In this episode, Emily interviews Brendan Henrique, a fourth-year PhD student in education at the University of California, Berkeley. Brendan leverages his conference and research travel plus personal spending into free luxury travel by amassing credit card points and elite status at hotel chains. He breaks down how he pursues the points and miles hobby even while living on a grad student stipend and how it’s motivated him to work hard so he can play hard. Brendan’s travel habits might seem out of sync with his income or ‘student’ status, but it’s achievable for many grad students who are free from credit card debt and have a small degree of savings.

Links mentioned in the Episode

- PF for PhDs Spring 2025 Giveaway

- Brendan Henrique’s Substack: Grad Student Travel

- Brendan Henrique’s TikTok: Grad Student Travel

- Host a PF for PhDs Seminar at Your Institution

- Emily’s E-mail Address

- Travel Hacking Resource: MilesTalk

- Frequent Miler

- PF for PhDs Subscribe to Mailing List

- PF for PhDs Podcast Hub

Teaser

Brendan (00:00): There is a little cognitive dissonance sometimes, um, to the point that through Instagram, some of my friends thought I just had a pile of money in the corner. Part of the reason I’m kind of talking more about it is there’s not any money in the corner, there’s no treasure chest. It’s just really using points effectively. It’s kind of a big disparity sometimes where like for a conference hotel, I’m staying under the university minimum and you have to be this like very responsible steward of like a grant. And then when I do leisure travel for less money because it’s effectively free, I’m at five star luxury resorts.

Introduction

Emily (00:41): Welcome to the Personal Finance for PhDs Podcast: A Higher Education in Personal Finance. This podcast is for PhDs and PhDs-to-be who want to explore the hidden curriculum of finances to learn the best practices for money management, career advancement, and advocacy for yourself and others. I’m your host, Dr. Emily Roberts, a financial educator specializing in early-career PhDs and founder of Personal Finance for PhDs.

Emily (01:11): This is Season 20, Episode 8, and today my guest is Brendan Henrique, a fourth-year PhD student in education at the University of California, Berkeley. Brendan leverages his conference and research travel plus personal spending into free luxury travel by amassing credit card points and elite status at hotel chains. He breaks down how he pursues the points and miles hobby even while living on a grad student stipend and how it’s motivated him to work hard so he can play hard. Brendan’s travel habits might seem out of sync with his income or ‘student’ status, but it’s achievable for many grad students who are free from credit card debt and have a small degree of savings.

Emily (01:52): Because we in academia and research are experiencing such precarity in our finances and careers at the moment, I’m doing as much as I can on the financial education side to help you. I’m calling this initiative Giveaway Spring. I’m giving away 60-minute group Q&A calls, 30-minute individual coaching sessions, books, and digital resources—all completely for free—and I’m also sharing the best free financial and career resources I come across for PhDs. Register for my mailing list at PFforPhDs.com/giveaway/ to receive all the details of the current giveaways and an update every other week. You can find the show notes for this episode at PFforPhDs.com/s20e8/. Without further ado, here’s my interview with Brendan Henrique.

Will You Please Introduce Yourself Further?

Emily (02:55): I am delighted to have joining me on the podcast today, Brandon Henrique. He is a fourth year PhD student at University of California Berkeley and we are here talking about travel hacking or the points and miles hobby or stacking travel rewards. We don’t have a really firm term for this, but that’s our topic for today and Brendan’s gonna tell us all about how he does this as a graduate student. So Brendan, thank you so much for volunteering to come on the podcast. Will you please introduce yourself a little bit further for the audience?

Brendan (03:23): Yeah, thank you so much for having me on. I’ve been a fan of kind of the website and everything for a long time. So I am a fourth year student out in sunny California. I study uh, computer science education, um, at the school of Education at UC, Berkeley and I’ve been, I’m in my fourth year.

Using Travel Rewards for Once in a Lifetime Trips

Emily (03:39): Excellent. For you as a graduate student, what kinds of travel rewards stacking strategies do you use? This is a big question, it’s what we’re gonna talk about for the whole interview, but let’s get a high level intro and then we’ll kind of dive into some different ones.

Brendan (03:54): Yeah, so my kind of claim to fame in this is I use a variety of credit card points, whether it’s signup offers, hotel points, conference days where I can generate points to kind of stay in these amazing once in a lifetime resorts, flights, and were kind of redeem these points for really amazing experiences. And that’s kind, I think if I had to summarize in like one paragraph, that’s kind of what I do.

Emily (04:18): Okay. There’s the part of this process where you are um, gaining points and like amassing the rewards and then there’s a part of it where it’s like deploying the rewards and the points and stuff that you’ve amassed. So I wanna talk about both of those. Um, but first do you stay within like a certain um, family of types of points or certain airlines that you use or do you kind of spread everything all over the map? Tell us about that selection process.

