In this episode, Emily interviews Adriana Sperlea, a PhD student in computational biology at the University of California at Los Angeles (UCLA). Living in Los Angeles is financially challenging to say the least, and Adriana has found ways to improve her cash flow over time, such as by doing a summer internship, moving into subsidized graduate housing, living car-free, and budgeting intensively. She has even recently started contributing to a Roth IRA! Adriana and Emily additionally discuss how Adriana discovered that she owed a large tax bill on her fellowship income and how she paid those back taxes and started paying quarterly estimated tax.

Links mentioned in episode

- Tax Center for PhDs-in-Training

- Volunteer as a Guest for the Podcast

- Why You Should Invest During Grad School

- Quarterly Estimated Tax Workshop for Fellowship Recipients

Teaser

Adriana (00:00): I tell everyone, I, I’ve told people in my lab being like, no, you have to do this. It’s simple and it’s easy, and it can help you a lot.

Introduction

Emily (00:15): Welcome to the Personal Finance for PhD’s podcast, A Higher Education in Personal Finance. I’m your host, Emily Roberts. This is season two, episode six, and today my guest is Adriana Sperlea, a PhD student at UCLA. Adriana shares her detailed budgeting process, how she keeps her expenses in Los Angeles in check, and what a difference doing an internship made in her financial life. We also discussed the mistake she made with her taxes while receiving a fellowship and how she got that aspect of her financial life back on track. Without further ado, here’s my interview with Adriana Sperlea. I’m welcoming to the podcast episode today, Adriana, who is joining us from, uh, Los Angeles. She’s a graduate student at UCLA, and in today’s episode, we’re covering budgeting, you know, the big challenge of living in a high cost of living area on a grad student stipend. Um, she’s doing really well with this, and she’ll tell us all about her process and what financial goals she’s able to accomplish, and then also about something that happened in her second year of graduate school, which is a big, uh, financial mishap, financial challenge that she had to overcome. And we’re talking about how to, one, not let that happen to you, and two, if something big like that does happen, how to work through it and how to recover from it. So that’s a subject for, um, today’s episode. So Adriana, thank you so much for joining me today.

Please Introduce Yourself

Adriana (01:40): Yeah, hi. It’s great to be here.

Emily (01:43): Uh, so first question right off the bat is, you know, just take a moment to introduce yourself to us, where you are, what you’re studying, and so forth.

Adriana (01:50): Yeah, so my name’s Adriana. I, um, go to UCLA for graduate school. I’m in the bioinformatics program there, uh, which is actually an interdepartmental program, so we don’t have our own department, uh, which sometimes causes all, like, funding gets complicated also. Um, yeah, and I live in Los Angeles. Um, I’m, and I’m actually an international student, so I’m originally from Romania, uh, which also adds a wrinkle to the funding situation.

Emily (02:15): Yeah. Okay, great. Um, and so what, what are you making there? What is your stipend?

Adriana (02:20): Yeah, so, um, we’re, I’m pretty fortunate. We’re in a fully funded program. The stipend is 30, around $32,500 a year, I think it is now. It goes up a little bit every year with inflation and stuff. Um, and so that’s before tax, like after tax, it comes out to about 28,000 a year, I think. Um, which what I know is that every year I get, every month I get $2,400 into my bank account.

Emily (02:45): Okay. And how long have you been there?

Adriana (02:47): So this is my fifth year, that I’ve been here for.

How do you live within your means in Los Angeles?

Emily (02:51): Okay, great. You have long experience then, um in Los Angeles. So, um, right off the bat, you know, when, when we were prepping for this episode, I know about you that you live, uh, within your stipend, you live within your means, you’re not having, you know, loans and so forth coming out for you. And so, um, why did you do that during graduate school? Because I think some people might look at living in LA and living on, you know, 30 some thousand dollars a year and say like, oh gosh, this is gonna be really, really tough. I’m gonna need some extra support from here or there. Um, so why, why did you per not not pursue any of those routes?

Adriana (03:31): So, um, it basically wasn’t really an option for me to pursue those routes. Um, a I don’t have any extra support from my family, um, just because they can’t really afford it, and they’re also far away from me. They’re still back in Romania. Um, and because I’m an international student, I can’t actually take out loans. Um, I, there’s some small private loans that I could probably qualify for now after a few years, but at least in the beginning of my graduate school for sure no. Um, so that was kind of, yeah. Um, the only way I could supplement my income and I did, um, it was actually through, um, internships. So I did do an internship, um, in between my, uh, after my third year of graduate school. But yeah, that was the only extra income, otherwise it would be extremely illegal for me to work, um, federally illegal, so I would get potentially deported. So yeah.

