In this episode, Emily interviews Hui-Chin Chen, a Certified Financial Planner specializing in advising globally mobile professionals. Hui-Chin is a managing partner and financial advisor with Jade & Cowry, and she is a repeat podcast guest. Her first interview from 2019 is required listening for international graduate students and postdocs prior to starting this episode. Hui-Chin gives us a bird’s-eye view of a simple investing strategy for nonresidents in the US if using a tax-advantaged retirement account proves too complex. Hui-Chin and Emily review the IRA eligibility criteria for nonresidents with respect to fellowship income and married filing separately. They discuss whether and when someone moving out of the US should engage a tax advisor. Finally, Hui-Chin answers one investing and one tax question submitted by subscribers to the Personal Finance for PhDs mailing list.

Links mentioned in the Episode

- Hui-chin Chen’s Company Website

- Hui-chin Chen’s Blog

- Hui-chin Chen’s LinkedIn

- PF for PhDs S4E17: Can and Should an International Student, Scholar, or Worker Invest in the US?

- PF for PhDs Quarterly Estimated Tax Workshop

- Host a PF for PhDs Seminar at Your Institution

- Emily’s E-mail Address

- PF for PhDs Subscribe to Mailing List

- PF for PhDs Podcast Hub

Teaser

Hui-chin (00:00): Probably a lot of people have that decision fatigue and just, I don’t know what the first step should be. So if you’ve been thinking about this for a year plus and you haven’t taken action, I would say just take that action and that would you know your future self will thank you.

Introduction

Emily (00:25): Welcome to the Personal Finance for PhDs Podcast: A Higher Education in Personal Finance. This podcast is for PhDs and PhDs-to-be who want to explore the hidden curriculum of finances to learn the best practices for money management, career advancement, and advocacy for yourself and others. I’m your host, Dr. Emily Roberts, a financial educator specializing in early-career PhDs and founder of Personal Finance for PhDs.

Emily (00:55): This is Season 22, Episode 1, and today my guest is Hui-Chin Chen, a Certified Financial Planner specializing in advising globally mobile professionals. Hui-Chin is a managing partner and financial advisor with Jade & Cowry, and she is a repeat podcast guest. Her first interview from 2019 is required listening for international graduate students and postdocs prior to starting this episode. Hui-Chin gives us a bird’s-eye view of a simple investing strategy for nonresidents in the US if using a tax-advantaged retirement account proves too complex. Hui-Chin and I review the IRA eligibility criteria for nonresidents with respect to fellowship income and married filing separately. We discuss whether and when someone moving out of the US should engage a tax advisor. Finally, Hui-Chin answers one investing and one tax question submitted by subscribers to the Personal Finance for PhDs mailing list.

Emily (02:00): Let’s talk fellowship taxes for a minute here. These action items are for you if you recently switched or will soon switch onto non-W-2 fellowship income as a grad student, postdoc, or postbac; you are a US citizen, resident, or resident for tax purposes; and you are not having income tax withheld from your stipend or salary. Action item #1: Fill out the Estimated Tax Worksheet on page 8 of IRS Form 1040-ES. This worksheet will estimate how much income tax you will owe in 2025 and tell you whether you are required to make manual tax payments on a quarterly basis. The next quarterly estimated tax due date is September 15, 2025. Action item #2: Whether you are required to make estimated tax payments or pay a lump sum at time tax, open a separate, named savings account for your future tax payments. Calculate the fraction of each paycheck that will ultimately go toward tax and set up an automated recurring transfer from your checking account to your tax savings account to prepare for that bill. This is what I call a system of self-withholding, and I suggest putting it in place starting with your very first fellowship paycheck so that you don’t get into a financial bind when the payment deadline arrives.

Emily (03:25): If you need some help with the Estimated Tax Worksheet or want to ask me a question, please consider joining my workshop, Quarterly Estimated Tax for Fellowship Recipients. It explains every line of the worksheet and answers the common questions that PhD trainees have about estimated tax. The workshop includes 1.75 hours of video content, a spreadsheet, and invitations to at least one live Q&A call each quarter this tax year. The next Q&A call is on Thursday, September 4, 2025. If you want to purchase this workshop as an individual, go to PF for PhDs dot com slash Q E tax. You can find the show notes for this episode at PFforPhDs.com/s22e1/. Without further ado, here’s my interview with Hui-Chin Chen.

Will You Please Introduce Yourself Further?

Emily (04:30): I have a real treat for us today. I have a returning guest, Hui-chin Chen, who is the managing partner and financial planner at Jade and Cowry. Hui-Chin was first on the podcast in season four, episode 17, and by all accounts, this is one of the most popular episodes of this podcast, if not the number one most popular. And it is definitely the episode that I get the most thanks and compliments about. So I want to thank and compliment Hui-chin for the excellent interview that she gave last time, and for the listener we are going to build on that interview. We are not gonna go back and rehash all the points that we made in the first one, and I would say it is a must listen if you are an international graduate student or postdoc or worker or similar in the us, go back and listen to that episode, then listen to this one because we are building on top of it. Um, we are, we’re not going back and asking all the same questions. So Hui-chin, thank you so much for agreeing to come back on the podcast. Thank you for your previous contribution and the contribution you’re about to make. Um, is there any, is there any further introduction you would like to make to give us background on what you do and who you are?

Hui-chin (05:39): Uh, sure, uh, of course. Thank you Emily for inviting me back and thank you for all the compliments, <laugh> from, from you and the listeners. I definitely heard from some of your listeners reaching out, uh, in the past. So in addition to my work at Jade and Cowry, so I’m a cross-border financial planner. Uh, I work mainly with globally mobile professionals and multinational families, which a lot of you are. I also started a, a professional network called the CIGA Network. It’s for, uh, cross border financial planners from a lot of different jurisdictions outside the US so we can collaborate on work for clients better to provide cross-border financial planning better. So, um, so for, for those of you who are not planning to stay in the US or have, uh, plans to go around the world in the future, um, that could be a resource as well.