Brendan (04:50): Yeah, and this is actually one of the kind of cool parts about points is depending on what credit card family you want to join. So if you’re an Amex person or a Chase person, a lot of those points transfer. So for me the best value for my chase points is transferring it to Hyatt. So I’ve become a really big Hyatt person to the point that I’ve been able to gain the top status with Hyatt where I get the upgrades, I get the free breakfast, kind of the bells and whistles. And so what I recommend to grad students is pick a hotel brand and stick to it. So the big ones are being Marriott, Hyatt, Hilton, and then when you go to those research meetings you have to do field work for a month and they have you at the Holiday Inn, well it might be great to join IHG collect those points. And all of them really have great luxury properties that you can kind of spin the points from the casual stay to the super stay.

Emily (05:39): It makes sense to me that if your university is sending you somewhere for a period of time, they might control, they might choose which brand you’re staying with, it might depend on exactly the location, what’s available and so forth. Um, do you, have you in your experience had agency over that? Um, like when I go to conferences I just try to stay at the conference hotel, but I know some people stay you know, down the street or whatever. So like do you exert control to like stay within your preferred rewards family or do you just go with wherever they wanna send you?

Brendan (06:10): I’ve had both experience. So sometimes it’s like where we have to go to Philadelphia, stay within a mile of the conference center and at that point I do try to go outta my way. Like where’s the nearest Hyatt, my backup kind of family is Hilton so if there’s not a Hyatt, there’s probably a Hilton and that kind of rings true most of the time. There’s been a couple of times where I did like a two week research project where I was on the road and we had to say like a motel, I tried to pick one that had a super family. So for this one it was Wyndham, I forget the sub-brand and Wyndham points can be transferred to Caesar rewards in Las Vegas at one point percent. So I got to eat a great steak dinner because of my two weeks in a motel.

Accumulating Travel Rewards Points

Emily (06:53): I see, okay. You’ve picked a preferred brand but also you try to have some flexibility depending on you know, the location that that’s calling you or what have you. Let’s talk more about the accumulation of rewards. So it sounds like when your university is paying for you to go and stay somewhere that somehow benefits you personally. Can you tell us how that works?

Brendan (07:13): Yeah, so what I make sure I do is I book direct. So if you book through expedia, booking.com, you don’t collect points. So what I recommend to every grad student, I would honestly sign up for the top five hotel brands, make a loyalty account it’s free and then when you do get sent to conferences you can just plug in your rewards number and even if you have to book through like the travel agency or like the conference booking page, every time I’ve had one it allowed me to put in my number and then on the backend they were sync up. So I’m welcomed as like an elite member or loyalty team member. Usually you get better service, especially with a conference hotel, they’re sold out so if there’s a way to split the difference, they’re gonna look who’s a member who’s not and it’s free to join. So that’s kinda one way to personally benefit is to just kind of sign up and make sure you’re using um, kind of the family you want to stick to, whether it’s you know, your Hyatt or Hilton.

Emily (08:05): Okay. So we have our very easy applicable tip number one which is just sign up for the, you know, the loyalty programs for all the hotels that you interact with in your uh, daily, you know, yearly life. Um, so just sign up for ’em all. Great. Let’s talk more about um, amassing points to yourself. Um, you mentioned Chase earlier, so tell us about your, the credit card like aspect of this strategy.

Brendan (08:31): Yeah, so using credit cards you can get a return on the point. So like I think the Chase Sapphire preferred is kind of your typical, most people will say it’s like your introductory travel card. It gets like two or three times on travel. Those points are transferrable to Hyatt. So let’s say you spend a hundred dollars on a hotel for a conference, you get 200 Hyatt points that you could transfer from Chase to Hyatt. You can also use it a few different ways That is kind of a slow grind but it helps you kind of slowly accumulate points. The big leaps are signup offers. So the Chase Sapphire, I think the signup offer right now is 60,000 points. That’s a significant amount of Hyatt points or you can transfer to I think United Air France, a few other partners. That’s a lot of points for Amex. Their offers tend to be a little more generous I think I’ve seen on the platinum card 175,000 Amex points with 1 cent up offer With them though you have to spend a certain amount of money in a certain amount of time. So for Amex I think it’s 8,000 in three months, which is a massive ask Chase. I think it’s a little bit lower, it’s like 4,000 in three months and some are six months. So you kind of have to play what’s that public signup offer and with what those points are worth for you and can you hit that bonus.

Emily (09:46): I think that’s the real key there. Like I just barely started dipping my toe into credit card rewards when I was in graduate school and I mostly stuck with the cash back offers because of two reasons. One, I was nervous about meeting those minimum spends required to get you know, the big sign up bonuses. Um, and two, I really didn’t wanna pay an annual fee ever <laugh>. I didn’t wanna do the math on whether or not it was worth it. I just didn’t wanna pay fees. So can you speak to both of those kind of like objections?