Emily (04:18): Yeah, I noticed that, um, you know, I, I talk a lot about side incomes and stuff and, and to some extent I know that debt is an option, uh, for domestic graduate students. But the thing is that like, if you’re in a tight situation, like some places, some programs, they just plain are not paying enough, and it’s really the international students that are in the hardest squeeze because they have no, as you said, legal, other options out of this. Like, there’s no other way to work, there’s no way to get access to these loans, like that is it, that’s the end of the story. And so I really think that in, in some cases, domestic students can learn a lot from international students on how to make things work because their back is really up against the wall, um, more so than domestic students. So I wanna hear a little, a tiny bit more about this internship, um, so in that year that you, the summer that you did the internship, were you, like, did your grad student stipend stop and you were instead paid through the internship, or did you get like both or how did it work?

Adriana (05:17): Yeah, so I actually got both, but that’s a corner case, like that’s not how it usually works. Um, other people in my program have done internships, and I think depending on when your, where your funding is coming from, most of the time your other funding stops and you just get your internship. Um, in my case, I was on this training grant that, um, encourages, I think it’s actually a requirement of the training grant to do an internship, um, because it’s called Biomedical Big Data Training Grant. So they want to do an internship where you actually explore using big data in the biomedical field, yada, yada. So it’s actually part of the training grant, so they keep paying you. Um, so I got my training grant. I didn’t get, the training grant was actually supplemented by a little bit of a graduate student researcher funding. Um, I didn’t get that part, but I was still getting that and my income from the internship. And I was living in San Diego, which was slightly cheaper than Los Angeles, so that helped too. <laugh>.

Emily (06:08): Yeah. Cool. Okay. So did you actually like sublet your place in Los Angeles for the summer?

Adriana (06:13): Um, so I was living with my boyfriend at the time. Um, so he kept paying. I, I kept paying. Did I pay? It was a little bit ago. I think we had, yeah, I stopped paying half of my rent, I think my half of the rent here. Um, and then, yeah, I subleted a place in San Diego.

Emily (06:29): Yeah. So it’s good that you had the double income because you had the double rent <laugh> for a little while. Yes. Yeah, that can be really tough when you do have to move for just a short, a short period of time. Yeah. Um, okay.

What is your approach to budgeting in Los Angeles?

Emily (06:41): But you had, through that period, I would imagine already this effective like, budgeting system in place. So for, for making it work, for making it on your stipend with no other kind of outside income sources, um, yeah. How, how do you budget? Tell us about your system.

Adriana (06:58): Yeah, so I mean, I think even before budgeting, there’s like kind of the more basic thing where like you kind of have to figure out housing that’s like the first order of priority in LA and it’s hard, but there are ways, I mean, currently for example, I’m in a situation where I’m in graduate student housing that’s subsidized. So it’s actually really affordable. Um, but not, there’s not enough for everyone. So it’s not a, not all graduate students get it. So making it work with roommates, like finding the roommates, like hustling on Craigslist, finding the right deals, like you have to shop around a lot. Um, but there are still ways to find something that can kind of fit in that, like desirable percentage of your income. Maybe. Like, I, I don’t think 30% is feasible in Los Angeles <laugh>. Um, it’ll still probably go up to like 40%, but still, um, yeah, making it work.

Emily (07:47): Well, I would like to hear a little bit more about that one, about the subsidized housing, and then two, just about your, when you’re hustling, when you’re hustling on Craigslist, what are you looking for? How do you find those deals? Because I mean, Los Angeles is a huge city. We’ve got a lot of universities there. I’m sure there are some local people who wanna hear about this because it’s such a problem. And then it will also translate well, I think, to other high cost of living cities. So tell me a little bit more about the, the subsidized housing through UCLA. Like how do you get into it?

Adriana (08:14): So that’s a, that the subsidized housing is a lottery based system. Um, so you just apply and then when someone moves out, they let someone off the wait list in, and I think there’s some random component to it. I don’t really, know, there’s not a, I don’t know exactly how that process works, but you get an email if you got it. So, and you celebrate.

Emily (08:31): Are you allowed to stay as long as you would like? Or is there a cap on it?

Adriana (08:35): So in the one that I’m currently in, yes. Um, well, no, not, I think it’s nine, seven years, seven or eight years, basically, as long as hopefully you don’t need more than that, so, yeah. Um, but it is month to month, so people sometimes will move out, like not, not at the beginning of a year. Um, and then anyone can take their spot. So, yeah. Um, the, it, it’s actually a great system, but it’s just not enough of it. And I’ve, I’ve talked a lot at UCLA trying to push, um, more housing, more affordable housing for students. It’s needed like Los Angeles, it’s impossible. So

Emily (09:06): How much of a discount are you getting? Like how much is the subsidy?

