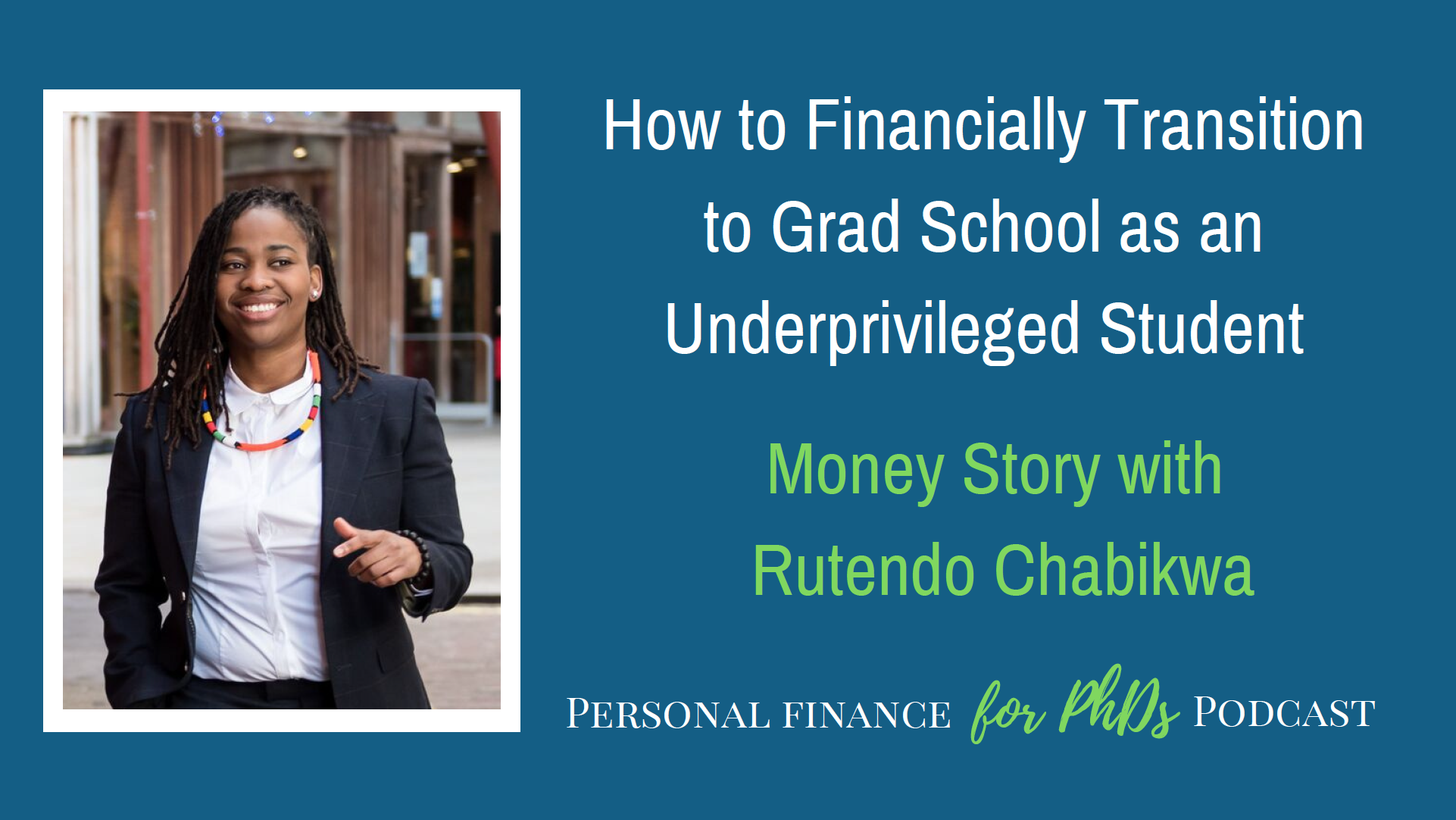

In this episode, Emily interviews Rutendo Chabikwa, a first-year PhD student from Zimbabwe at the University of Oxford and the host of the podcast So, You Got A Scholarship? The topic is the financial aspects of transitioning to graduate school. Emily and Rutendo list start-up costs, explore the financial “hidden curriculum” of grad school, and discuss financial habits to establish and how to do so. This episode has a particular focus on underprivileged and/or international students.

