real Job! Your new yearly salary is $72,000, and you increase your savings rate to 20%. This means that you can put $1,200 each month into your retirement account(s).

In the first four months of 2022, you max out your 2021 Roth IRA with $3,900 and also put $900 into your 2022 Roth IRA or other retirement account options. You can use the rest of 2022 to max out your 2022 Roth IRA and contribute to your other retirement account options.

In this example, you ended up contributing $17,100 to your Roth IRA over three years ($5,100 in 2020, $6,000 in 2021, and $6,000 in 2022). Had you not rolled forward your contribution room, you would have contributed only $13,200 to your Roth IRA ($3,600 in each of 2020 and 2021 and $6,000 in 2022). (The rest of the money would go into your other retirement account options in 2021, presumably.)

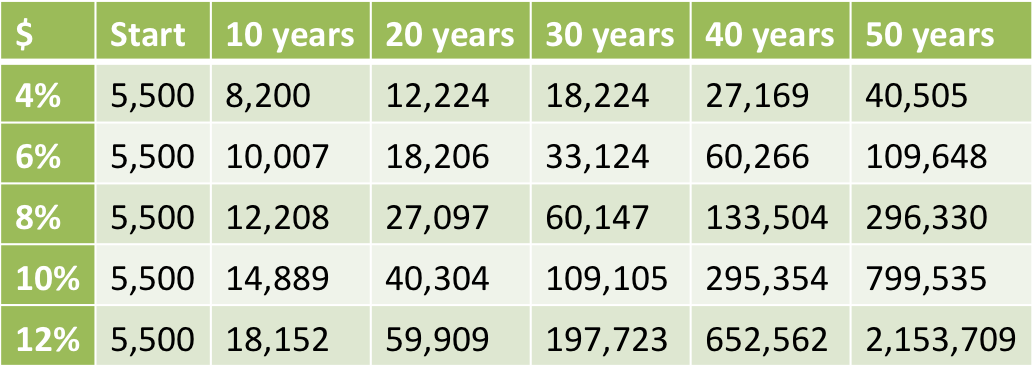

Free Email Course: Investing for Early-Career PhDs

Sign up for the mailing list to receive the free 10,000-word email course designed for graduate students, postdocs, and PhDs in their first Real Jobs.

The Psychology of a Ceiling

The previous illustration assumed that you would save at the same rate no matter what contribution room you had available or what account you used. However, if you are a competitive person, you might benefit even more from rolling forward your contribution room by contributing to your prior year Roth IRA first.

I’ve noticed that many people strive to max our their Roth IRAs each year, irrespective of the actual amount or percentage they might otherwise want to save. They use the contribution limit as their goal. This is not a good thing if you would otherwise contribute more than the limit, but I think many grad students and postdocs might have the opposite issue: without the limit serving as an implicit goal, they might contribute less than the limit.

By rolling forward your contribution room, you can create ever-higher savings rate goals for your Roth IRA, which might modify your behavior and help you save even more overall.

I fell victim (in a good way!) to this psychology in a similar scenario. When I started contributing to my Roth IRA, my goal was 10% ($2,400) per year. But once I found out that my now-husband maxed his Roth IRA out every year, I made keeping up with him and maxing out my goal, too. I found creative ways to gradually increase my savings rate. I didn’t quite make it to $5,500/year (the contribution limit at the time) by the end of graduate school, but I sure got a lot closer than $2,400/year.

I think the contribution limit can create the same kind of competitiveness, and rolling forward your contribution room makes the challenge even greater.

My Personal Experience with Contributing to Prior Year Roth IRAs

A couple years before we finished our PhDs, my husband and I started following this suggestion of contributing to our prior year Roth IRAs as much as possible before switching to our current year Roth IRAs. It seemed not to matter much for a couple years until we experienced an income increase, and then having the extra contribution room was really helpful.

My husband’s Real Job offered a 401(k), but it was through a notoriously expensive full-service brokerage firm, which we did not want to use. Instead, we contributed our target amount of savings to our Roth IRAs (still maxing out the prior year first) and a self-employment retirement account (available through my business). The extra Roth IRA contribution room we created through rolling forward was particularly helpful in the transition year because 1) it took some time to figure out our 401(k) and self-employment retirement account options and 2) my contribution room in my self-employment retirement account wasn’t very high after working on the business for only a few months.

Further reading: Avoiding an Expensive 401(k) Plan through Self-Employment