During graduate school, you’re heavily investing in yourself and your career. You’re sacrificing significant income potential to receive super-advanced training in your field. You’re probably anticipating a large income jump upon exiting grad school. Why should you even try to make your stipend income work for you? Is it possible or feasible to start investing while you’re so consumed by graduate school?

A version of this article originally appeared on GradHacker.

Free Email Course: Investing for Early-Career PhDs

Sign up for the mailing list to receive the free 10,000-word email course designed for graduate students, postdocs, and PhDs in their first Real Jobs.

The Power of Compound Interest

Einstein declared that compound interest is the most powerful force in the universe. Just kidding – that’s an oft-misattributed quote. But compound interest is amazingly powerful: When you invest money and achieve a rate of return consistently over time, your money experiences exponential growth. The growth in your account balance itself is what grows with time.

Let’s look at a toy example of the power of compound interest (in reality, you would never receive a high rate of return on a consistent basis, but rather it would fluctuate):

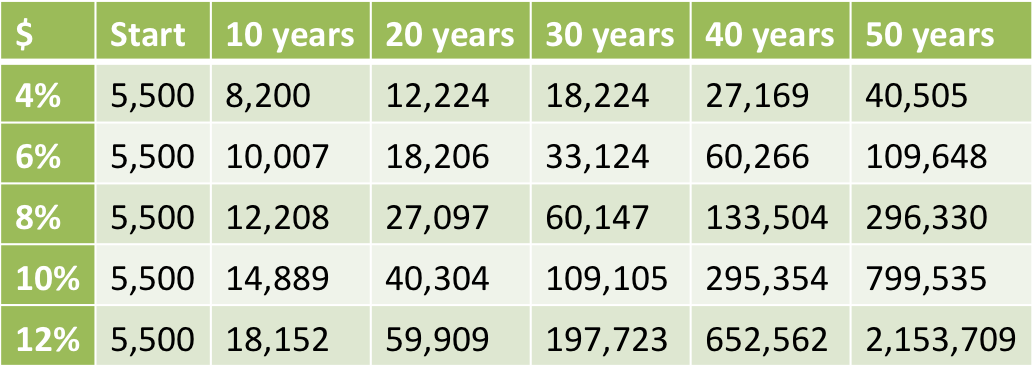

You make a one-time investment of $5,500 (no ongoing contribution). Below is a table of your account balance at different points in time, given different rates of return.

Now imagine how your earnings would layer and multiply as you consistently invest year after year throughout your career! Given enough time and a reasonable average rate of return, even a modest amount of yearly savings can turn into millions of dollars.

Compound interest works for you in the case of investing (if irregularly), but it works against you in the cases of inflation. The long-term average rate of inflation in the US is a little above 3%. That means that you must invest your money to get a rate of return of at least 3-4% to just maintain its purchasing power!

The principle behind the power of compound interest teaches us that the more time given to the process the better it works for you. Graduate school is a wonderful time to start investing for the long term, if you haven’t already. You won’t be able to save much money, at least not in comparison with how much you might after graduating, but the extra few years of compounding will work their magic and over the decades that small amount of money will grow into a staggering sum.

Passive Investing Is Maximally Time-Efficient

Many graduate students are intimidated by the prospect of investing. They suffer from analysis paralysis at several different steps and end up doing nothing, even if they have the capital available. My goal is to dispel the misconception that investing has to be difficult or time-consuming. Certainly if you want to make a hobby of investing you can spend a considerable amount of time on it, but that’s absolutely not required. The average graduate student can invest quite successfully while spending only a few hours to set up the investment and a few minutes over the course of a year checking up on it.

The approach to investing that is most successful and time-efficient is called passive investing. When you passively invest, you strive to get the same returns in your personal account as some sector(s) of the market. You are not looking to beat the market, but rather match it. This is in contrast to active investing, which involves picking individual investments and timing the buying and selling to try to beat the market average. When these two approaches have been compared head to head, the passive investing strategy beats out the active strategy 80% of the time. Plus, it’s simpler, easier, and cheaper.

Free Email Course: Investing for Early-Career PhDs

Sign up for the mailing list to receive the free 10,000-word email course designed for graduate students, postdocs, and PhDs in their first Real Jobs.

To passively invest, you simply choose to put your money into index funds. Index funds replicate a market sector. For instance, the S&P 500 index fund replicates large-capitalization stocks by holding the largest 500 companies traded on the US stock exchanges. Depending on your investing goals, you could buy an index fund that represents the entire US stock market or bond market – or their international counterparts – or a mix of several index funds. Then, once you have invested, you stay invested for the long term – no jumping in and out. (You can often find an Exchange Traded Fund version of your preferred index fund, which is usually offered at an even lower cost.)

Because the passive investing strategy is a buy and hold strategy, the significant time investment is up front to research and choose your index fund(s). This can be done in as little as a few minutes or as much as tens of hours, depending on how thoroughly you want to understand the investment. Once you have made your choice, you can just glance at the account balance a few times per year to make sure it’s in line with your expectations (given how the market is behaving).

How to Get Started Investing

If you are investing for retirement, your first decision is whether you can or should use a tax-advantaged retirement account, such as an individual retirement arrangement (IRA). (You must have taxable compensation to contribute to an IRA.) It’s very rare, though not totally unheard of, for graduate students to have access to a workplace-based retirement account, such as a 403(b). If you are opening an IRA, you will have to choose between a Roth and a traditional version.

Your next decision is where to open your investment account (IRA or taxable). Most DIY investors would do well to choose a brokerage firm. Vanguard, Fidelity, and Charles Schwab are all excellent, though not the only, options for low-cost index funds. With a brokerage firm, you will have a wide selection of investment options available to you (unlike at most banks). You can open and fund such an account completely online.

The next step is actually choosing your index funds, which is the one where you might spend the most time. Brokerage firms often offer similar index funds to one another, as they are all trying to replicate the same market sectors, though there may be subtle differences in the holdings or the cost. These brokerage firms usually offer tools and quizzes to help you identify the right investment for your time frame and risk tolerance.

If you don’t know where to start your research, check out target date retirement funds. They assume a risk tolerance for you based on your projected retirement year (e.g., 2055), and then invest in a small number of index funds to create an appropriate asset allocation. This type of fund handles all the necessary rebalancing among the index funds, so it is a totally hands-off investing strategy. For this reason, it is great for a graduate student who wants a set-it-and-forget-it investment strategy.

The biggest barrier to investing for a graduate student should be freeing up the money to put toward it rather than intimidation or analysis paralysis. Passive investing is totally compatible with the existing demands on a graduate student’s time and energy. For ideas on how to reduce your expenses and increase your income so that you have more money available for investing, see:

- Stack Frugal Strategies for Long-Term Savings

- Give Yourself a Raise: Evaluate Your Fixed Expenses

- Give Yourself a Raise: Prepare Your Own Food Even with a Busy Schedule

- Give Yourself a Raise: Find Inexpensive Entertainment on or near Campus

- The Best Kind of Frugality for a Busy Grad Student

- How Much of Your Stipend Should You Spend on Rent?

- Your Most Important Budget Line Item in Graduate School and Why You Need to Re-Evaluate It

- Can a Graduate Student Have a Side Income?

- Simultaneously Earn Extra Money and Advance Your Career

Join the Mailing List to Download Frugal Tips for PhDs-in-Training

The download includes 30+ frugal tips for PhDs-in-Training with links to video and additional written content.

You'll receive 1-2 emails per week to help you make the most of your money during your PhD training.

If you have already started investing, are you using a passive strategy? Have you suffered from analysis paralysis with respect to investing? How are you harnessing the power of compound interest?