Links Mentioned in This Episode

- @rutendochabikwa (Rutendo’s Twitter)

- PF for PhDs: Fellowship Orientation (Webinar on May 23rd, 2021)

- Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together (Book by Gaby Dunn)

- Bad with Money (Podcast)

- Emily’s E-mail (for Book Giveaway Contest)

- PF for PhDs: Podcast Hub (Instructions for Book Giveaway)

- Episode 3.01 of So, You Got a Scholarship? (Rutendo’s Podcast, feat. Emily)

- Council Tax in the UK

- PF for PhDs: Tax Center

- Notion (Organizational Workspace)

- Mint (U.S. Budgeting App)

- Money Dashboard (UK Budgeting App)

- Moneybox App (Round up your expenses to save)

- TopCashback (UK App)

- Rakuten (US savings app)

- PF for PhDs Episode: Can I Make Extra Money as a Funded Grad Student on an F-1 Visa? (Money Story with Frank Alvillar)

- PF for PhDs: Subscribe to Mailing List

Teaser

00:00 Rutendo: If there’s something that you think somebody might cover, even if you don’t think somebody might go cover it, just ask. That’s definitely something I think underprivileged students can fall behind on simply because some of us have to cover a lot of gaps, not coming from families with people that have done PhDs or some of us who will be first-generation graduates to even begin with.

Book Giveaway Contest

02:19 Emily: Now, onto the book giveaway contest. In May 2021, I’m giving away one copy of Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together by Gaby Dunn, which is the Personal Finance for PhDs Community book club selection for July 2021. Everyone who enters the contest during May will have a chance to win a copy of this book. I’ve listened to a few episodes of the Bad with Money podcast, and I’m looking forward to reading and discussing this book because Gaby has such a different perspective and approach to personal finance than I do. If you’d like to enter the giveaway contest, please rate and review this podcast on Apple Podcasts, take a screenshot of your review, and email it to me at [email protected]. I’ll choose a winner at the end of May from all the entries. You can find full instructions pfforphds.com/podcast. Without further ado, here’s my interview with Rutendo Chabikwa.

Will You Please Introduce Yourself Further?

03:24 Emily: I’m delighted to have joining me on the podcast today Rutendo Chabikwa. She is a first-year PhD student at the University of Oxford. She’s from Zimbabwe. So we are going to discuss in this episode the transition into graduate school, some of the financial stuff that goes on in that time, especially for underprivileged students. This is going to be really great episode. Rutendo and I have actually spoken before because I was on her podcast. She has a podcast called, So, You Got a Scholarship? and my episode of season three, episode one. So we’re doing a swap here. I’m so glad, Rutendo, to have you on my podcast. Welcome. Will you please tell the listeners a little bit more about yourself?

03:58 Rutendo: Thank you so much, Emily. Glad to be here. Glad we could do this. My name is Rutendo. Yes, I am a first-year PhD student, or DPhil as it is called, at the University of Oxford. I’m from Zimbabwe. But basically I have been an international student for the past about 10 years, starting with my two years of high school. Did that in Canada. My undergrad was at upstate New York at St. Lawrence University. So I have a bit of U.S. experience in there with also a couple of study abroads. And then my master’s was in London at the LSE and then now I’m here for my PhD. So it’s a bit, quite of a long trajectory over there, and I am studying information communication and the social sciences. So basically things to do with the internet, digital media, and political participation.

Costs for Anyone Starting Grad School

04:42 Emily: Wow. Okay. Yeah. Fascinating. Thank you so much. So we’re going to jump right in with talking about the financial startup costs for entering graduate students. And obviously you’ve done this before at minimum for your master’s and now again for your PhD. So you’re quite familiar. Let’s talk about this in three layers. One would be for just anyone who’s starting graduate school that didn’t require a move. Two, someone who did need to move to get to graduate school. And then three, someone who had to move internationally to start graduate school. So we’ll layer those on. So what are some costs in that first layer of just anyone who’s starting graduate school?

05:16 Rutendo: Yeah, absolutely. So anybody that is starting, I mean, there’s the obvious in terms of just generally your life in grad school, household items. I know that sounds very minimal, but it can be actually something that builds up and that we underestimate as well as, you know, your working equipment, your laptop. Right now, we’re in a pandemic, so everybody’s sort of working from home, but even outside of pandemic, generally grad students need to have really well stationed, you know, workspaces for your work. Books, and not just books that are not just textbooks as well, because you might have costs to do with like your research topics. Sometimes you might prepare having your own book to highlight or write in, things like that. And obviously we can talk about ways of minimizing those costs later, but definitely anybody going there, your stationary, books. Definitely.

06:07 Emily: Yeah. Well, I’ll add, you know, in the U.S., and you can tell me if you’ve experienced this at LSE and Oxford, but a lot of graduate programs in the U.S. seem to require some fees to be paid upfront. Like even before you ever get your first paycheck as a graduate student, you owe hundreds, maybe a thousand dollars of some kind of fee, which is just, I wish they set the system up differently. But it is that way in many places.

06:33 Rutendo: Absolutely. This is actually, I mean, even before actually getting accepted, right? So these fees, even for applications alone, so there’s that, and then getting accepted, the deposit fees. Sometimes you might be lucky enough to get a waiver. Sometimes not so lucky. They could, you’re right, go from a few hundred dollars to a large sum of your tuition as well. And then I think there are also, depending on your institution, fees, such as for student association fees as well. Those are definitely something to consider and look up how your institution works on that.