Adriana (09:10): Uh, well it’s, it’s not like percentage based, but it’s, it’s subsidizing that it is cheaper. So, uh, a one bedroom, we have like a junior one bedroom. It’s me and my fiance now living in it. Um, and we pay, uh, 30, around 1300 for the whole place. So split, I pay like $650 for, for rent, which is amazing for LA.

Emily (09:31): Yeah, 650 sounds like pretty good for a lot of cities around the country. Yeah. So a junior, one bedroom. Okay. Yeah. So it helps certainly if you have someone that you’re willing to share a bedroom with.

Adriana (09:43): Yes, a hundred percent. So that may be, if you have a significant other, then that’s a lot easier. I’ll be honest, I’ve talked to people in grad school that talk about like the advantages of having a partner in terms of rent <laugh>, um, but then also you can share a bedroom. I mean, it’s not ideal as a graduate student. You don’t want to be sharing a bedroom, but if you need to make it work because there’s no other money share a bedroom like that, that can be the case. Yeah.

Emily (10:08): Yeah. I just actually ran into someone, um, not ran into, someone attended a seminar of mine a couple days ago and she said, yep, I live in a, I share a bedroom with my roommate. That is still a thing that is happening, like to make her her budget work. So it’s not, it’s not totally unheard of, not totally out of the question. Okay. I totally agree with you. You have to get that housing component kind of set, and that’s something around which a, a lot of the rest of your budget will, will be determined. Um, yeah. So is there anything else like that? Is housing the one expense that you need to fix first? Or like, what about transportation? Did you figure that out before really working on your budget?

Adriana (10:43): So I mean, housing and transportation are probably the two big ones. Um, I don’t own a car. Um, so for me it’s like you can pay a little more for rent because I don’t own the cars. I don’t have car costs like insurance and all that, or parking. And so I can live a little closer and not have the car. You can have the car that’s more cost, but you might be able to get cheaper rent. So that’s kind of a balance, I feel like. Um, I mean, if also if you’re somewhere that has public transit, then you, your problems are way easier. But in LA it’s kind of the trade off between car and, um, housing. Yeah.

Emily (11:13): Yeah. Okay. So you live car free. That’s awesome. I love that.

Adriana (11:16): Well, so my fiance does have a car now, so

Emily (11:18): Oh, okay. So you’re sort of, you sort of share a car.

Adriana (11:20): Yes, now I do. Yeah. But I didn’t have one for a very long time,

Emily (11:24): So I, I forgot that I wanted to go back to this, um, this idea of how can you find like, affordable housing? Do you have any tips about that?

Adriana (11:33): Um, yeah, I mean, honestly, a lot of it’s just like spending time and looking around and eventually you’ll find kind of these offers that are not as common. Um, there are in LA there the, there’s this one type of building in LA in particular, I forget what they’re called, but basically they’re like older houses that are honestly like, not earthquake proof, <laugh>, um, they’re the <inaudible> build. They have like a carport underneath. Um, and those, because they’re not retrofitted and they tend to have like slightly older furniture and like the AC is like not super up to date and stuff like that, they tend to go for a little less. And occasionally in some areas there is rent control. So if you can get into a place that has the rent control, then your rent at least won’t go up. Um, so there’s various hacks like that, and it’s all about just like having patience and kind of starting early on the housing search. Um, but I do know that it’s getting harder every year. So yeah, there’s, there’s only so much you can do with that, to be perfectly honest. Like, I don’t wanna like claim that it’s, I have some amazing magic for finding housing because it’s just tough.

Emily (12:37): Yeah. So you’re just saying be patient, um, sort of target, you know, types of buildings that you know, are gonna be less expensive. Yeah, I’m a little concerned about this not being earthquake proof thing, <laugh>. Um,

Adriana (12:50): It’s the truth. That’s how it, I mean, yeah, I don’t know if that like, it’s a good thing to say that you should live somewhere that’s not retrofitted, but I do know those apartments are not well retrofitted. It’s a common thing. And that’s why I think they’re going, a lot of them are being like, replaced by newer developments. Um, but yeah, there’s, I mean, maybe don’t live somewhere that you don’t feel safe, of course. But, um, there, you know, you can definitely sacrifice on things like granite countertops, <laugh>, or the open space. You know, like you’re not gonna get, um, something beautiful, but you can get something livable and clean for, um, more affordable.

What is the system that you use for budgeting?

Emily (13:27): Yeah. Okay. So, okay, so let’s return to the, the budgeting, um. System that you used. I, I’d love to hear more about just how you make it work overall. Once, once you’ve gotten this rent and then like your decision about transportation in place.