Common Travel Rewards Concerns: Minimum Spending and Annual Fees

Brendan (10:13): Yeah, so I think it’s also a very valid objection if you’re like, you know what, I don’t really like to travel, I like I would rather put the money in a cash back and just kind of pay myself back then there’s cards meant for that. Like I would still recommend you look into it and there are cards that offer great cash back offers where you spend X amount of money and you immediately get it back. So maybe you wait until the end of the year to pay your taxes, you have that sum or estimated taxes, you kind of time it right, you pay with a credit card even with a 2% fee, if the cash back is significant enough it might offset that. And then in regards to I think your other, oh the annual fees, those are a lot trickier. What I like to tell people is we’re graduate students, we’re really good about spreadsheets and like details make a map of it’s gonna work out for you. Some of like my top annual fee card is the platinum card, it’s like 700 a year. I’m very meticulous about extracting every dollar of value on every cent. So there’s a way to get, they have one part of it is a $200 airline fee, so you can’t use it for airfare, you can use it for incidentals. The backdoor hack is the United Travel Bank where you like fill up your travel bank counts as an incidental which you can use for a flight and I find SFO is a United hub, um, as well as like a bunch of other kind of major airports around the country that you can totally one united flight a year that’s paid for.

Emily (11:36): Going back to my, my first objection about like meeting the minimum spends, um, and my comment about like sort of sticking with cashback cards which are usually have lower minimum spends and typically no annual fee. What I’ve learned since then <laugh> since I was in graduate school and had those kinds of objections was that using points for cash back versus using them for travel. There’s a massive um, ROI difference, it’s something like five times, six times, maybe even more of a difference between using those points for travel and points for cash back. So if you are really frugal like I am and especially was in graduate school, I actually would’ve been better served probably by um, using those points that I was accumulating through my normal spending and so forth, um, for travel purposes instead of for cashback purposes. But you know, I didn’t have the bandwidth at the time to understand the whole system. So that’s what you’re, what you know, what you’re helping us do here, which is really fun. Okay, so we talked about collecting points through signup bonuses through ongoing spending on certain cards, whether an annual fee is worth it, do the math, um, figure that out. Tell us a little bit more about the spending of the points and how, how you’ve done that in a really worthwhile way.

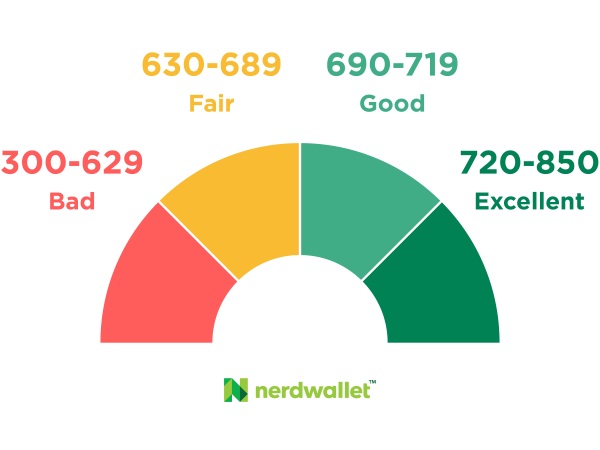

Brendan (12:47): Yeah, so it ends up being this kind of complicated optimization problem where you know the points are worth about a penny a piece, some are a little bit less, some are a little bit more and you want to track the maximum value. The best way I found to do that is if you’re trying to redeem it for kind of the lower end of the spectrum. So like a southwest flight, a basic hotel say you’re really only gonna get a penny, a penny 0.5 per point. Where this starts to really get exponentially bigger is your business class flights. Your five star hotels are like, uh, one of the hotels that I’m hoping to stay at is in Paris, the minimum is like 1300 a night but it’s, it’s 45,000 Hyatt points, which is a massive amount of points but point per dollar. It’s an incredible return on investment. And same thing for business cost flights, some of them are like three or $4,000 or international where if you use the points that way I’m getting five to 6 cents per point, which is five times then if you just used it regularly. And that’s kind of the hack is knowing those optimal um, utilization and when to kind of u- hit that value. And that’s the complicated part I would argue.

Emily (13:56): So it sounds like your, is your preference to redeem these points for like the more the step up the little, little luxury travel and not go for economy class and basic hotels and so forth? Or do you do both or like how are you using them?

Brendan (14:11): I kind of aim to get like a minimum value on my points. So for chase points I try to aim to 2.5. So if I do the math that the cents per point redemption isn’t gonna gimme that, I’ll kind of make a hard decision of like do I have to stay at this hotel? Can I find another way to stay there? Like not through, maybe it’s not Hyatt this time, maybe I’ll go to Hilton and check it out and then that’s kind of my cutoff for Amex points. I’m a little more, I kinda held them close because I knew I wanted a business class flight for Europe on a upcoming big trip. Um, so I kind of held them until I saw the moment and then I knew that that value would be there if you watch closely and it popped up on my computer and I snagged it.

Emily (14:52): Okay, this is a bit of a weird question, but you’re a grad student, how does it like feel like psychologically to be traveling in an upgraded way?