07:09 Emily: Yeah, those are the kinds of fees that I was referring to, like a recreation fee or an activity fee, or even sometimes the health insurance premium here, you know, it needs to be paid upfront. That can happen. So that could add up to a sum. The thing about that is that you can know in advance, right? So as soon as you figure out which school you’re going to go to in April, or whenever you do that, you can start asking what is the amount of money that I need to give you before I get my first paycheck? Now, I don’t want to say that everywhere is that way, because it’s not. But it’s definitely something worth figuring out as early as you can.

07:44 Rutendo: Absolutely. And also to find out from the different sort of stages, right. There’s fees, your department might have some type of fee or, I mean, if you come into something, I guess like the Oxford system, you might also try to talk to your college, see if they have any kind of fees or which is a different sort of department or different area. So to make sure that you’re checking boxes with different offices and different levels of the institution to make sure that you have that. Always definitely ask for that.

Startup Costs Associated with a Move for Grad School

08:09 Emily: Hmm. Yes. Okay. So let’s add a move on top of that. If you are moving, what kinds of, you know, startup costs are associated with that?

08:17 Rutendo: Oh, absolutely. Transport for sure. However way you’re getting there. Moving costs, shipping costs. In order to save money, you might have to use money. So in order to save money on buying all new items, for example, let’s say for your house, your desk, it might be cheaper to move with them, but that’s also a cost. So there’s, you know, you need to juggle that and, you know, do your tallies and do your trackings and write that out and see what’s cheaper and what’s easier for you and most convenient. So those moving costs are definitely a thing. Some people, I mean, I guess if you’re moving, then you’d have to consider things such as deposits on rent, rental fees. There might be costs as well for even finding a place to stay if your institution doesn’t provide that. Some people might work through agents. If that’s easier and safer for you, obviously different cities, different countries have different rules and regulations.

09:10 Rutendo: But I’d say that’s definitely a big thing to consider. So, and then the different taxes. Council tax in some places. I know in the UK, council tax is sort of like a big thing, which is one of the bills to do with, you know, your household that you need to consider and that you need to kind of look up at if you know, what’s easier and cheaper for you. If you’re a student, generally, depending on what household you’re living in, you can get a waiver for that. The process on that also requires research. I think the biggest expense is definitely if anybody moving, let’s say cities right now, would be things to do with, with living, added on to what we talked about before.

Different Scales of Moves

09:47 Emily: Yeah. I’m actually thinking back because there are different like scales of moves, right? So I’m thinking back to when I started graduate school, which I was living within a long drive, it was like a four-hour drive from where I was living before to my new graduate student city. So I was just able to drive with my stuff in the back of my car, did not bring any furniture. You know, it was pretty like low-key in terms of the actual transit costs. And then also I got into an apartment complex where they were doing, they didn’t require like a massive upfront deposit. It was some kind of like student special, you know, kind of thing. Like, so I feel like my move, which I did with no savings. I had like my last paycheck that was going to get me through two months, you know, to my first graduate student paycheck.

10:29 Emily: I did that without, you know, any real strain. I didn’t really buy furniture. I kind of lived without furniture for awhile, but that was a really, really low-key, low-scale kind of move. And like there can be, and we haven’t even talked about moving countries yet, but you can go way, way up on that scale. If you have an entire, you know, household, if you have stuffed move, if you’re flying and you have to ship your car, like plus as you just said, you know, I’m thinking about like Boston, where many people go through brokers and have to pay some kind of fee. Like, I don’t know if it’s a month’s rent like upfront just for that plus like the deposit, which could be large. Like, moves can vary so much from, I would say maybe a couple hundred dollars up to like thousands of dollars easily without even going, again, international. So like, that was my experience. I somehow like skated by with very little like actual outlay of money. What was your experience in this most recent move?

Rutendo’s Recent Move: 3 Suitcases

11:20 Rutendo: The most recent move? I could only fly with three suitcases. Somehow Emirates had a really great deal. So I could fly with three suitcases. In that, I made sure that I had my coffee pot because that’s always an essential, I had my bedding and my clothing, including my winter clothes. I knew winter clothes would be actually quite a big expense. So made sure that I had that over here. And then I didn’t have to buy furniture, thankfully, because I’m living in a student flat. So my apartment is actually furnished, so that’s great. But the biggest expenses now came into trying to, I guess, kind of make it feel like a home. Pots and pans, that that was not provided. The couple of basics. So it was a bit costly, but honestly, I guess not as costly as my master’s move, which is a whole different situation because I was not in student accommodation, which we could talk about later, the advantages and disadvantages of that.

12:13 Rutendo: So, this move was definitely slightly easier. But I did have quite some costs. And I did want to say there’s another cost that I think people, not even just internationals, might have to consider. If you’re changing things like your different insurances that you have, your health insurances. If you’re switching, you might need to do a bit more. So that’s also a cost that you need to consider, I guess, talk to your family about, or if you’re by yourself, figure that out how are you going to deal with those.