Investing While Living in the US as an International Grad Student or Postdoc

Emily (06:28): I know both of us reviewed that prior episode, which is published back in 2019 before jumping into this one, and you observed that we approached that interview, we got very quick into the tactics, how do I do this? Where do I do that? And I know you want to take a little bit of a step back and give us kind of a bigger picture about investing while living in the US as an international graduate student, postdoc, et cetera. Can you give us that perspective?

Hui-chin (06:56): Of course. Um, so now I have I, I guess five or six years more experience working with more people from walk all walks of life. All the commonality is that they have some kind of international background coming from different countries. We’re going to different countries. You realize that there are a wide range of possible tax situation, wide range of what people want from their life wide range of family situations, wide range of how many nationalities are in the household. Eventually, those are like Emily, like you said, and those are important considerations when you go down to the weeds. But if you’re new to investing, take a step back. The question if you’re asking, should I be investing while I’m studying in the US or I’m working in the us? I don’t answer a lot of questions with a hundred percent yes, but that’s probably a question I would give you a hundred percent yes, <laugh>, um, just do it.

Hui-chin (07:53): If you’re considering, um, you know, I have extra money, I have saved up my emergency fund. I want to prepare for my future. Should I be investing in an account in the US which I can right now open with no problem. And I say, yes, go ahead and do that. Don’t worry too much about, um, the future tax situation yet. Um, of course then there’s the, okay, if my situation’s a little bit more complicated, I want to know what kind of accounts to use. We’ll talk about that later. Um, but the big picture is investing for your future is important. If Emily hasn’t told you that, you know, in the past, I’m sure she, I’m pretty sure she has, and she probably repeat that over and over. And that’s one thing we really want to drill in. Don’t get bogged down down into your particular situation and just not do anything because you don’t know what the best way to invest is in terms of accounts. Just, you know, open the most simple accounts, uh, taxable brokerage accounts and start investing

Emily (08:55): Could not agree more. And I think that is actually a really good kind of summary of the highest level takeaway from that previous episode, which is, if you are financially ready to start investing, you have the emergency fund and so forth, as you mentioned, do not let your status in the US hold you back from engaging in this process if it’s right for your finances at this time. And the way that I’ve heard this phrase before, maybe from the US perspective, is like, don’t let the tax tail wag the financial decision dog, right? So like the taxes can be worked out <laugh>, there’s nothing to work out if you don’t just start investing, right? You just need to start, you know, if you’re ready. So thank you so much for that like high level, and I really, I’m glad that you added, Hey, if, if the account situation is so complicated and, and you don’t know if you wanna use a tax advantage retirement account and all of that, hey, a brokerage account is available to you, a simple taxable brokerage account, normal kind of account that you could open at a brokerage firm that is always available to you. Again, there may be tax implications, but it’s the simplest level. And so that is an appropriate way to get started investing. If that’s all you wanna do at that time, that that’s perfectly fine. Am I hearing that right?

Hui-chin (10:07): Correct. I, I know probably a lot of people have that decision fatigue and just, I don’t know what the first step should be. So if you’ve been thinking about this for a year plus and you haven’t taken action, I would say just take that action and that would, you know, your future self will thank you.