Adriana (13:40): Yeah. So I’ve had, for a very long time I had this like spreadsheet system where I would put in my income that comes in every month and I would separate it. I would put in my fixed costs, like the rent that has to be paid and my bills, like my phone bill, um, whatever other bills you have that are just monthly, like if you have a gym membership, if you have other bills, et cetera. Um, if you have to pay for insurance, I guess you have a car, you would have that there too. Um, and then I split whatever is, I did sub subtract that from my monthly income and then I divided into four. Um, ’cause there’s like four weeks in a month. And then whenever I buy something, I entered it, I entered in my spreadsheet and I have a cell that subtracts that from my weekly budget.

Adriana (14:22): Um, and so I always have a sense kind of like, of what I’m spending. Um, and I try, so for me, I, I notice, I think, I think it’s common from a lot of grad students that eating out tends to drive your budget up a lot. Like if you don’t cook your own meals, like that’s gonna be a big expense. Um, so for me it’s all about just, you know, buying my, making sure I buy my groceries on the weekend and kind of prep some type of food and make sure I’m cooking my meals. And if my meals are cooked and I’m on top of that, then I pretty much don’t spend anything Monday through Friday, to be honest. ’cause I just go into lab. I eat lunch that I brought from home and then I come back home. So there’s not a lot of expenses. And so then by the end of the, on the weekend, you still have like a hundred something dollars to work with that. Um, you can, you know, you can go see a movie, you can go out, you can do something.

Emily (15:09): I’ll just recap that for a second. ’cause I wanna make sure I, I really like what I’m hearing. I wanna make sure I understand. So, so you take your, your total monthly income, and then you subtract out all of your, basically your monthly bills. They’re often fixed expenses. Maybe there’s some variable in there, like some utilities or something. I dunno if any of your utilities are variable, but, so you’re subtracting out all those monthly bills and then you take the remainder and you divide it up by the week. And so you have your, your sort of, uh, discretionary or variable spending money for each week, and you start that week by buying your food, your groceries for the week. And you basically just are living sort of a, uh, a lifestyle where you don’t spend much during the week. Like, you know, you’re not, you’re not buying gas, you just said you don’t have a car. You’re not eating out during the week, you’re presumably not doing any entertainment stuff so that when you get to the following weekend, you know, you have, you know, the amount of money you have to work with, uh, in terms of being able to do some discretionary stuff, some fun stuff, um, eating out or entertainment or bar or what have you. Does that sound, is that, yeah.

Adriana (16:08): That’s pretty much it. Yeah. And then, I mean, there’s, you know, you wanna have a little bit of room. I have, I actually have a little bit of money set aside for like, things that come up, you know, like things can come up, so you can’t always anticipate that, like the miscellaneous stuff. Um, but yeah, that’s pretty much how it works. And I mean, um, the other thing is like if I have, I see something that I wanna buy, right? That’s just like something I want that’s fun. I want this new pair of jeans, or I want this, I don’t know, whatever it is. Um, like for example, a new part for my gaming computer, something like that, right? Um, I will, I won’t buy it the moment I want it. I’ll make a list and then at the end of either the month or the week or whenever, after a while, I look at that list and then I go through it and kind of rank the things that I’ve I, that I’ve seen that are like, oh, I would really like to own this. And then the impulse part is out of it, right? So now I can make kind of a cool-headed decision about it and I can see where I’m at, how much can I actually afford? And then I can actually buy a few of those things.

Emily (17:08): Yeah, I love that. I love that idea. So you’re, you’re sort of formalizing the practice of delayed gratification. You have a centralized list that you’re using and you’re adding something catches your eye, you add it to it, and then after some days or maybe a full month or something, you’re reevaluating, do I really want that? Is it worth it? What’s the amount of money I have right now available to spend on it? Yeah, that sounds awesome.

What do you do about large expenses?

Emily (17:30): Um, what do you do about like, large expenses, like if you were to fly home?

Adriana (17:35): Yeah, so I mean, in this past year, because it’s been, um, my rent has gone down since I’ve moved into the subsidized housing, um, I’ve been able to have a little more leeway with that. So I usually have a little more extra money at the end of the month. Um, I have, since my internship, I’ve actually maintained this emergency fund, um, that’s about two or $3,000 in just a savings account that’s not, that I can still access whenever I want to. Um, so usually for big expenses like that, I’ll go into, it’s not really just an emergency fund, I guess it’s more of a big expenses that I, that are necessary though. Um, and I’ll, I’ll use from there and then I’ll gradually fill that back up, um, with money as I have extra during the month. Before that, um, before the internship where I did, I had this like extra money saved up. Um, it was pretty tough. Um, I didn’t go home that often, like all the way to Romania. Um, occasionally my mom would help with that, like she would help with the plane ticket. Um, but yeah, so it, it’s tough when big expenses come up.