International Moves for Grad School

12:39 Emily: Yeah, absolutely. Okay. Let’s add that third layer on of now the move is an international move. Anything else you want to add about that particular cost?

12:47 Rutendo: Absolutely. Visa expenses. Sounds like just this one thing that you have to pay for, but then you need to consider the medical expenses within those. You need to consider health insurance within that. Some visas, like for example, the UK visa you have to pay, I think now it’s up to 500 pounds for every year of your visa. And so if you’re getting a five-year visa, it’s quite expensive. So you need to consider that. And then consider obviously things, things like flights you need to consider expenses to do with opening up a new bank account. You can get free bank accounts thankfully, but navigating that system. So, and if you’re going to a new country that you’ve never been to, I would say always make sure that you are able to have money to move around. So transport, to be able to do a couple of things in the first few weeks that you’re there. Add this to everything else that was mentioned before deposits: first month’s rent, household items, textbooks, and all the good stuff.

Challenges for Underprivileged Students Starting Grad School

13:46 Emily: Yeah. Wow. It can be quite a list here. So let’s now focus in particular on underprivileged students. What are the, you know, particular challenges that they’re going to have when they start up grad school?

Challenge #1: Funding

13:57 Rutendo: I’d like to talk about this in four different groups. So the first one is funding. I think this is the biggest thing to even begin with. Sometimes you can have funding for a year. Make sure you understand what your funding structure is as an underprivileged student. You want to know what is included and what is not included. Make sure that when they say it’s just tuition, you’re aware that it’s just tuition and you need to consider how you’re going to live and where that money is going to come from, what opportunities there are for RA ships, TA ships, how much they pay. And so to navigate that, before even I think I would say accepting and finalizing your offer. The different reasons why underprivileged students, you know, can have more difficulty navigating the funding structure, especially if you’re international, there’s that added layer. One of the things is that if you’re from certain countries, for example, I’ll give you the example of myself as a Zimbabwean. I am from a country that was formerly the Commonwealth and is no longer slash officially in the Commonwealth. So there are a lot of funding things that I could qualify for, but I don’t qualify for anymore. And so I needed to understand what I could get and what I couldn’t get. The offer I got, right now it covers tuition. My tuition is covered by the lab that I’m a part of. I’m a part of the computational propaganda lab here. However, there is no stipend. So for me to get a stipend, I need to work my maximum number of hours as an RA. And so that’s something I had to think about. Do I want to not have 20 hours a week to do my research, but to be an RA?

15:21 Rutendo: And so you need to be able to think about the time factor and how that is affecting or adding onto your work. Fortunately, my RA actually allows me to do the work in my research field. So it’s not like I’m spending 20 hours a week doing something that has nothing to do with my research, just so I can pay bills. However, I do need to do this so that I can pay bills. And so there’s that aspect as well of funding. And then one of the things I am consistently aware of is that my funding is pretty much dependent on grants that the lab has. And so that might be perceived as somewhat of a risk. However, it’s a bit of a new situation, not a new situation. It’s something that the lab has done for years. And so this is just how a lot of students in my lab are funded. But just me understanding that it’s not coming from a specific fund, is very useful for me to know what I can do and what I can’t do. So to ask those questions for funding.

16:14 Emily: Yeah, I totally agree. And I think this is, how funding works. It actually varies quite a lot by where you are the field that you’re in the type of university that you’re at. And so like, I am just thinking, Oh wow, I should really create a resource that’s like all just how funding grad school works. And I’m thinking to myself, do I know the full picture? Because I know things very well for certain fields that I’m close to, but like to know the full picture I think is very difficult. So for anyone, really, you do need to understand how funding works in your field, in that school, in that specific situation, where it’s coming from, what you have to do to get it, like you were just saying, how reliable it is, who it’s depending on? You know, if there’s a downturn in enrollment, are TA positions going to go away?

17:01 Emily: If your lab doesn’t get that next grant is like, that, you know, sector of your funding going to go away? Are there any guarantees? You know, guarantees at least in the U.S., they vary quite a lot. Some people get them. Some people don’t. Depends on the field. Depends on the school. Not getting one is not necessarily a bad sign. Although certainly getting one is a great sign. So there’s just a lot of layers to this. And yeah, I think the less versed you are in it, the more, yeah, you’re kind of flying by the seat of your pants, and it’s worth investigating for sure. Probably at an earlier stage than we’re talking about right now, we’re talking to basically rising or matriculating graduate students. And this is something you should ideally try to figure out kind of before you even apply so that you can, you know, know that you’re applying to the right places that have the right funding structure for you.