Taxable Compensation and IRA Eligibility for Non-Residents

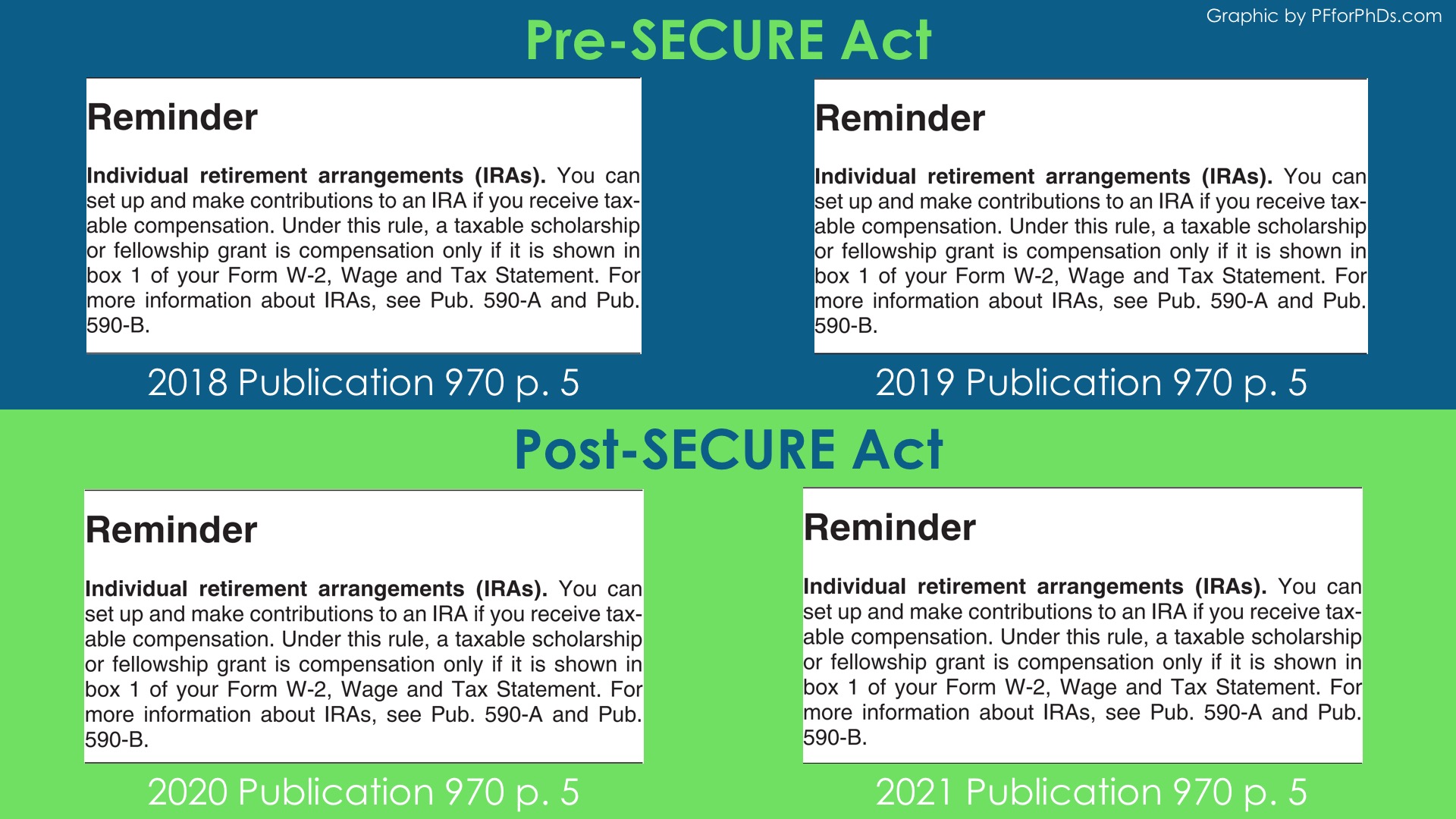

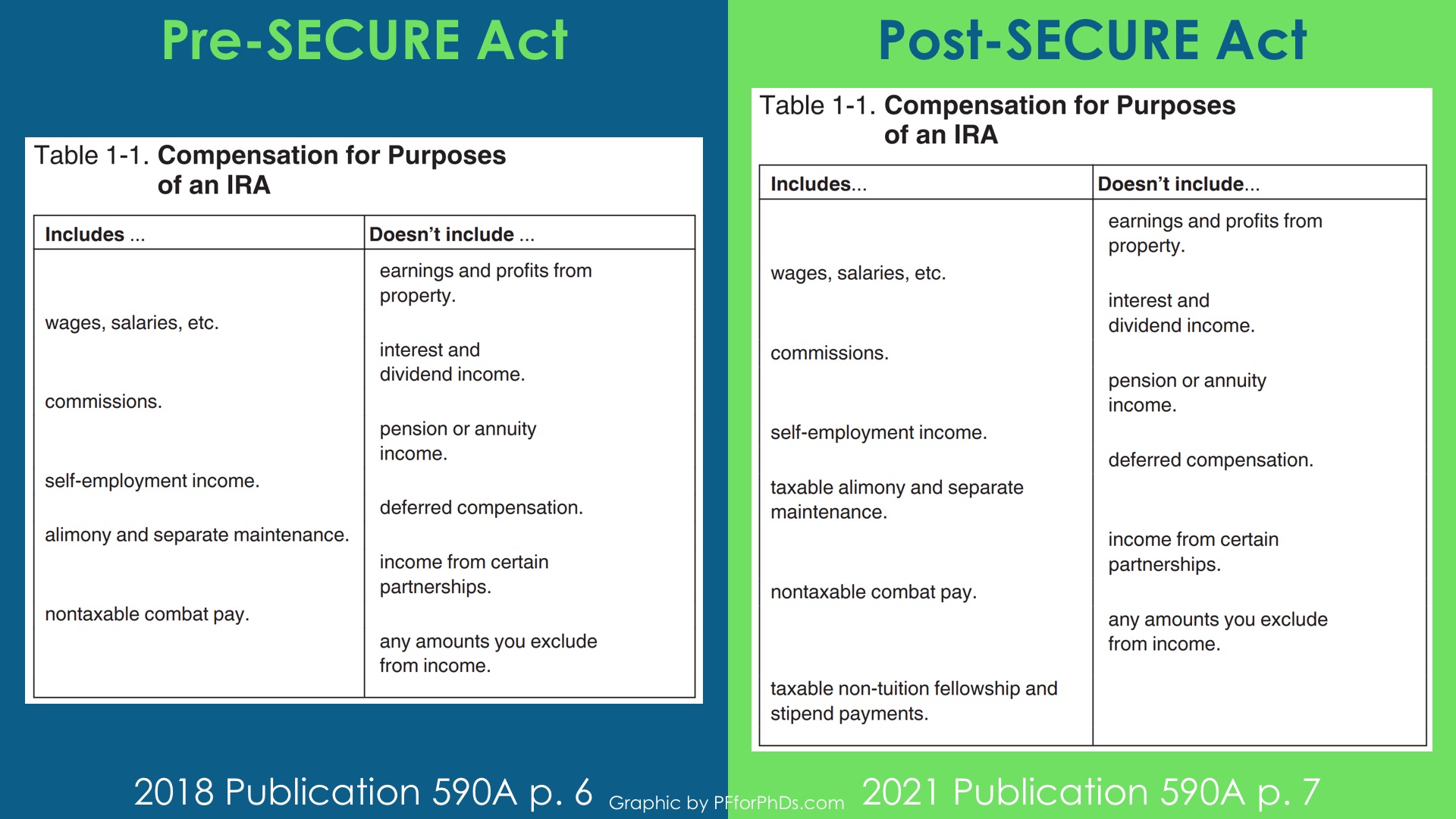

Emily (10:25): Absolutely. Just get off the starting line, just do something. I I tell the same thing to, um, the people who I teach as well. It’s like you have a lifetime of investing ahead of you and it’s a long journey and you can expect that you will make mistakes or at least have to take steps that you’re not a hundred percent sure of along the way. And that’s okay. You have time to course correct, you have time to fix things later on. Getting started is the most important step here and then you can make some adjustments as you go along. Now I’ve gotta take us into the weeds. Okay. We got a lot of weeds questions. I had some weeds questions. I asked for questions from my mailing list. They submitted some down in the weeds questions. So, okay, we’re gonna go there. Now that we’ve gotten the high level, let’s assume that someone is ready to invest, uh, while they’re in the US and, and they have those questions about what kind of account should I use. Okay, I wanna go beyond the taxable brokerage account. So when we last spoke, um, it was right before the secure act passed and we did discuss the change that was coming in the secure act. So as a review for the listener, um, it used to be that income from fellowships, so like non-employee type positions, but given inside academic, you know, graduate student and postdoc positions, um, this was initially not eligible to be contributed to an IRA, an individual retirement arrangement. Um, the secure act changed that for graduate students and postdocs. So now even if you have fellowship income, not from an employee position, but you are a grad student or a postdoc, that income became eligible in terms of it being compensation from this term taxable compensation. But what we talked about is, okay, well is it taxable? Because that is what someone who’s a non-resident in the US needs to consider. Okay, yeah. If you’re a US citizen or resident, it’s gonna be taxable, we know this, but if you’re a non-resident, well, we have the questions about what is the tax treaty that applies and so forth. So can you elaborate on that anymore? How can someone who’s a non-resident in the US tell whether they have taxable compensation, whether they have income that is eligible to be contributed to an IRA?

