For graduate students with sufficient stipends, investing during graduate school is a fantastic financial goal. Counterintuitively, the long-term goal of funding retirement should be the first or one of the first investing goals any individual has. An Individual Retirement Arrangement (IRA) may be an appropriate vehicle in which to invest during graduate school, when the vast majority of graduate students do not have access to a retirement account at their universities such as a 403(b) or 457. But not all graduate students are eligible to contribute to an IRA, and an IRA is only the best choice for certain investing goals. If a graduate student opens an IRA, she must choose either a Roth or a traditional version.

A version of this article originally appeared on GradHacker.

What is an IRA?

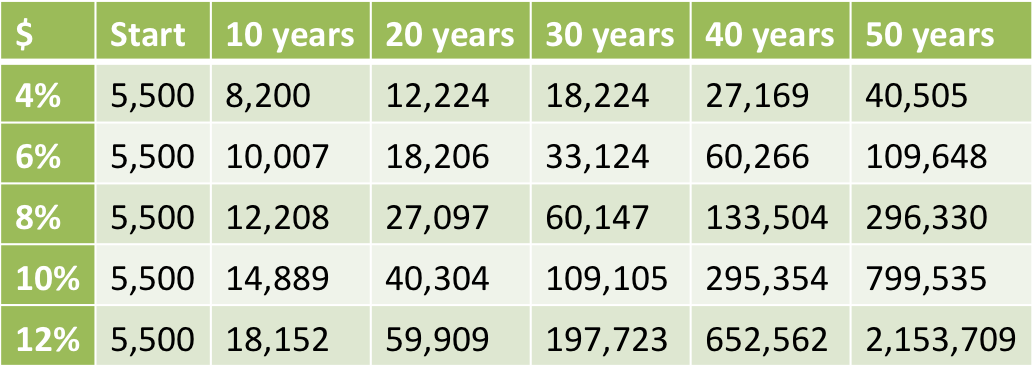

An IRA protects your investments from being taxed while they are growing. An IRA is not synonymous with certain investments, but rather is an envelope around whatever investments you have chosen. As the name implies, the IRA is intended to be used for retirement savings, and by protecting your investments from taxes over the decades, your investments will grow at their fastest possible rate. Due to the power of compound interest, not having to pay tax on the growth of your investments can make a significant positive impact on their value. Therefore, it is a very good idea to use tax-advantaged retirement accounts to the greatest extent of your ability.

In 2018, the contribution limit for people under the age of 50 is $5,500 per year or your amount of taxable compensation, whichever is lower. You can make contributions to your 2018 IRA until April 15, 2019.

Many brokerage firms require a certain minimum account size that may be too high for a grad student just starting out with saving. If that is the case for your preferred brokerage firm, you can save into a savings account or IRA at another brokerage firm (some waive account size minimums if you set up a monthly auto-transfer) and transfer the money when you reach the minimum.

Free Email Course: Investing for Early-Career PhDs

Sign up for the mailing list to receive the free 10,000-word email course designed for graduate students, postdocs, and PhDs in their first Real Jobs.

Who can contribute to an IRA?

Only taxable compensation (previously known as earned income) can be contributed to an IRA. A graduate student’s stipend is taxable compensation if it is reported on a W-2 at tax time. If a grad student has only fellowship or training grant income during a calendar year (not reported on a W-2) and no outside income, he will not be able to contribute to an IRA for that year. Senators Elizabeth Warren and Mike Lee proposed the Graduate Student Saving Act of 2016, which would include fellowship stipends as taxable compensation for the purposes of IRA contributions, but it was not enacted.

If you are married to a person with taxable compensation, you can contribute to a spousal IRA, again subject to the limit of $5,500 or the amount of taxable compensation. There are income limits as well for IRAs, but they are much higher than grad student stipend levels.

If your stipend is not taxable compensation, you can still save for retirement, though it may not be inside an IRA.

Is a Roth or a traditional IRA better for a graduate student?

There are two versions of IRAs available: Roth and traditional. The first-pass difference between the two types of accounts is when you will pay income tax on the money inside it. While the money in your IRA grows tax-free, you do have to pay income tax either upon the contribution (Roth IRA) or withdrawal (traditional IRA).

Initially, when people decide between the Roth and traditional IRA, they compare the marginal tax rates the taxpayer will be in upon contribution vs. withdrawal. The idea is to opt to pay the tax when they are in the lower marginal tax bracket. You know your marginal tax bracket currently; for graduate students without outside income, it is usually the 15% tax bracket or lower. You do not know what your marginal tax bracket will be during your retirement, as both your income and the tax brackets themselves will change in the intervening decades. However, this educated guess applies to the majority of graduate students: You are currently in a relatively low tax bracket because you are in training and building your career. Later in your life, you expect to have a much higher income and be in a much higher tax bracket. If that assumption holds, the Roth IRA is the more appropriate choice. Virtually every graduate student I’ve spoken with about this has chosen to contribute to a Roth IRA during graduate school.

The Roth IRA has some additional flexibility that the traditional IRA does not that may be attractive for graduate students.

Details on Emily's Roth IRA

Sign up for the mailing list to receive a 700-word letter on which brokerage firm I use for my Roth IRA and what it's invested in.

What are the pros and cons of using a Roth IRA?

As graduate students usually lack access to other tax-advantaged retirement account options, the best practice is to only contribute money to a Roth IRA that you intend to invest for retirement. This is in line with the government’s purpose in creating IRAs. The main con of using any tax-advantaged retirement account is that accessing the funds earlier may trigger an income tax payment and a 10% penalty. However, the Roth IRA is unusually flexible.

As you have already paid income tax on the contributions to your Roth IRA, you can remove them at any time without additional tax or penalty. Five years after opening a Roth IRA, a first-time home buyer can remove up to $10,000 without incurring a penalty.

Because of the Roth IRA’s flexibility, some people use it “off-label” as a general savings vehicle. Others may make contributions even if they are not 100% sure they will preserve the money for retirement. Just be sure to match your investment strategy with your intended use for the money; the type of investments you choose for long-term money should be different than those for mid- or short-term money.

Of course, saving for retirement is not an appropriate goal for every graduate student. If you are currently taking on debt (student loans, personal loans, credit cards), your first priority should be to minimize that debt acquisition or even start to repay it. If you can keep your head above water with your stipend but don’t have any kind of cash savings for emergencies or short-term expenses, saving those funds should be your goal, not investing (yet). Even graduate students whose stipends allow for saving may not want to start investing for the long term if they have other financial priorities and their values don’t align with early wealth-building.

If you are a graduate student with a livable stipend who values financial security or independence, using a Roth IRA for your retirement savings is a wonderful choice. If you don’t have taxable compensation, you can still save for retirement in another vehicle. If you aren’t sure what financial goal you are saving for, using a Roth IRA is an option but saving in a taxable account is almost as beneficial and prevents the different purposes from becoming confused.

Did you save for retirement during graduate school? If so, did you use a Roth IRA?