Challenge #2: Research

17:45 Rutendo: Then the next piece for me is research. Your actual research, but also I do need to say maybe this is in my field as a social scientist. I do not know how things work for sciences or humanities. But generally funding in terms of money and personal finances, there are things that your department, you know, some people can self-fund for a lot of things. So for example, some software that we use, some people in my department will say, Oh yeah, the software is fairly cheap. And I just subscribe this much a year. For me, that takes quite a bit out of my budget, you know? And it is part of research. It is actually part of a research cost. So things like that. However, I guess the best way to go about it is to talk to your department about it and understand what you need for your research.

18:27 Rutendo: If anything, if you think anything at all is tied to your research, talk to your department about it because they should be able to support you through that. But definitely I think as an underprivileged student, if I hadn’t spoken to other people who have navigated the system before, I would be worried about buying such software, for example, or I would be worried about managing the cap on the research fund that I have to be able to do field work and get those needs met as well. And so I think that’s definitely something that, you know, you kind of learn as you navigate the system. Yeah.

19:02 Emily: Yeah. Absolutely totally agree. Ideally, get someone else to pay for everything. And if not, at least you ask and then, you know, well, this is not something that we cover. And then you get to decide, you have to decide if it’s something that you’re willing to do out of your personal funds. But just apply, apply, apply, I would say, for funding. You know, extra grants. A lot of times travel in U.S. institutions sometimes comes down to the student to fund. Like, you know, summer trips to here or there to do their research. Basically, you’re going to get a grant for it, or you’re not going to go. I don’t think that too many people fund those things by themselves, but the smaller costs, like you were saying, like software or some kinds of equipment. Yeah. You should definitely be asking, at least, that your department will do it.

Challenge #3: Professional Development

19:44 Rutendo: For sure. The third one is professional development, and these are things that are not necessarily tied to your work or your research, but you need to do to begin to build up your CV or your presence in the field. And so some of the things might include, some courses offered through either online courses offered through either organizations or sometimes schools do actually offer these, but you still have to pay for them. So I know my library offers different professional development courses and, you know, each of them cost like about 15 pounds, a course. And so imagine taking about, you know, four or five of those a year. For some people, that could add up quite a bit. There could be things like attending conferences as well, that are not necessarily hosted by your school. It could be things like attending events.

20:37 Rutendo: I mean, I know I’m saying attending now, they’re all on online. Some thankfully are free, some still aren’t, which is still a cost for a lot of people. And so even though these things aren’t necessarily tied to your research, these are expenses that some students have actually footed themselves, but I don’t think it’s necessary for you to always do that. And this is, once again, when we talk about applying for assistance. But when it comes to applying, I do want to point out that the information isn’t always out there explicitly to say, Hey, there’s money. You can apply for this. So if there is something that you think somebody might cover, even if you don’t think somebody might cover it, just ask. The chances are that somebody will know where the answer is. Even if it’s not, you know, on the website that says, Hey, we offer professional development funds. But that’s definitely something I think underprivileged students can fall behind on simply because some of us have to cover a lot of gaps, not coming from families with people that have done PhDs, or some of us will be first-generation graduates to even begin with. And so we might have a lot more things and a lot more sessions or professional development work that we need to do but not enough money to actually pay for those things. And so there are a couple of costs entailed in that.

21:52 Emily: Yeah. And when you say ask, I just wanted to point out, who? Who should the people ask?

21:59 Rutendo: A supervisor, I would say start with your supervisor as the first port of call is your supervisor. Your department might have somebody that’s in charge of your program as well. I don’t know how different institutions work, but generally there’s someone that’s not necessarily your supervisor, but oversees your actual program. Those are the people to talk to you. And then if it’s things that are very just professional development focused, career services. I know a lot of schools have career services departments.

22:24 Rutendo: Those places are actually really great, whether you’re an undergrad or a PhD student. They know a lot about what’s going on. And so definitely those three, start off with those three. One of them will be able to assist.

22:36 Emily: Yeah, I would also add older students, students ahead of you. If they’ve done a conference that you want to go to, just ask them if they had it funded from somewhere. If they say, no, that’s not necessarily the final word, but if they say yes, then you’ve gotten a really good lead. And I would say also, you know, the person in charge of the program at my school that was called the Director of Graduate Studies, DGS. That person has an assistant. That is the person who knows everything going on everywhere. So that is the person to befriend to get on your side to advocate for you. That person is going to be an amazing resource just generally, but specifically with respect to funding and knowing how everything works behind the scenes.

23:17 Rutendo: That is definitely true. There is always that one person in administration who’s a great person to know. And I agree with that. Finding those people is very useful.

Commercial

23:28 Emily: Emily here for a brief interlude. Taxes are weirdly, unexpectedly difficult for funded grad students and fellowship recipients at any level of PhD training. Your university might send you strange tax forms or no tax forms at all. They might not withhold your income tax from your paychecks, even though you owe it. It’s a mess. I’ve created a ton of free resources to assist you with understanding and preparing your 2020 tax return, which are available at pfforphds.com/tax. I hope you’ll check them out to ease much of the stress of tax season. If you want to go deeper with the material or have a question for me, please join one of my tax workshops, which you can find links to from P F F O R P H D S.com/T A X. It would be my pleasure to help you save time and potentially money this tax season. So don’t hesitate to reach out. Now, back to our interview.