Hui-chin (12:30): That’s a question I, I don’t know. I have a hundred percent answer to that. Obviously the, the original distinction be before like there was a confu, not the confusion, but before secure act, the distinction is if it’s W2 reported on W2 versus the income that you’re getting either from school or organization, that’s non W2, right? So that’s the fellowship income and things like that. Now it’s clarified or added in the legislation that those non W2 income that may, may be reported as miscellaneous income on 1099, those can be counted as fellowship income, but those supposedly would be reported, uh, taxable. Meaning when you file your tax return in the us it’ll be added depending on um, your tax, whether you’re already a resident past your exempted uh, uh period, or if you have, um, that the tax treaty like you mentioned so that you know not fall into the normal exempt period.

Hui-chin (13:37): My take is if it’s not listed on your tax return when you report as a taxable income, then you cannot use it to contribute to, uh, an IRA or Roth IRA or 401k for that matter. Of course, if you don’t have, uh, W2 income is unlikely, it’s 401k, it’s most likely your own IRA or Roth IRA. But the idea is that taxable means not, doesn’t mean that you didn’t pay tax on it because you have the standard deduction, you have potential other things to reduce how much become taxable income, but that income must be listed on your tax return to begin with for it to count as taxable compensation.

Emily (14:22): Yeah, I like that you pointed out that that’s a very clear resource that one can go to after you’ve filed one type of tax return. Um, in the US like a non-resident can see, okay, I had taxable, potentially taxable income, and then I have maybe some income over here that’s listed as tax exempt. You can see they’re in different, they’re different boxes, different sections. So did I have any in this taxable column? Um, then okay, then that’s taxable compensation. Um, and I like that you pointed out that just because income is taxable doesn’t mean it ends up getting taxed, but it has to be eligible to be taxed. Yes. So I think that makes total sense.

Married Filing Separately as a Non-Resident: Implications for Roth and Traditional IRA Eligibility

Emily (15:06): This next question comes from me actually because as I’ve been learning more about non-resident taxes, I realize that it’s pretty common for non-residents to file married filing separately. Can you explain why or in what circumstances non-residents would file married filing separately and then what implications that has for their Roth IRA or traditional IRA eligibility?

Hui-chin (15:29): Well, to clarify, there is no married filing jointly on 1040NR <laugh>. So you’re either single or you’re married, you know, and each filing as an individual. So I know a lot of countries like that in the world, like they don’t have filing joint option anyway, so you might feel like, oh yeah, it’s normal. But in the US the default when you’re married as a resident is filing jointly and they usually get better tax treatment than if you do married filing separately.

Emily (15:59): And this is one of those examples, is this Roth IRA eligibility? So if someone does is married and they’re filing separately as a non-resident, then what happens to their IRA eligibility?

Hui-chin (16:11): Yeah, so for the Roth, IRA, um, there is a income, uh, limit. Obviously if you are doing the normal single or married filing jointly, the income limit is much higher. But the married filing separately, because it’s not a, um, I should not comment, but it’s a, a specific thing that when they put in their legislation, they don’t want the people with married filed separately to have the same benefit as married filing jointly. So they set that limit very low at $10,000, I believe. And um, and that’s the one that doesn’t index by inflation. All the other are indexed by inflation. So right now, if you’re married filing jointly, the income limit would be like 200 something thousand. Yeah. And it, it changes every year. So I always, whenever I tell people, you just Google <laugh>, you know, Roth, uh, Roth IRA contribution can limit that year, like this year 2025 will show you a chart that clearly laid it out.

Emily (17:11): And then I also read something about there’s a difference if you never lived with your spouse during the course of the year

Hui-chin (17:17): For international student. Yes, I can see if you come here on your own and your spouse is not even here yet. I think that’s just this, the, the married filing separately distinguished between if you’re truly, you have basically you’re truly two households, right? So that they set that limit to be the same as what if you’re single.

Emily (17:35): Okay. So let’s take a couple scenarios here. So one, you’re a married non-resident and you and your spouse are living in the us you’re living together then for a Roth IRA, your income ceiling to be able to contribute is $10,000 and that’s the taxable in the US $10,000, right? Okay. Um, then let’s say you are married and you and your spouse live separately. Maybe you are going to two different universities for your graduate degrees. You do not occupy the same household, then the eligibility is is if you were single, is that what you’re saying?

Hui-chin (18:08): Correct, because the, the two uh, different sections are single head of a household or married felling separately as the, the same category. And you did not live with your spouse at any time. So the, I the basically the distinction is that if you’re clearly married, living in the same household, they want to kind of, I shouldn’t call it penalize you. They don’t want to afford you the same benefit of why not you could marry filing jointly, but obviously if you’re non resident then you cannot, so it’s not an option. Um, but for just because this, uh, specific rule applies to residents and non-residents. So the idea is that if you’re truly just, you know, even you’re married, you are in two different households, like you’re single, so they give you that same limit as if you’re single.

Emily (18:58): And same kind of logic if your spouse is in another country, not even living in the us correct?

Hui-chin (19:03): Yeah. So you would still have to file married filing separately unless you want to tell the world that you are single <laugh>. Again, the, the idea is that we’re into the weeds. If you are contributing so little and you just want to make sure you’re investing, don’t worry about Roth IRA, you know, traditional non-deductible, IRA, open a normal account, invest the same amount, that’s totally fine too.