Emily (18:47): Yeah, definitely. I mean, I like that you, I mean, it sounds like you had this, this one, one summer, only one summer where you did this internship, but because you were getting that dual pay, because the pay rate was a bit higher, it, it sort of gave your finances overall a boost plus the boost that you’re getting from the subsidized housing. And so kind of between those two, you’ve gotten a little bit ahead, right? You’re able to have this money set aside for kind of whatever comes up. It’s already there, you can draw on it and then refill it. Um, instead of being like, I don’t know, putting something on a credit card and then having to repay that over time, you’re sort of repaying yourself into your own savings.

Adriana (19:25): Yep.

Emily (19:25): Kind of like doing the debt, you know, process. So

Adriana (19:28): I’m super afraid of credit cards, actually <laugh>. So I have credit cards for maximizing like rewards and stuff like that, but I absolutely do not spend money on a credit card unless I have that money in checking like that liquid money. So, yeah.

Emily (19:41): Yeah, that’s perfect. I, I use, in grad school, I, I also was pretty afraid of credit cards for like, the first few years that I was like an adult. And I very strictly stuck to that system of, okay, the money is already in my bank account. I’m spending it just like I would if I were swiping my debit card, but I’m only doing this because I’m getting like extra rewards at the end of the day. I think there’s a healthy amount of fear right there. There’s a healthy level of fear that you can apply to credit cards. Maybe you can take it too far. And certainly some people are not afraid enough, but there’s like a sweet, you know, middle, middle there. Um, okay. Yeah. Is there anything else you wanna say about like, your budgeting or just how you’re making it work in la?

Any other comments about your budget or how you make it work in Los Angeles?

Adriana (20:21): One thing is that recently I have kinda like loosened the reins on how I budget, where I don’t maybe like log everything. Like I would log literally, oh, I bought coffee a dollar 50 into my Excel spreadsheet. I don’t do that anymore in the past year or so. Um, just ’cause you kind of get a sense of it after you’ve done it for a long time of what you can or cannot afford. So you don’t make silly purchases because you know what’s affordable and what’s not. Um, and I think that’s part of the learning system. Like you just, you learn that as you go. So

Emily (20:49): Yeah, you’ve sort of, you’ve internalized your budget. It’s now like in your mind instead of explicitly like in your spreadsheets.

Adriana (20:56): Yep, exactly.

Emily (20:57): Yeah. That’s nice. I, I think I, well, I never completely stopped tracking. I think I also internalized, um, my budget during grad school, but then everything got thrown when I moved. Right? If you go to a new city, you have a different life, different setup. Like you’re kind of, you’re not starting over at, you know, square one, but you’re taking a couple steps back in terms of that, that intuition or that like internalization, I think. So that’s a good time to start doing all the, you know, intensive tracking. Again, if there’s a big shift, you know, in your life.

Commercial

Emily (21:30): Do you know what’s even scarier than an upcoming committee meeting the prospect of preparing your tax return? But it doesn’t have to be that way. I’ve created a variety of free and paid resources to help you get through tax season with as little pain as possible. These resources are specifically for grad students and fellowship recipients postbac through postdoc, check them out at pfforphds.com/tax.

Can you talk about saving for retirement?

Emily (21:59): Okay. And you also told me earlier that you are saving for retirement, you’re contributing to an IRA. Can you tell me a little bit about why you’re doing that and how you’re doing that?

Adriana (22:09): Yeah. I’m not saving much. I’m not even maxing it out <laugh>. Um, but I am saving, so, um, about a year or so ago, I just, so my fiance’s uh, dad actually, he like talks a lot about, uh, investing and stuff like that. And I was like, on Thanksgiving, I was like, I, I need to figure that out. Like, can you tell me what you’re doing? Because you talk like there’s stocks that sounds super complicated. And he was like, all right, this is what you do. You go and you buy this book, it’s called A Random Walk Down Wall Street*, and you read it and then you got this. And that’s what I did. I bought the book and I read and I was like, oh, this is not at all complicated. Like, investing is not rocket science at all. Um, there’s just a weird culture around it that makes it sound complicated.

[* This is an affiliate link. Thank you for supporting PF for PhDs!]

Adriana (22:51): And I think people like to talk about it as if it’s something that’s just rocket science, but it’s totally not. It’s super easy and you can do it at like kind of a low risk. I’d say, um, if you want to, and also this is the best time in your life to do it because it doesn’t matter what, like, oh, the market is crashing, I don’t care. That’s a perfect time to buy more because I only have to have access to this money in like 60 years. So maybe not 60, but you know, like 40 years from now. So it’s actually really not stressful at all. I thought it would be super stressful of like, oh my God, now I have to worry about the market. But you really don’t. The best investment strategy when you’re, uh, our age is to just forget your password or something like that, you know, for your investment account and just don’t look at it.