Challenge #4: Emergencies

24:34 Emily: Okay. And we had a fourth one, right?

24:38 Rutendo: Now, the last one has nothing to do with all of these other things, but it’s emergencies. These happen. And sometimes, especially as a student, as an underprivileged student, if you’re moving somewhere new, you might have used most of your money for moving in and getting settled, but emergencies do happen. And this actually recently happened to me whereby I needed to go to an emergency room. Thankfully, it was not COVID-related. So just have to say that in a pandemic, just to make sure. However, you know, I ended up being able to talk to my welfare team here at the college and they covered a lot of the costs for a lot of things that I didn’t even know they could be covered for that are emergencies simply because I wasn’t ready then when that happened.

25:25 Rutendo: And so I think it’s really important that we understand that whatever emergencies we face to be able to be open about them, to the best of our abilities and you know, and obviously balance keeping your privacy and your private information private, but also letting letting the right people know to give you assistance. Because while some people might be able to just write their families and, you know, call up home and say, Hey, look, I need an extra, this amount of money. Some people might not be able to. And so to know that most universities will be, there will be some funds somewhere. I know my university has something called hardship funds for things like that. And different levels of it that you can apply for, but definitely the understand that emergencies for underprivileged students can be something difficult to navigate and challenging as well.

26:13 Emily: Absolutely. Absolutely. Could not agree more. I think in the U.S. it’s becoming more common, but I wouldn’t say it’s totally common, that universities or graduate schools have either emergency grants or emergency loans available. It’s not everywhere, but it’s definitely, definitely worth inquiring about because it’s, yeah, it’s becoming more and more popular to set up those kinds of things. As we understand, not everyone has the means to cover an emergency in cash or has access to debt even to finance an emergency or has family to fall back on or whatever the case may be. Yeah, not everywhere, but definitely worth asking about.

People are Your Best Resource: Talk to Them

26:53 Emily: Okay. Yeah. Anything else you wanted to add about sort of helping, you know, underprivileged graduate students prepare for starting graduate school or, you know, make it to the end? Because finances are a big reasons that people leave PhD programs.

27:08 Rutendo: I mean, I would say that, you know, the most important thing in terms of getting a hold of your finances is also just, you gave the advice of talking to older students in one of the specific categories for professional development. But in general, talking to as many students as you can, once you accept it, try to connect. If there are any people that you see online, if you’re on Twitter, for example, you know, when somebody says I’m doing this program, try to connect with them. I set up a couple of Zoom calls with third years and second years and even people that had just finished their PhDs in my department, just to talk to them, just to hear about their experiences and, you know, students, you know, not just underprivileged students, but everyone just to know about the experiences outside and inside to know what I need to prepare.

27:51 Rutendo: And so I think that’s part of your research and getting so that you really understand your finances. Especially if you’re going to be doing some form of RAing or TAing, it’s important to talk to somebody that has done it so that you understand such as the salary structures as well. Because, you know, sometimes they tell you, this is how much you get paid pro rata, but you don’t even understand what pro rata is, for example. And so it would be useful to talk to people. So I’d say, that your best resource is people that have been through the very same system as well. And just understand the general lifestyle that helps you understand the costs, you know. So just asking them what they do in general, how much things cost, ask people where they go shopping, what things they had to buy, things like that would be very useful as you are preparing to go, and helps you definitely understand your finances, even before you start.

Establishing Good Financial Habits in Grad School

28:40 Emily: So the last thing we wanted to talk about was establishing good financial habits at the start of graduate school. Both what those habits might be, and how to actually go about establishing them, which is really the key. So let’s talk about what habits are great to establish at the beginning of graduate school, and for each one, how people can do that.

Habit #1: Track Your Expenses

28:57 Rutendo: Okay. I think the first habit is to track your expenses.

29:02 Emily: I always say that number one as well.

29:03 Rutendo: Which is, I must actually say, something I got from your podcast. So I listened to this podcast before doing my PhD and honestly like it’s, I went on a binge and it has been very useful for me. And I learned to track, just track. So what I did was I had the first month of not knowing, you know, what is needed or no projections, not knowing how much I might be able to save, just to track everything I bought. It sounds tedious, but you do need to track. And so the how, I think there are different ways of doing this. The way I did it was I used Notion. So I made a table and this sort of like budget looking thing in Notion, even though it wasn’t a budget, it was what I was spending.