Emily (19:30): Hmm. I’m glad you took us back there. I was gonna do the same thing. <laugh>. Um, if this is all getting too complicated, if you have question, like if you’re listening to us talk about the married filing separately stuff and you’re like, I’m just confused, I don’t know what my eligibility is anymore, don’t worry about it. You don’t have to use that type of account. You can just use a regular taxable brokerage account and that’s perfectly okay. <laugh> for the time being.

Building an Investment Portfolio as an International Postdoc Residing in the US

Emily (19:54): Now I received this question actually, uh, from someone who was at, I gave a webinar recently for the National Postdoctoral Association, um, overall, and then someone who, uh, is an international postdoc asked me this question as a follow up and I said, submit this to my upcoming interview because I’m gonna be asking question these questions. Okay. So her question was, given the high mobility rates of postdocs and balancing long-term investment with liquidation of assets, what are medium risk investments that international postdocs residing in the US can take advantage of?

Hui-chin (20:30): It’s a good question, but also, um, a question I think needs a little bit more, um, explanation from the person we’re asking what that means, right? So first of all, I wouldn’t say there’s one investment you can find is just medium risk, right? The idea is that when we’re talking about risk spectrum, so this is going back to investing 101, like how do we build a portfolio that’s appropriate for your risk tolerance and risk capability? Meaning a lot of times I deal with how long you can invest. This usually is come from a portfolio construction of different investments, and that’s what diversification is. It’s not just, oh, I’m buying a hundred percent stock, but you know, a hundred stocks in my a hundred percent stock portfolio. That’s diversified, that’s diversified within your stock, but your portfolio is not diversified across risk spectrum, right? So without going into, you know, like going into inve investment philosophy and basics, the idea I would say is looking at the asset allocation of, of your portfolio, are you, um, investing across stock and bonds, which is the two main building blocks of, um, the publicly traded portfolio.

Hui-chin (21:49): Usually if you go look at, um, for example, target date funds or, um, some other kind of life strategy funds, so like target date funds is based on risk capability. So how long you have to invest. So if you say, see a target date fund of 2050, that means they don’t expect you to need the money until you are in 2050. But if you get one that’s 2025, that means, oh, I need the money now. So you can see how those two funds have different stock versus bonds asset allocation, and that gives you an indication for your time horizon, right? So when you’re talking about you’re globally mobile and you know, you wanna balance liquidity, it sounds like in your mind there’s a chance you might need to take the money with you, you don’t wanna keep it here, but then, um, it doesn’t necessarily mean that’s your investment timeframe, right? If there’s an account, you can leave it there forever, you might. So again, like your balancing act might be different from other people’s balancing act. So you might in your mind, decided what my investment timeframe is, and that’s your, um, sort of risk that you are able to take. So I would suggest that without going into, you know, looking at everybody’s risk tolerance and how to build the proper portfolios, a starting point, when you’re looking, you, you can go look at, you know, Vanguard, fidelity, all of those companies, target date fund, and see how they have the different asset allocation and pick the date that matches yours. It doesn’t mean that you have to buy that exact fund because a lot of them are mutual funds. So for, um, non-residents, you can’t buy them <laugh>. And for people who are residents, uh, but you might eventually leave, but want to keep the account open. Um, mutual funds not the best option. So I don’t re recall if we discussed that in the last episode. So you might want to see, okay, how can I replicate this asset allocation with this kind of investment timeframe, um, by buying the ETFs myself. So for example, Vanguard, if you go to their target date fund, they will tell you exactly how, what other individual Vanguard funds or ETFs they use to build that target date fund, so you can replicate that strategy yourself.

Emily (24:15): Thank you so much for that explanation. And this is news to me about the mutual fund. So we’re gonna put a pin in that and come back to it in a minute. When I was conversing with this person who, who posed this question, I was asking her, what is your actual timeline on your investments? And not necessarily how long you think they’re going to stay in the us but overall do you think you’re going to be investing from now until you’re in retirement, you know, many decades from now? And so I, I think even someone, you can correct me if I’m wrong, but I think even someone who is planning on moving their money, let’s say in the next decade to a different country, they still may have a very long investment horizon and their choice of investments, how much risk to take on would probably still reflect that total view, not just the time period that they plan on keeping the money in a US type account. Is that correct?

Hui-chin (25:08): I think the main issue is, um, if they need to move the investments overseas, most of the time if you’re buying a US domiciled, um, investment, it may not be possible for them to move, move the investment in kind, meaning not sell them, right? If you need to sell your investments, then that’s what your investment timeframe is.

Emily (25:29): But wouldn’t, couldn’t you just sell and rebuy something similar?

Hui-chin (25:34): Correct. But the, the risk of your selling at a loss is the, is the same. So is the, so technically you’re right. If you like, they can come a hundred percent replicate their existing strategy and rebuy in a different jurisdiction. It’s kind of like when we’re talking about tax loss, harvesting <laugh> type situation where you can sell and rebuy and technically you are not losing out. But when you’re talking about transition, usually there’s a slightly longer timeframe. So I would say you are, you’re correct in that too. Like if you can, if you know that your likely will be able to create a strategy after it’s just a brief time outta the market to transition into that, you might take a loss, kind of like non-deductible loss or something. But the idea is when you repurchase the investment, it’s still at the low point, so you’re not really taking a full loss

Emily (26:34): So it could go either way. It depends on where you think you’re gonna move the money to the investment options that are there. So there’s again, a lot of considerations. We, it’s hard to simplify it down super, uh, super a lot. So as ever, it’s gonna depend on the specifics.

Commercial

Emily (26:52): Emily here for a brief interlude. Would you like to learn directly from me on a personal finance topic, such as taxes, budgeting, investing, and goal-setting, each tailored specifically for graduate students and postdocs? I offer workshops on these topics and more in a variety of formats, and I’m now booking for the 2025-2026 academic year. If you would like to bring my content to your institution, would you please recommend me as a speaker or facilitator to your university, graduate school, graduate student association, or postdoc office? My seminars are usually slated as professional development or personal wellness. Ask the potential host to go to PFforPhDs.com/financial-education/ or simply email me at [email protected] to start the process. I really appreciate these recommendations, which are the best way for me to start a conversation with a potential host. The paid work I do with universities and institutes enables me to keep producing this podcast and all my other free resources. Thank you in advance if you decide to issue a recommendation! Now back to our interview.