Adriana (23:34): Um, yeah, so I just used, um, I use a Roth IRA because it’s, um, money that’s after. So I’ve already paid taxes on it, um, as opposed to using a traditional IRA or something else that, um, you pay tax when you take money out of it. So when you retire. And my rationale for that was that I’m in probably in the lowest tax bracket I’ll ever be in, um, because it’s the lowest tax bracket that exists. Um, so this is a good time to do that because my tax, uh, is only gonna go up. Um, and yeah, that’s what I do. I put like $200 every, uh, month in it. Um, and that’s just been a recent thing ’cause I was like, oh, I probably can swing that now because of the rent and whatever. So I just did it and it goes up pretty nicely. It’s just like fun to look at it every once in a while and so that you’ve accumulated money and, um, yeah, it’s, you can actually, because of compound interest, right, you can end up having a lot more money when you retire. And I know you write about this on your blog too, and I, I read a little bit about the that there as well.

Emily (24:35): I just, for, for any listener who is nervous or intimidated about investing, I just want you to go back and go back, you know, three or four minutes in this podcast, listen to exactly what Adriana said like a few times and listen to her like, you know, the transformation that she went through in being intimidated to just asking a very simple question of someone getting a book recommendation, which she just gave to you and just saying, read this book. It’s so simple. We do have a culture of making investing seem a lot more complicated than it is. And like, I guess that’s because people make money off of making it sound complicated. But for goodness sake, that does not need to be, it should not be, it is so simple and, you know, you just put it absolutely perfectly about your strategy and, and why you’re doing it that way. And yeah, everyone just listen to that a few times over again. Um, great. Go pick up a random walk down Wall Street. Perfect. Perfect recommendation. Thank you so much for sharing that. I’m, I’m really glad to yeah, hear that the same thing that I say, but just coming from someone else who, who approached it from a different way and got to the same conclusion and I think it’s exactly right. So thank you so much for that.

Adriana (25:42): Yeah, no, yeah, I’m super into inve. Like I tell everyone, I, I’ve told people in my lab being like, no, you have to do this. It’s simple and it’s easy and it can help you a lot. Yeah.

Can you tell us the story of your big financial mistake from your second year?

Emily (25:51): Exactly. Um, so let’s switch gears and talk about this, uh, big financial, uh, mistake or challenge that came up in your second year. Can you tell us that story?

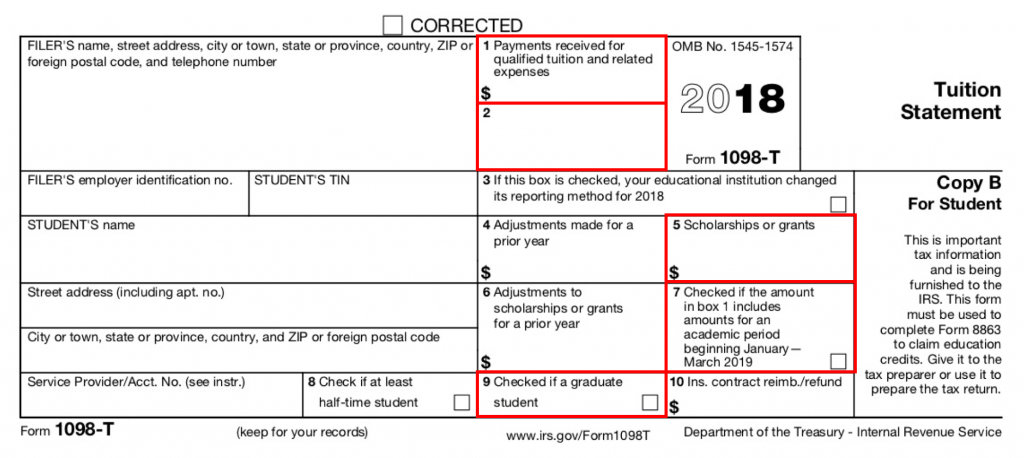

Adriana (26:02): Yeah, so it’s a little bit of a longer story, but I’ll, I’ll try to make it short. Um, so, um, I guess, so when I started graduate school, I was still taxed as an international student. Um, so what that means is, and so I went to, I was an international student in undergrad as well. I went to college in the US um, and I had never had to worry about taxes because they were always withheld from my, um, any salary I had. So I had some small on-campus jobs in undergrad and taxes always been withheld, right? So I never had to worry about it. Um, and then in my, after one quarter in graduate school, I had officially been here for five years and that’s when your, um, your residency status for tax purposes changes from a non-resident alien to resident for tax purposes. So that’s, it literally just means we can now tax as if you’re a resident, but you don’t get anything else that residents get <laugh>.