Brendan (15:06): Yeah, it, it’s kind of a big disparity sometimes where like for a conference hotel I’m staying under the university minimum and you have to be this like very responsible steward of like a grant. So it’s kind of a, and then when I do leisure travel for less money because it’s effectively free, I’m at five star luxury resorts, it, there is a little cognitive dissonance sometimes, um, to the point that through Instagram some of my friends thought I just had a pile of money in the corner and I had, part of the reason I’m kind of talking more about it is there’s not any money in the corner, there’s no treasure chest. It’s just really using points effectively so that we can, my uh, fiance and I have been able to say at some incredible places from Arizona to Florida and do some incredible stuff because of all these hacks and like tricks.

Gaining Elite Status at Hotel Chains

Emily (15:53): Now you mentioned earlier like stacking deploying of points with like having status at like Hyatt for example. Can you tell us how that works?

Brendan (16:02): Yeah, so what’s great about it is when you redeem the points it’s free to like, or the hotel becomes free. When you then have status, you still get your status benefits. So for Hyatt it’s a little bit harder to get status but when you hit their top, if there’s a suite available that’s in their basic suite, you’re guaranteed to get upgraded to it. Granted some front desk give you a little bit of a hard time, but there’s been times where I’m like, Hey, is there a suite available? I saw one on the app and they’re like, oh my bad. And then all of a sudden I’m in a 800 square foot room, two bathrooms and that’s the fun times at conferences when it’s like you have the massive room because every other room gets sold out and then in the morning for, Hyatt at least, you get to eat breakfast in the lounge or there’s not a lounge, they give you a voucher for the restaurant. So it’s been actually at conferences it’s helped a lot because I’ll fill up at the free breakfast and not have to pay lunch out of the grant money. So it kind of actually I’ll pick a Hyatt and like I’ve argued with like in present an argument to the like whether I’m getting reimbursement, like no, no, by booking this hotel I actually saved you money by the free breakfast and lunch. It allowed me to kind of offset the cost.

Emily (17:11): So I’m so attracted to this idea because I, I know just from my light study of the travel reward space that as you said that Chase redeeming chase points at Hyatt is like a really great value. Um, overall. So I just wanna know how do you get status at Hyatt?

Brendan (17:28): So for their top status you have to stay 60 nights in a year, which is an absurd amount of years. Um, not years, uh, nights there’s some kind of short cuts to get that number lower. One way is if every conference I pick Hyatt, I go to two or three conferences a year, three or four nights, that’s already kind of 10 to 12 nights. So already out of pocket I’m down to like what 50, 48 nights, use point and when you use points, nights count as qualify nights. So then I lower the pay like paid nights even more. When you have the Hyatt credit card, which is their credit card, they give you free, um, what is it, five free qualify nights. So that’s five more nights to hit the 60. And then there’s a few other kind of backdoor hacks where I can gift my status to someone and when they stay I get the night and that allows me to kind of lower, I don’t actually stay 60 nights a year in a hotel because that would be like twice a month, you know. Um, so you’re able to lower that number through some credit card hacks, some of, and then some taking advantage of the Hyatt loyalty program structure itself.

Emily (18:35): Okay. And is this something you have to do every year?

Brendan (18:38): Uh, to some degree the year you earn it you earn it through the rest of the year. And then so if you were to earn Hyatt globalist, I guess you couldn’t hit it now because we’ve only had 28 days. But let’s say you stayed 60 days, you hit it early February, I mean early March you would have it for the rest of this year and the following year. Um, so when I hit globalist, you keep it for the kind of, it’s 12 months plus the remaining of the year.

Emily (19:04): I can see this is a great um, program on their end to retain loyalty <laugh> from you know, frequent travelers and so forth. I think you also mentioned that you use um, travel hacking strategies for rental cars as well, which I’ve like never heard of. So how does that work?

Car Rental Strategies Specific to Grad Students

Brendan (19:18): So this isn’t so much a travel hack as taking advantage of what grad students may not know and if you’re at a large university system, your corporate like office for travel at the university negotiates a ton of travel deals. So I found out recently at Berkeley that because they’re part of the University of California system, they negotiate hundreds of thousands of deals. We have tons of travel offers that just by being an employee of the university you get one of which is uh, tr uh, renter cars. So we get I think 35 to $45 a day rental cars anywhere. What’s amazing about kind of stacking the university discount with a credit card is the Amex platinum gives you top hertz status which allows you to pick any car in like their luxury lane. So when I go to an airport and I need to rent a car, I don’t pick the car that I booked, I go straight to the lane and see what’s available and I’ve done everything from like a Mustang convertible for like 37 a day in San Diego to like we were going to the Grand Canyon. And I wanted like a supped up SUV, there was this like really nice all-wheel drive Buick, but I still paid the same base rate that I paid based off the university discount. And I’ve seen most public big university systems have something like this, whether it’s a travel portal or like just kind of your standard corporate discounts.