Investing as a Non-Resident: Mutual Fund Restrictions and ETF Options

Emily (28:12): I just learned that non-residents can’t buy mutual funds, but they can buy ETFs. Did I hear that? Can you expound on that a little bit more?

Hui-chin (28:21): Yeah, so in essence, mutual funds and ETFs are two different financial products. Mutual funds are when you are buying the shares, you’re buying directly from the mutual fund companies. So once they get your money, they go out there and buy more stocks and bonds that represent part of their funds. The ETFs are in a sense also a mutual fund, but the shares are traded on the exchange. So when you’re buying a share, you’re most likely buying from another investor from the fund. And because it’s treated on an exchange like a stock, um, there’s no restrictions on who you can, uh, who who can own those shares versus mutual funds. Because the us um, regulations or the compliance situation, they do not let non US resident tax resident, um, become a shareholder in that mutual fund company. So that’s the, the main difference. So a lot of times it’s, it’s not always like you cannot hold them. Like for example, I know, um, Vanguard in the past would let, um, if you say, oh, I no longer live in the us, they would just say, okay, we won’t sell it, but you can’t buy anymore. So the only, the only thing you can do is to take it, to sell it eventually. But there are some mutual funds that would say, we just don’t, we cannot have non-US tax resident as, um, a shareholder. So they would, um, ask you to sell.

Emily (29:57): Okay. So is it then up to the policy of the firm that you’re working with, whether they would allow you to buy and it’s just a widespread com common policy that you wouldn’t be able to buy mutual funds? Is, is that what I’m hearing?

Hui-chin (30:10): Correct, that’s on the custodian side. If you started your account as non-resident, most likely you’re not having access to mutual funds. You would just buy ETFs. If you started as a tax resident and you have mutual funds, when you change, um, your tax residency, they may ask you to sell all of your mutual funds, but technically it’s a mutual fund site, uh, decision, not the custodian decision.

Emily (30:37): All of this is, again, we’re getting down into the tiny little weeds there because in terms of investor strategy and behavior and so forth, mutual funds, index funds, ETFs, they can be very interchangeable in a sense. There, there are differences, but the differences are not super material for a basic investor, right? So it’s perfectly fine hearing this go ahead and buy an ETF that reflects, you know, the index fund that you wanna be in or the set of index funds. That’s all good, right?

Hui-chin (31:04): Correct. And Mutual fund has a benefit of, normally all you do is you send the money and you say, I want to put my $3,000 on Vanguard Total index mutual fund Admiral Shares, right? They would just take it, okay, you don’t even need to think about it in order to buy the same ETF class, you need to do it when the market is open and then, you know, between nine 30 and four eastern time, and then you go to the custodian and say, I wanna buy this number of shares. So it, it is a calculation <laugh>, it’s a change of mindset and I, I know a lot of people, you know, who start started investing previously when it’s more like a mutual fund, you know, uh, time before ETF’s prevalent, it’s used to like, I’m just throwing this money into mutual fund, I don’t have to do the actual purchase, right? It’s just saying, I’m giving you $3,000, I own the share, versus I need to actually go on the exchange. Meaning the market has to be open and to decide how many shares to buy. Like you would decide how many shares of Apple you want to buy, and then you own the shares. So it’s a, it is just a different, uh, type of investment process, but once you’ve done it, you’ll be more familiar with it.

Emily (32:24): Yeah, so slightly different buying process, but presumably we’re buying and holding <laugh>, so you just need to buy once per month or whatever your, you know, dollar cost averaging frequency is and then just hold it from that point. Uh, beautiful. Thank you so much. I’m glad I learned <laugh> something. Well, several things so far from this interview. Thank you.

Leaving the US After Investing as a Non-Resident

Okay. Let’s say we have a, uh, international grad student postdoc or other kind of worker in the US and they’ve been investing while they’re in the US and then they decide they’re gonna be moving to another country and they don’t know yet should they leave the money in the US in the US funds, should they, uh, be moving it at the time that they move. Is it appropriate to engage some kind of financial or tax professional with this decision perhaps about making the decision and perhaps about executing the decision?

Hui-chin (33:15): Correct. Um, I would say both. Um, it depends on what, um, at what point of decision you are, you are at, right? It’s usually a series of decision. I’ve worked with clients in like, uh, from, from the very beginning or they only engage me when, you know, we’ve decided we’re moving to this country because we get a job and we’re definitely going there at this date. So just tell me what do I need to do before I leave? Right? So that happens. And there’s also the, hey, I got three job offers in three different countries with three different packages. Which one should I choose? Right? Then that’s more at the beginning of the process. So depending on where you are or what you need, like a financial planner, cross border financial planner or people at least uh, familiar with international planning aspects should be able to do that kind of strategizing with you. Like if your decision is upfront or if your decision is just, okay, I have money, I have like, I have investments, I’m definitely going there at this time, what do I need to do? Gimme a checklist, that kind of thing. And we, we’ve also, you know, done that. So I would say definitely talk to someone before you move because there are are quite a few things that’s just easier, like most from a process perspective and also from sometimes tax savings, um, perspective because you, depending on whether you’re moving to a higher co, higher tax or lower tax jurisdiction, um, sometimes the jurisdiction has, you know, some exemption period upfront. So you want to, um, for example, we know that when, when you’re a true non-resident from US perspective, you can sell without paying taxes on your capital gain. So a lot of people plan to do that right when they leave, so they can cut off any US tax, but depending on where you move to, you might be paying the higher tax in the other jurisdiction anyway. So that’s one consideration. But if you’re moving to somewhere where they don’t tax foreign income, then that’s a perfect time to consolidate, uh, to, to sell. Then there’s also the, or there are countries where there’s exemption period or you know, the exemption period can be only six months or it can be four years, right? So it’s helpful to know in advance so you can, um, do the things, the right sequence and timing.