29:50 Rutendo: And I had categories for each thing. So groceries and toiletries. So I knew that week one, this is what I spent. Week two, this is what I spent. So that helped me also see an average about on average per week, what am I spending on this? And then I kept my subscriptions. So knowing what subscriptions, you know, I have, and then during that month also making sure am I actually using them, like I have Spotify premium. Do I actually use it? How important is this feature for me? And then there were miscellaneous as well. Things that I, you know, that I’m spending on this month that I won’t necessarily be spending on next month, but just to understand that how much cushion and move room do I have in my budget for that? So I wasn’t going to be buying pots and pans every month, for example. But I kept that in there. That helped me understand an average. Because there will be some things that I will need to pick up throughout the month that are not in necessary, you know?

30:40 Rutendo: So having all of that. The other way you could do your tracking is to use the budget apps, you know, the ones that you connect your bank accounts to an app. I think in the U.S. it might be mint that most people use. In the UK, I use money dashboard. Personally, I find that to be really good. It has, you know, web interface and app interface, and it’s fairly automatic. And so habit number one is track. Just, you know, just to understand exactly what you’re spending. Don’t try to, and don’t lie about anything. If you spend, if you spend money, I spend money on sparkling water because I love sparkling water and I don’t have a soda stream. I wrote that down just so that I actually understand how much money I’m spending on sparkling water. Things like that.

31:32 Emily: Yeah. Completely could not agree more. And I would say when you’re choosing like this manual method, which as you said, can be tedious. I think there’s a lot of power there in the tedium and staying close to the expenses. But if you know yourself and you know that you’re not going to do it, you know, you’re not going to do this daily or multi times per day or whatever it is, and you decide to use mint or you need a budget or something similar, that’s okay. Know yourself, know what’s sustainable for you. And just choose something that, as you said, can become a habit and it is, you know, less maintenance to use one of these automated systems, yeah. But whatever can become easiest for you to sustain. I know for example, I kind of fall on this manual tracking side of things. My husband will not do that. So for us keeping a joint budget together, it has to be software, or it’s not going to get done. But it is a habit. And when we use software, we do check it. So whatever you think is sustainable for you in the longterm.

Habit #2: Understand Your Expenses

32:22 Rutendo: Right. Absolutely. And then the second habit would be connected to the tracking. So after the tracking comes the budgeting. And that’s something that I have found to be very useful. So I then moved, after understanding my expenses, I then, you know, created like a, okay, so per month here’s how much I want. Here’s, you know, on average how much I think I need for groceries, how much I need, I think, for this and this and that. And then I then moved it into the automated system. The automated system for me was easier simply because there were things that I could grab, let’s say, and sometimes forget to enter. I was afraid I’d forget to enter manually because I was no longer in the tracking phase. I was now in, you know, I’m technically still the tracking phase, but you know what I mean?

33:04 Rutendo: Like in the actual making sure I understand how much I spent of what phase. And so I moved that understanding to money dashboard and had all the different categories. And, you know, it’s been very useful, but like you said, even if you do automate something, it’s a habit. So I do check my money dashboard just to make sure that an expense has gone into the correct category or into the category I want it to go into by the categories I’ve set in my budget. So, and also just to see how far I have, how much do I have left this month for this specific thing?

33:35 Emily: One thing that I think is really valuable about tracking, and also budgeting to an extent, is even if you don’t really think you need to do it right now, you may, six months from now, want to look back at that data and, you know, get some insights from it because of a decision or something you have to make at that point. So, it’s just a good thing to make a habit, you know, make as low maintenance as you possibly can, just so you may want to use that data in the future you’ll have it.

34:03 Rutendo: Absolutely. Yeah, one thing I do understand that because of, I do regret not having had a budget during my master’s degree because it was in the same country, so I really have no excuse. So, I couldn’t actually say how much I spent on groceries on average. You know, now I can say that and now I can. And so I do agree. It is nice to just have that data at some point. You never know what you might do next in a couple of months or a couple of years even.

Habit #3: Save

34:30 Emily: Yeah. What’s the next habit on your list?

34:33 Rutendo: The next habit on my list is to save. This one is a bit, I think people, people go about it different ways. I know that the advice generally is pay yourself first, which I understand is great advice. As somebody who’s not that wealthy, not even, let me not even put a “that.” Who is not wealthy, who is mostly just doing enough to get by, paying myself first is actually quite, quite difficult, even on my budget categories. What I always do know is that I always have some little leftover. So I do this thing that I actually learned again from another guest on this podcast, which is at the end of the month, whatever I have leftover in my checking account, I put into my saving and I start from zero with my new paycheck. That is my saving. And then there’s also the other way that I save, technically kind of like save/invest, is through this app called Moneybox.

35:31 Rutendo: I think the U.S. equivalent might be Acorn. I don’t know if that’s what they do, they round up your expenses and sort of, kind of like quote unquote invest it for you. It’s not like you’re investing in big, very risky, you know, things. You’re not making like $5,000 worth of investments, but it is quite nice to just see that number go up. You know, if I buy something and then there’s 20 pence left, knowing that that 20 pence is going to do something. Because also, at the end of the day, in my head, in my budget, anyway, that was a round figure, right? That was not necessarily 0.8. you know. And so, that sort of save and invest model, I find it to be very useful, to always try and save. And it’s useful to save, even if you’re saving very little, because once again, emergencies do happen.