Adriana (26:56): Um, so when that changed, they actually, so sorry. No, that’s <inaudible>, it was a long time ago, but when it, that actually changed in June, in June of my first year of graduate school. And so what they did is they retrospectively went and said, okay, so this applies to this whole year. It doesn’t apply just starting after June, so we’re actually gonna give you back $3,000 that we withheld from your stipend because you were an international student and we withhold from international students, so we’re giving you back $3,000. Um, and I was like, what is this money that I’m getting back? Why am I getting it back? I don’t even know what it is. Um, and they’re like, yeah, well, taxes, blah, blah, blah, something, something. So I had never heard of anyone having this issue before. I asked a few of the people in the program like how much money they spend on, they, like, did they pay taxes on the fellowship?

Adriana (27:44): How does it work? Because all my money did come from, so it’s, it’s different and, and you write a lot on your blog, there’s tons of resources on this. Um, I’m like, how it’s different if you’re in a fellowship, taxes don’t get withheld, you still have to pay them. Um, and people were like, oh, I paid about a thousand dollars. Oh, I paid like $2,000. There were just like sums all over the board. And I think part of those are from like people, some people were still getting claimed as dependents on their parents. Some people potentially were just committing tax evasion, I’m not quite sure. Um, it’s just all sorts of like information from so many places. And I was like, okay, well this seems fine. Like, I don’t know, I’m just gonna, I’ll, I’ll put this money kind of away. But I did end up spending a little bit from it that I got back.

Adriana (28:26): And then I didn’t know that after that I have to start, like my paycheck went up and I just had no idea what was going on. And I was kind of like, you know, I was like, if, if something bad happens, I would’ve heard about it, right? Because someone else would’ve had this issue and I would’ve, there would’ve been a big uproar about it, but no, then April hit and I had to do my taxes and I did my taxes and it said, you owe $3,000 in taxes. Uh, which was like, what? Um, and it was pretty scary. Um, like I kind of freaked out about it a little bit, um, the way I, you want me to talk about how I dealt with it too, right? Like what happened next?

Emily (29:04): Yeah, yeah. So like the first part of this story is, it’s complicated a little bit because of your previous status as a, a non-resident alien, but it, it is a similar story to what many graduate students go through often, you know, they enter their programs in the biomedical sciences, it’s very common to be on a fellowship or training grant, uh, non W2 income for a year or two, three years at the beginning of your PhD, maybe you won an outside fellowship and so that, that first year, yeah, maybe you came out of college, your income wasn’t too high, maybe you’re still dependent on your parents. It’s, it’s complicated, but also you have usually very little tax due for that year, if any. But then that’s that first full calendar year that you’re in graduate school when you’re supposed to be paying quarterly estimated tax, but you don’t know to do that.

Emily (29:51): Super, super common. I mean, I meet, I meet people in this situation all the time. You don’t know that you’re supposed to be paying and then maybe at the end of the year you figure out that you, you know, had this large amount of tax that you either should have been paying or at least at that point it’s due all at once. Um, or you know, I’ve talked to people who go several years without making this discovery and so then it just builds up and builds up and builds up. In your case, you did figure it out just one year in, um, yeah. That you, you were, were, you know, going to owe tax a good amount of tax on your stipend and maybe you were supposed to be paying that or maybe not during the year. Um, so yeah, that’s kind of where we are. You see this big bill.

How did you pay the tax balance?

Emily (30:28): How did you, I mean, it sounds like you still had some of that money set aside. Did you use that and then where else did you turn for the balance?

Adriana (30:35): Yeah, so I had a little bit set aside, um, but it wasn’t, I think I had about a thousand dollars set aside. Um, so I still had to pay like $2,000. Um, I did get lucky again in that I was actually from a previous year disputing with the IRS, um, over a thousand dollars that they hadn’t given me back on a return. Um, and it was because of this. Um, so they withheld from me, uh, in that first quarter of graduate school, right? That’s from the previous tax year. And I actually was owed that money back because there’s a treaty between Romania and the US and so when you have a treaty status, you can get your tax money back from the first five years. But UCLA still withheld it and they weren’t giving it back, and it was this whole thing. So the, that thousand dollars finally got resolved at the same time as with this giant tax bill. So I got some money from there. Um, and then I actually applied for a payment plan with the IRS, which you can do. And um, they kinda laughed at me because it was only for a thousand dollars <laugh>. Um, but I did, this is usually people that apply for, those have like giant sums, right? That they have to pay, um, or I’m not sure, but they seem to make, they made it seem, when I talk to ’em on the phone as if, why do you need a payment plan for this?

Emily (31:50): Um, yeah. ’cause you’re a grad student and you can’t make a thousand dollars materialize out of nowhere.