Emily (35:40): Okay. So let’s say we have someone who is planning that move, but it hasn’t happened yet and they engage someone like you to for help with this, are, are they gonna be able to know and do everything that they need by engaging someone, let’s say from the US side or do they also need to hire someone in the country that they’re moving to perhaps, or, or would you for example, be able to handle things on both ends

Hui-chin (36:07): Depending on the kind of structure that you’re working with the advisor. Some advisor, they specifically are cross country of those we call it um, country, country payer advisors. So they only deal with US Canada for example, or US UK. So they know everything they, you need to know <laugh> about those two countries. You can engage in one of them and then they can help you on both sides technically in terms of knowledge, right? So not all of them are registered to practice on both sides, like having their company on in two countries that requires, you know, heavier capital investments obviously. So some companies do they, they are just like two, like they have both US branch and UK branch, so they can like take you over. Um, but also there are just people who are deal who who are used to deal with the situation in a cross country, uh, sense. Uh, so they can do the planning part and they have people they can work with after you’re on the other side to um, do the implementation if needed. Um, but not necessarily have to redo your entire planning part. So it depends on, um, the type of professional you engage with, obviously there’s, you know, Canada and UK is the two most common places, you know, us uh, residents go for international students you can like that. It opens up the range quite bit. Um, especially I know a lot of, uh, people, um, come back to Asia where I am at right now. So for my company, what we do is, that’s why I started the CIGA network where there are people who p practice in different jurisdictions that can pull into, do a collaborative, um, type of consultation or um, project. So that’s kind of a short way of saying, you know, well maybe not too short <laugh>, you know, a a sort of a generalized way of saying like there are different options. So you can do find, try to find one person can do both or you can find one person who knows the scene that can collaborate with other people. But either way, um, make sure you’ve talked to someone who knows at least about the exit or the inbound because people who are only dealing with US tax residents, they don’t even know what you need to look out for when you leave. ’cause they’re not expecting to work with people who are ever, you know, renounce their US citizenship for example. So they don’t know what the exit entails. That’s the one big, um, drawback of working with someone who’s never dealt with exit or inbound.

Emily (39:01): For sure. And the CIGA network, which I believe you said you started, um, is that something that advisors use to find each other or is that something individuals could use to find an, an advisor or an advisor pair?

Hui-chin (39:14): So it’s sort of like how, it’s not like a technically a client facing thing, although we have our advisors listed. Um, it’s more for advisors to kind of collaborate with each other.

Emily (39:28): So then how does an individual go about finding someone to help them with this?

Hui-chin (39:34): Um, you can find our members on the website so that you can tell like what countries they have worked, um, listed has worked before, uh, the situation. So you don’t all have to come to me for me to do, make a referral. Like they, they are listed, um, but obviously it’s, if you’re thinking about a more complex situation, it takes a little bit digging. It won’t be able to say, oh, this, if you’re talking to talking, um, with me, then I can probably give you some solutions like who you can talk to. But it’s diff i, I understand it is difficult for someone who doesn’t know the playing field and try to find the right person to, to answer a question, especially when a lot of them do still work with high net worth individuals.

Emily (40:24): Hmm. Yes. Yeah, I was actually just going to ask, so I think the reason this question comes up is because graduate students especially, and also postdocs have been low income for so long that the idea of hiring a financial professional might be kind of daunting. Um, but I, I think what you said earlier emphasizes that it’s really necessary, um, because it’s, it’s, it’s an investment <laugh> like so that you don’t lose out on a bunch of, you know, tax advantages. You could have, you could have used had you known about them. So it sounds like a worthwhile cost.

Hui-chin (40:57): Correct. And also it has to do with how much, um, general income or asset you are thinking, thinking about planning for, right? So if you have only made one contribution to your account and you’re leaving, so it’s a very small amount in your account and you just want to know what to do with it, it might be slightly higher cost <laugh> than if that’s your only question and you need to find someone to answer that question, it might feel to you that, you know, the cost is more than the benefit that you’re gonna get from it. So listen to Emily <laugh> and whatever, you know, information you can get and make a decision if you don’t think the cost is worth it. I think for everything it is a cost benefit, but obviously for people who’ve lived here for 10 years, you accumulate it enough, you might even have a home, you might have to sell your home. All of those things have implication whether you’re a resident or non-resident before you do it. So definitely talk to, even if it’s not a investment advisor, if you feel like, oh, I know my investment, I just want tax help. Um, find a person who understands, um, the tax transition from resident to non-resident and do a consultation with them.

Managing the Fear of Making Mistakes on Your Taxes as a Non-Resident

Emily (42:18): Mm, very good. And going back to what we talked about at the top of the episode, hey, just start investing <laugh> right when you get here if you can. So you’ll have a lot of, uh, years of, of contributing behind you and hopefully it’s a significant sum that you’re then, um, getting some advice on. Okay, down to our last question, also submitted by a subscriber. This person says, I’m terrified of messing something up with my taxes. How do I make sure that I do everything correctly? I don’t wanna have mistakes on my record. How would you respond to this person?

Hui-chin (42:51): It’s a common fear, unfortunately for even for us tax residents or people who grew up here and need to file their own tax returns, it’s the US tax return is complex. It’s how, how it’s, you know, laid out for taxpayers. It just feels like it’s a form that people shouldn’t know how to fill out. That if you need to read through all the instructions, but I would say be like, I, I can understand being an immigrant myself, you feel like anything you messed up will become something that mess up your chance of saying or, you know, have other implications. So beyond talking, like beyond working with someone who knows what they’re doing, um, I don’t have like a really good, um, solution for that. But I would say, and I i, given the current political climate, I don’t wanna come out and say, oh, you don’t have to be afraid. You know, it’s a simple mistake and you know, it cannot be used to, you know, in other aspects of life, I cannot feel, I, I feel like I cannot say that ’cause I don’t know what the future will bring, but the, the main thing is make a good effort of understanding your tax return. Even if you, after you hire someone to do it, don’t just assume that, oh, I hire someone they know what they’re doing and just sign whatever giv- they give in front of you. If you, if it is the first time or the first few years you’re doing your tax return, um, it should be fairly simple. Like there should be like three, four lines with actual numbers, right? Like on your tax return, make sure you understand why they’re reporting. Make sure you, it matches whatever tax form you have gotten before. Whether it is W2, 1099, you know, I’ve seen people, you know, like professional tax preparers enter the wrong number because, just because, um, so I would say the only thing to combat the fear is actually knowing, um, not just thinking about it as, oh, I will never understand it. I’m just afraid it will get messed up and there’s no solution. It will, I think the, the, the more it get, the more events you are like into your career and things like that, the tax return will only become more complicated. So start from the very beginning, understand when it was really easy <laugh>, right? Like when you only have one W2, like, oh, this is what it does and oh, like at the first year you become a tax resident. Oh, I need to report all my foreign accounts. You know, I hope everybody already know at this point. If you’re reporting as a tax resident or the foreign accounts or the foreign income interest dividend from your bank account from when you were a child overseas starting the day, you become tax residents. You need to start reporting them. So make sure like that, that first year you really know what you’re reporting and if you feel like you don’t want to take on the burden of doing it alone, obviously then you hire someone. But kind of being a partner with that, someone to make sure everything is correct.