Emily (20:36): I had no idea about that. So like I’m not affiliated with the university anymore but I wish I had known that <laugh> back when I was at Duke ’cause yeah, probably they had something if you’re saying that. Um, most do but that’s, that’s like easy tip number two is just check out is there a travel portal for a university that you’re, you know, permitted to book through and yeah see what kind of deals you can get. And it sounds like you can use it for personal travel as well as university business.

Brendan (21:00): Most of them are, they’re tell you you can’t on the travel portal. So for Berkeley there’s some that are very clear that they actually get a, I think the corporate contract gets a kickback and they don’t care whether it’s leisure or for business. With business there’s some more benefits but with leisure you can use the corporate code at lease.

Emily (21:16): Okay, wow. Alright, this sounds really great

Commercial

Emily (21:21): Emily here for a brief interlude. Would you like to learn directly from me on a personal finance topic, such as taxes, goal-setting, investing, frugality, increasing income, or student loans, each tailored specifically for graduate students and postdocs? I offer seminars and workshops on these topics and more in a variety of formats. This is a perfect time to book me for a workshop at the end of the current fiscal year or at the beginning of the upcoming academic year. If you would like to bring my content to your institution, would you please recommend me as a speaker or facilitator to your university, graduate school, graduate student association, or postdoc office? My seminars are usually slated as professional development or personal wellness. Ask the potential host to go to PFforPhDs.com/financial-education/ or simply email me at [email protected] to start the process. I really appreciate these recommendations, which are the best way for me to start a conversation with a potential host. The paid work I do with universities and institutions enables me to keep producing this podcast and all my other free resources. Thank you in advance if you decide to issue a recommendation! Now back to our interview.

Using Travel Rewards for a $30,000 Honeymoon

Emily (22:46): Now you’ve mentioned your fiance a couple of times. I understand you’ve been gearing up for a honeymoon on you know, using these strategies. Can you tell us about what you’ve booked?

Brendan (22:55): Yeah, so I kind of have been in like points slumber mode where I’m just accumulating hidden and sign up bonuses, asking my fiance if she would also apply to get double the the bonus and you can usually backwards transfer and we’re gonna do a couple weeks in Europe. I’ve never actually been to Europe so I’ve always dreamed of going. Um, so I’m really excited to kind of stay in Europe for a very long time for essentially no money because every hotel has been on points. We got business class flights to and from for about a quarter of a million Amex points, which is like a big number but um, we’ve been kind of saving up for a while with our points to make this once in a lifetime trip possible.

Emily (23:39): Give us like a scale on how many points this took

Brendan (23:44): I actually, I wrote it down just because I knew that this might come up. So it’s about 280,000 chase or Hyatt points kind of. I had to combine them three Hyatt. They have these things called suite upgrade awards where you take your basic book reservation upgrade to the suite three Hilton free night certificates, 800,000 Hilton points and about 350,000 Amex points. So a lot across multiple brands, multiple credit cards.

Emily (24:13): Yeah those are like eye popping numbers um, to me. So how, how long would you say that this took to generate all the points for this trip?

Brendan (24:23): I would say depending on the card, three to four years depending on some were accidents. We were gonna do a big stay at a Hilton so I had started to get into the Hilton ecosystem, decided not to go on the trip so I just had this leftover treasure chest from like three summers ago. Then I was like oh this might be useful on a rainy day and it just kind of kept growing as different Hilton offers came out with different um, signup and you were able to kind of stack them and so I would say we’ve been Hyatt, I tend to use ’em more quickly. So the Hyatt I would say was more than like a year, year and a half.

Emily (24:59): And it sounds like even though you know, you’ve been, the points have been accumulated for around three to four years, but you’ve still been traveling some during that time. You said most recently you’ve been quieter on the travel front to like finalize all of this, but it’s not like it took you all of your spending devoted for three to four years just for this one trip.

Brendan (25:17): No, this involves multiple, like I’ve definitely stayed at Hyatt quite a bit in the last two years. Hilton, I haven’t touched the points I very much like that was kind of don’t touch and then Amex I didn’t touch because I knew, I knew I wanted us to fly to Europe in business class so I kind of wanted to have this kind of flexible chest of points to be able to find the right value and find the right flight route for us to get home.

Emily (25:40): Okay, so you’re staying for essentially free, it sounds like you got all the nights, you got all the flights covered, those, that aspect of the travel. Um, if you would have paid cash for that, how expensive is this trip?

Brendan (25:54): So I have a spreadsheet where I kind of track the value of like the hotel room, what suite we got upgraded to the business class might, when you add it all up plus or minus a little bit, it’s around $30,000 which is, I was almost shocked when I did the math. I checked it twice because I couldn’t believe that the amount of value we were able to extract and we’re averaging anywhere depending on the point like three to 6 cents a point, which is incredible value sometimes I think at the, the Park Hyatt in Paris, the suite goes for 3000 a night. So that was an incredible value for $0. Um, and 45,000 Hyatt points isn’t like normally a lot but at that cash rate, which I certainly would never pay $3,000 for a suite, but that’s what they’re charging someone for it. Um, so I was very amazed that it’s pretty much a brand new car of points.