Adriana (31:55): Exactly. <laugh>. Um, so I did a payment plan and they were like, yeah, sure, it’s fine. Because usually the, the conditions are just, you have to not have applied for a payment plan in the past five years, I think, and the sum has to be below something absurd, like $200,000. I don’t even know what it was. It was something that wasn’t close. Um, so yeah, so I did that and then I slowly just kind of paid it off. Um, and that actually happened, a similar thing happened to my fiance where he also did a payment plan because he had a smaller tax bill, but it was still a pretty significant sum that he couldn’t just make a appear overnight. So yeah, we, we both took advantage of that. So that’s a good pro tip I guess to.

Emily (32:32): Yeah, that is um, I don’t think I’ve spoken with anybody. I mean, I’m aware these payment plans exist, but I, I don’t think I’ve spoken with anybody before who’s been on one. So it sounds like it was a pretty easy, positive experience. I mean, a lot of people are very intimidated to even like talk to the IRS, like if they know they have this outstanding balance, it’s like, oh, I don’t even wanna engage with this because, you know, they’re gonna like gobble me alive or whatever. But it sounds like it worked out okay. Right.

Adriana (32:58): Yeah, there’s a lot of time spent on hold because they’re, uh, like when you call them that you, there’s not, the call center is super overwhelmed with calls. Um, but they, they, they were, yeah, they were okay with it, so, yeah.

Emily (33:09): Okay. Yeah, so that’s how you worked through it. You had, uh, the savings still, you had a different <laugh> unrelated dispute being resolved at the same time, plus the payment plan and that kind of got you through that. That’s really, really good to know for anyone who is facing a similar, you know, I’m, we’re gonna be releasing this episode shortly before, um, April 15th, 2019. And so if you are a graduate student and you’re coming up on that, you know, you’re filing your annual tax return or maybe it’s your first, um, estimated tax payment for 2019 and you realize that you cannot pay this, the IRS is a place to turn to for help really. Um, it’s, I guess it’s a little bit like finance. I mean it’s IRS debt, like it’s, you’re sort of financing it through the IRS, but it’s, uh, manageable it sounds like, as long as you can afford to be waiting on hold to talk with them. So I’m really glad that you shared that aspect. Thanks.

Adriana (33:57): Yeah, and I don’t think there’s any interest. They never, there’s, it’s an interest free thing, I think for the most part.

Emily (34:02): Yeah, I think if you totally ignore what’s going on and they’re like, then that’s when penalties and interests rack up. But if you engage with them and start working with them, then they can like waive those fees and, and penalties and stuff. So it’s definitely better to just admit that like, Hey, I know, I know this debt exists, you know, this debt exists. Uh, let’s work on, you know, figuring out how to pay it rather than just, uh, yeah, just sort of trying to run and hide ’cause it’s not gonna work out in the long run.

Adriana (34:26): Yeah, absolutely. <laugh>.

Final Comments

Emily (34:28): Yeah. Well, um, yeah, thank you so much Adriana for, for sharing that with us. Do you have any sort of closing comments about, you know, any, any tips you didn’t get in any other part of this interview?

Adriana (34:39): Budgeting can definitely be tough and kind of it’s time consuming and a little bit stressful. Um, but it’s totally worth it because it’s more stressful to not afford to pay your rent <laugh>. So that’s, yeah.

Emily (34:52): Kind of what we were just talking about, like it’s, it’s better to just face up, fess up, face up to the reality of the situation always and engage, you know, with what, whatever you need to engage with rather than just trying to run hide because it just, it just compounds the problems really. Yeah. Thank you for, thank you for sharing with that, that with us. And uh, thank you so much for being on the podcast today.

Adriana (35:14): Yeah, thank you for having me. This was great,

Outro

Emily (35:18): Adriana. Thank you so much for being my guest on the podcast today. Show notes for this episode are at pfforphds.com/S2E6. As a postscript, this episode is being released shortly before April 15th, 2019, which is the deadline both for your annual tax return and your quarterly estimated tax payment for the first quarter of 2019. If you’re unsure how to go about calculating and making that payment, please consider purchasing my quarterly estimated tax workshop for fellowship recipients. The prerecorded videos walk you line by line through how to fill out Form 1040es. I also hold a live q and a session once per quarter to answer any questions that arise for you during the process. You can find more information about the workshop at the tax center on my website pfforphds.com/tax. If you wanna get in touch with me, you can email me at [email protected] or find me on Twitter at pfforPhDs or Facebook personal finance for PhDs. If you’d like to receive updates on new podcast episodes and other content, go to PFforphds.com/subscribe. See you in the next episode. The music is Stages of Awakening by Poddington Bear from the free Music Archive and is shared under CC by NC Podcast. Editing and show notes creation by Jewel Lipps.