Emily (46:16): I I agree with you, no surprise there. I don’t think this person should be terrified. Um, like you said, just make that good faith effort to either prepare the return. Most people are using software, right? They’re using sprintax or something similar. Um, make the good faith effort to prepare it accurately to understand everything, to double check it. Like you said, if you’re working with someone else or software, double check it. Don’t assume they did everything perfectly because sometimes there are errors in communication and so forth. Um, not to be too self-promotional, but I do have a workshop called, um, how to complete your PhD trainee tax return and understand it too. Emphasis on that part. It’s like a big explainer, not just about getting through the process, but about, um, understanding what, what everything means and, and verifying and checking that that it’s, it’s done properly. It makes sense. Um, maybe you can corroborate this, but I know on, at least on the citizen resident side, our obligation is to faithfully report our income. And if you don’t take every single deduction you are eligible for or don’t take every single credit, they’re not too worried about that. What you really need to report is your income accurately. Is that the same on the non-resident side?

Hui-chin (47:27): Correct. So if you report all of your income and you don’t report deduction and you pay more tax, the government would be, you know, unhappy about you wanting to pay more tax, right? But from my experience, there are like simple checks, even though IRS system is still a bit arcane, there are checks that they do automatically. For example, the first year I did my own, um, when I had my first paycheck W2 paycheck and as a US resident tax resident, I didn’t take the correct personal exemption when there was still a personal exemption when before they were taken out. Um, I remember, uh, getting a kind of like IRS notice saying, oh, you didn’t take the exemption, we adjusted it, we’re giving you a refund. So that happens too, right? As long as you put all your income on there, um, and tax at whatever the ordinary tax rate, right? So don’t put your dividend, ordinary dividend into capital gains, right? Then that’s, you know, you’re trying to avoid tax. So as long as you’re putting all the income in the correct category, then it should yeah, be good.

Emily (48:39): I too have made mistakes on my tax returns over the years, some of which the IRS caught right away, some of which they didn’t. But like you said there, there are very simple checks that are automatically done. And so I’ve done the same as you. I’ve messed something up both in my favor and the IRS’s favor. It’s happened both ways and they’ve caught it both ways. <laugh>. So, you know, do your best. <laugh> is all we’re saying. Please don’t panic about this.

Hui-chin (49:01): Yeah, and the, I think a lot, a lot of the, the thing is people may not a hundred percent understand what is income. I encounter people, a lot of people asking can I, you know, my, my mom’s giving me this gift $5,000. Do I have to report it on a tax return? Right? So that’s a, that, that is a gift that is not income. So when in doubt, I’m not saying just put the 5,000 gift as income so you can pay more taxes. But if you feel like, okay, it’s, I don’t know whether this is income or not, that’s when you need to talk to a tax professional.

Best Financial Advice for Another Early-Career PhD

Emily (49:42): Yeah. That’s really great. Hui-chin, thank you so much for another fantastic interview. I wanna leave with the question that I ask all of my guests, which is, what is your best financial advice for an early career PhD? A grad student, a postdoc, someone who’s recently finished their PhD training. Um, can you give us any insight there?

Hui-chin (50:00): I think we’ll, um, come back to the first point we made, um, in this podcast is just, um, decision fatigue is real. And I think in the academia especially, people are used to doing research. So even when the personal finance side, we, we tend to want to do it, you know, understand everything and we’re just talking about you need to understand your tax return, right? So we all have the research mindset of like really understand what we’re doing doing, but at some point you need to, you know, make a decision and not just a decision. You need to actually carry out your decision. So if you’ve been thinking about investing, coming back to the same point, if you think about investing for a year and you’ve met your, you know, emergency fund, you’ve met your cash cushion, you’ve met all your other goals, you know, you need to invest for the long term now and you are just getting bogged down on, I don’t know which account to open <laugh>, I don’t know which investment to buy. You know, just use a normal taxable brokerage account that you can open and then look up the most common target date fund, see like Vanguard ones and see how they’re breaking down their stock and you know, bond allocation based on your risk tolerance and just buy it,

Emily (51:15): Buy a couple of ETFs and you’re good to go. You’re on your way. Um, Hui-chin, thank you again for coming on the podcast. It’s been a pleasure to have you back.

Hui-chin (51:25): You are welcome. Thank you for having me.

Outro

Emily (51:37): Listeners, thank you for joining me for this episode! I have a gift for you! You know that final question I ask of all my guests regarding their best financial advice? My team has collected short summaries of all the answers ever given on the podcast into a document that is updated with each new episode release. You can gain access to it by registering for my mailing list at PFforPhDs.com/advice/. Would you like to access transcripts or videos of each episode? I link the show notes for each episode from PFforPhDs.com/podcast/. See you in the next episode, and remember: You don’t have to have a PhD to succeed with personal finance… but it helps! Nothing you hear on this podcast should be taken as financial, tax, or legal advice for any individual. The music is “Stages of Awakening” by Podington Bear from the Free Music Archive and is shared under CC by NC. Podcast editing by me and show notes creation by Dr. Jill Hoffman.