Emily (26:44): Yeah, a brand new car, uh, I’m assuming over half your stipend for the year. Yeah, I mean it’s, it’s a remarkable, yeah, again, you wouldn’t have paid that but somebody would have for some of all these, for the some of all these components. So, uh, that’s so interesting and again that to me the cognitive dissonance is coming up of like, oh but you’re a grad student. Like you know, do you, you know, not do you deserve but like is it within your realm and understanding of the world to be traveling this way? But that’s the amazing thing that points makes this possible. My goodness

Brendan (27:21): And my fiance is a uh, she was a teacher and now she’s an instructional coach. So we’re both in a similar kind of like highly educated that middle class kind of group or like that it, there is a dissonance of coming back from a couple of really incredible resorts but it’s gone to the point that our friends know were the points people and they’re like, oh where are you off to now? How much did it cost you? Zero. And it’s almost an ongoing joke.

Teaching Other Grad Students about Travel Hacking

Emily (27:46): Yeah. Well on that topic, have you been teaching any of your peers about this? Are they receptive?

Brendan (27:52): So that actually led me to start a Substack, which is my weekly newsletter. I get a lot of questions from a lot of friends like we’re going to Italy, can you help us? So I was like, why don’t I just share everything I know in a way that’s kind of meant for grad students. Um, so every week I post a new post, um, every Wednesday and it’s some either hack some trip report and kind of different ways I’ve come to learn points and I’m trying to kind of write it in a way where to help graduate students understand um, and hopefully like I can kind of help people do this in their own lives with some of the hacks are very low lifts and it’s very much just sign up, search for the travel agency, get this one credit card sign up and you can do this end of year summer amazing dissertation celebration.

Emily (28:37): Yeah, I would say especially for graduate students who do a lot of travel or a decent amount of travel in the course of their work, like it’s kind of, I guess the impression from like travel hacking maybe from like the nineties or something was it was like, oh this is possible if you’re like a consultant who travels every single week on the same airline so you can you know, get the status or whatever. Um, and it’s just changed so much over the decades that this actually is accessible um, even for people who are making like a grad student stipend but especially if travel is a component that your work does pay for to some degree.

Brendan (29:10): Yeah, I think the reimbursable cost part is a really big part that even if you’re at like a Hampton Inn for 100 a night on field work, those are Hilton points. If there’s a Hilton double point promotion, you have the Hilton card, all of a sudden you can add such a big multiplier on something you’re getting, you have to do anyways for your research so why not go to that resort once summer break hits, you know?

Emily (29:33): Yes, wonderful idea. Okay. Earlier you mentioned some example minimum spend levels maybe $4,000 in three months, maybe $8,000 in three months. Um, how do you work it with your like typical level spending as a graduate student to meet any signup bonuses or maybe more like the more aggressive signup bonuses?

Brendan (29:54): Yeah, so let’s, if I, let’s use the 8,000 for the Amex Platinum as kind of like, that’s the highest one I’ve attained. Some tricks that I’ve used is you can pay your taxes with a credit card. They charge like a 2% fee. So if you use estimated taxes you could do time it right? Or if you kind of have the end of the year you have that big lump sum that probably might be able to allow you to hit at least half of it a quarter of it. The other hack I’ve been able to use for smaller ones is if you know you go to Starbucks once a month, 10 times a month, whatever that number is, you can prepay your year for credit like and gift cards. Same thing with Amazon. You can, if you know for uh, the holidays you’re buying a ton of gifts for both you and your friends or family, you can just load your Amazon account a little bit ahead of time and it’s all about the timing. So I wouldn’t sign up with the platinum card with 8,000 and just hope you’re gonna make it. I’d be very intentional with, oh we have the holidays in December, then taxes, maybe I’ll try to do them really quickly in February and then I can kind of get in that three month window or a big conference. If you have a international conference in France, you’re gonna spend a pretty penny. Why not use that towards a signup bonus?

Getting Started with Travel Hacking

Emily (31:08): My goodness. Yeah, most of the conversation around, you know, um, having to front travel expenses and conference fees for graduate students is around complaining rightfully so about you know, having to pay interest on it if they’re not able to pay off the cards and how it actually costs them money and so forth to do it. But you’re completely flipping this on its head and saying, actually use this to your advantage now it does take some savings, right? If you wanna prepay expenses, you have to have the money to do that. So like for you, is this a general savings fund that you have? Do you kind of tap your emergency fund? Like where is the money coming from for you?

Brendan (31:43): I kind of have a small revolving fund that I know that like I’m gonna get reimbursed for the conference or I know that this thing is gonna kind of come and go. So I typically would kind use it almost as like a flex fund that when I need to hit that signup bonus, it goes into it, then the tax or not tax a conference happens, I’m gonna get refunded a month later. Um, if that’s not possible for you, depending on your stipend structure, I would recommend credit cards are probably not a good because you don’t want to, as soon as you hit a penalty at interest charge, all of the point value really starts to get washed away really quickly that if you spend a couple hundred dollars in interest, even that $300 Hyatt Hotel, you’re not gonna break even anymore. So I’m really intentional about staying below and never, never missing a payment.

Emily (32:29): Yeah, this is definitely not an entry level strategy. If you’re a first time listener to this podcast, this is not, okay, go ahead and sign up for the loyalty programs. But like don’t try the credit card stuff until you have, you have all your credit card debt paid off, you have some savings like you said, a flex fund to be able to prepay some things or the conference expenses or, or what have you. Um, this is a level two <laugh> or further like kind of strategy. Um, yeah, I’ve noticed in my own life, um, I, I talk about irregular expenses quite a bit in my uh, teaching but now that I have a higher income than I used to when I was in graduate school. Um, but I also have different expenses. I have kids now I have a house, blah blah. So like I actually just sat down a few months ago and was like, okay, let me look at the cycle of my year. I can figure out like when are these higher expense, you know, periods it’s like March and April for me are like really high spending for some reason. It’s like kids camps, car insurance, like all this stuff. Um, okay now I know February let’s apply for a new card. Hit that sign up bonus. So I’ve just been more intentional about like looking at my year and figuring out okay, these are the key months when it’s a great time to sign up for something

Brendan (33:33): In February works really well because if you hit the bonus around April you can start thinking summer vacation that kind of gives you a three month window when resorts start to, not every hotel releases point availability the same. So three months out is a great time start looking. So that’d be, that’s actually a great timeline.

Emily (33:48): Yeah, Okay. We were just talking about some things you have to have set in your finances to play around with credit cards <laugh>, but let’s say someone is ready for that, they have all the credit card debt paid off or they’ve never had credit card debt, they have some savings. What’s like the first, the next first step after signing up for those loyalty programs after checking with their university’s travel portal? Um, what’s a good first step after that?

Brendan (34:10): Yeah, I think I would decide what you want to use the points for and then that’s a really great kinda decision tree. So if you’ve heard today you’re like, I really wanna stay at Hyatts, that sounds awesome. I would really recommend the Chase Sapphire preferred. The annual fee is like 95 a year. If you book once through the Chase portal, I think you get $50 back, which offsets annual fee pretty much immediately. The signup offer anywhere from 60, I’ve seen as high as like 90,000, but that hasn’t happened in a while. 60,000 Hyatt points gets you four nights at some like really nice hotels. It could also be two nights at an incredible once in a lifetime hotel depending on how you want to use the points. And I would say find that entry level card if you’re like, you know what I, I don’t mind paying for the hotel, I want an incredible flight experience. American Express points are great for business class flights to Europe, um, or even going west, I’ve seen some amazing deals to like Tokyo from the west coast, from like Seattle or LAX, you wanna fly in first class. There’s some incredible deals to be had that way and if you know that’s you or you want to visit there for leisure or for family or anything, then that might be the route that you want an introductory Amex card, which might be like the American Express Gold, which is kind of your dining and grocery reward card.

Emily (35:25): Yeah, and I would say my tip that I’ll add onto this, it’s just, it’s something you mentioned earlier, but just like staying organized <laugh>, um, staying on top of this. So like try one card, get a spreadsheet set up or whatever system you’re gonna be using to keep track of like, you know, the date that you sign up, the date you have to finish spending, the amount of the spend, what you’re gonna get for it, um, what those extra rewards categories are for ongoing spending. The little um, you know, $50 here, a free night there, all that stuff that can come like with your annual annual fee and so forth. Like just get your system going <laugh>, um, from that first card and then you can kind of layer on and add to it over time.

Brendan (36:01): Now I tell people to kind of get your sea legs with your first travel card and then once you’re like, oh I know how to use points, I know how to transfer, then it’s time to maybe think about a different one but try it out and um, take that first day and see how great if it was to not pay for it.

Emily (36:15): Yeah, I agree. I’ve been like just very slowly making my way into the travel rewards points and miles hobby kind of space. I’ve like, I feel like I know like the Chase Southwest system for that free budget <laugh> flight kind of situation. And the next thing I have my sights on is like international travel. Now I don’t know that I’m gonna be able to go business class ’cause I have a family of four, but we’ll see.

Brendan (36:39): That makes it a little harder.

Emily (36:40): Yeah. But just to be able to take those longer flights to that, you know, the further destinations again for free or you know, low, low fees, you know, depending on the taxes and whatnot. Um, so I’m excited about expanding my own like practice in this area. So I’m talking to myself too as well during this interview. Um, so what’s been kind of the overall like effect on your financial mindset, on your stress, on your, how you spend your time of like pursuing this hobby?

Brendan (37:09): Yeah, I think for me in terms of financial, it’s made me think about return on investment a lot more because now every time we go out as a lab or I take friends out or grad school, I’m the first one to say I’ll pay just venmo me. And you can kind of think about it as a return on investment that it might end up paying your dinner actually, if you think about the points that you get in terms of personal kind of enjoyment of life, knowing that there’s this kind of once in a lifetime stay coming up at the end of the year really has helped motivate me to work harder in my like day-to-day life as a PhD student knowing that as soon as I finish this conference I’m flying to Florida for this really amazing to stay. Um, and kind of, you know, that’s coming up that allows me to kind of stress a little bit more so I, because I know the de-stress has coming where I can just sit pool side for a couple days.

Emily (37:58): I think that’s such an important point because probably a trait that’s pretty common among PhD students is not, um, giving yourself the kudos that you deserve for all the great work that you do and not taking the rest and the rejuve rejuvenation and so forth. Um, and what a great way to sort of enhance that experience to be anticipating it, you know, while you’re collecting these points, planning the trip, working really hard as you said, and then be able to actually, you know, take the vacation and do that relaxation that you need. And it’s, it’s cyclical, right? So like that’s so helpful. I know I didn’t take enough like vacation or personal uh, time, you know, when I was a graduate student and it’s really, um, it’s, it’s not that healthy to live that way. So I’m glad you’re kind of an example here of like a different way to like work hard, play hard, work hard, play hard,

Brendan (38:45): And especially we have to to work hard a lot of the time. So like why not get that reward at the end of the tunnel, especially like whether it’s yearly at the end of the milestone. Kind of give yourself that reward.

The Grad Student Travel Substack and Other Travel Hacking Resources

Emily (38:57): Absolutely. First of all, share with us the name of your substack and then tell us some other great resources that you use in this space.

Brendan (39:03): Yeah, so my substack is gradstudenttravel.substack.com so when you go to that, you’ll be able to subscribe as soon as you put your email in, you have access to my archive of every post that I’ve ever written and every Wednesday you get an alert with, there’s a new post and it’s kind of a trip report, a new hack, a new trick and so on. And then the things that kind of got me into this space, um, there’s a lot of great blogs and kind of guides that get you in. One is MilesTalk, um, it’s a Facebook group that became, I think it’s a blog that became a Facebook group and now it’s kind of back and forth. He’s been really instrumental in kind of teaching how you can go from one thing to another and just stack all the rewards. And then Frequent Miler is another one. They do some awesome trip reports of, we use Amex points on this business flight to France. We didn’t like this so you should try this, another hack with Amex and kind of even like you read trip reports that people doing what you hope to do. So it’s been able to kind of gimme one aspiration of I want to be that guy on that plane or two how to get there.

Emily (40:07): It’s so much fun. Okay. When should we tune into your substack to see the trip report on your honeymoon?

Brendan (40:13): Yeah, so that trip report should come out probably next fall. Um, so I’ll be able to kind of write it up fully in the meantime. I’m going to, I started a kind of a six part post of like every little piece that went into it. So that would be every month or every two months I’m gonna kind of give a glimpse of how do we find the flight home, how did I use the points, how did I collect that? And then I’ll do a retrospective probably in like maybe a year from now where I say, this is the whole trip, these are the pictures, um, this is all the upgrades we got and everything.

Best Financial Advice for Another Early-Career PhD

Emily (40:46): Awesome. Well we will look forward to that. Okay, Brendan, thank you so much for this interview. I’m so like inspired <laugh>. Um, but I wanna end with the standard question that I ask all of my guests, which is, what is your best financial advice for another early career PhD? And it could be something that we’ve touched on on the interview already or it could be something completely new.

Brendan (41:05): I would say the best advice outside of like kind of dipping your toes in the water and like travel on points would be Roth IRA it. When I was a, I used to be a teacher, a older teacher kind of took me aside and said, Hey, you’re 22, you don’t know what you’re doing. Get a Roth IRA like first day. And I was like, oh, okay. Um, my mom had mentioned it too, so I should have listened to her in the first place. Um, but it really, if you think about what it affords you and there is kind of an opportunity cost for the PhD sometimes with retirement access that it really for me changed how I thought about retirement and finances and even invest in period.

Emily (41:43): Awesome. You know, I have to co-sign that. Love the Roth IRA for graduate students and really for everybody. Um, okay. Well Brendan, thank you so much again for volunteering to come on. It’s been wonderful talking with you.

Brendan (41:54): Thank you so much for having me. This has been awesome.

Outro

Emily (42:07): Listeners, thank you for joining me for this episode! I have a gift for you! You know that final question I ask of all my guests regarding their best financial advice? My team has collected short summaries of all the answers ever given on the podcast into a document that is updated with each new episode release. You can gain access to it by registering for my mailing list at PFforPhDs.com/advice/. Would you like to access transcripts or videos of each episode? I link the show notes for each episode from PFforPhDs.com/podcast/. See you in the next episode, and remember: You don’t have to have a PhD to succeed with personal finance… but it helps! Nothing you hear on this podcast should be taken as financial, tax, or legal advice for any individual. The music is “Stages of Awakening” by Podington Bear from the Free Music Archive and is shared under CC by NC. Podcast editing by me and show notes creation by Dr. Jill Hoffman.