36:19 Rutendo: And then it also is useful to try and strive towards getting to that three to six months worth of expenses, which is something you don’t always start with. Especially if you’re somebody that’s not coming from a wealthy background. You don’t always start out with being able to have three to six months worth of expenses in your savings account. But that little bit counts. Just that little bit counts, and hoping that emergencies don’t happen. Knock on wood. You will get there through I guess some of the other things we’ll talk about.

36:44 Emily: What I really like about that articulation. Now, of course I am an advocate of pay yourself first. I definitely am. But what I like about how you’ve set things up is that saving is not, even though it’s the last thing you do with your money each month, it’s not the last thing on your mind. You know throughout the month that you have that intention of doing it at the end. And so I’m sure it affects your behavior. Oh, well, I want to be able to save a little bit more this month. So I’m going to really try to come in under budget on this category, because I know that’s going to enable me to save this much more. And so what I like about that is that it’s still an intentional thing that you have throughout the entire month, even though you do the action at the end.

37:20 Emily: And I think that, you know, sometimes that’s just how you need to start. And when you’re living essentially paycheck to paycheck, you know, there’s a possibility you might spend your entire paycheck that month, if something odd came up and you can’t, you really can’t, you know, set anything aside in advance. It’s okay to do that system. As long as it’s working for you most of the time, most of the time that you’re able to save something at the end of the month and increase that savings as you were just talking about. I think, you know, it’s, it’s a way it’s a way to start. It’s a way to start saving,

37:47 Rutendo: Right. Also, just to actually say that that’s what I’m doing now, because I’m just starting out. So my intention right now is, because technically I’m still settling in. So there are still odd expenses that are coming up here and there since I’ve been here for a couple of months, but I don’t think that’s what I’ll be doing, let’s say, next year, this time. By then I will have, you know, very few things that come up and I will now know exactly what I can save, even if I’m still living paycheck to paycheck, which then just becomes something I do first. And so this is definitely something transitionary, but yeah.

38:18 Emily: I think it’s also easier as you learn a new city to become more frugal with time. You know, you mentioned earlier, well, where do you shop? That’s a very key question. Maybe when you first move to a city, you don’t know the least expensive places to shop, or the places that have the sales at this particular day of the week. You don’t have that insight. And so, you know what you’re spending on groceries, for example, in month one, you might be able to spend much less by month 13 because you figured out a few of those tricks. And so don’t think that just because you’re starting out completely paycheck to paycheck, that you’re going to be that way forever, because you will learn over time if you’re, you know, if you’re minded in that way.

38:53 Rutendo: Absolutely.

Habit #4: Learn How to Be Frugal

38:54 Emily: Okay. So do you have another habit on your list?

38:56 Rutendo: Yes. Which you actually kind of got to, which is understanding the best way you can be frugal. I put it in a different category than saving because the saving is something very technical, but the other habit you can do is try to find out how best you can reduce costs. It doesn’t matter how little it sounds. You know, for example, Spotify premium, normal is 9.99 pounds, student is 4.99. You might think, okay, that’s not much, but it is, it sort of adds up. So if you know what, just that extra amount of time it takes for you to sign up to student, if you need that. If you use that. Or knowing exactly where to shop, right? And if you go to the store and we’re like, here, we have reduced shelves where you can get fruits and vegetables that are technically about to go bad, kind of like the shelf date really, saves a bit more, you know, I could buy an avocado for 40 P or I could buy it for two pounds 70.

39:47 Rutendo: So then I get two avocados, instead. You know, something like that, just, just being as frugal as you can. If there are books that you want to buy, trying to get them second hand, instead of getting them new. You know, or if it’s something that you actually don’t need to be writing in and that you just want to browse, consider getting it from your library instead. If you’re fortunate enough to be living in, you know, even in a pandemic, some libraries are doing, you know, click and collects or things like that. So try to do that. So just finding ways to be frugal, no matter how small the amount seems, definitely adds up. And the other technique, and this is cash backs as well. I know that some banks do different cashback things with, you know, different retailers or you could actually sign up for like I think in the UK there’s TopCashback or something I think is also a U.S. thing online.

40:44 Emily: I use Rakuten.

40:46 Rutendo: They do have that. Yes. Yes. So things like that definitely, you know, for things that you’re going to buy anyway, might as well get a percentage of it back it’s really useful. And these things I know they seem very minimal when you think about you’re like, Oh, it’s 5%. It adds up. It adds up, and that 5% could be something that goes into your savings, for example. Fine. If you don’t want to spend it on something new, that’s how you end up getting to your three to six months worth of, you know, expenses of savings. So.

41:16 Emily: I was just going to say, tie any little frugal, you know, tactic that you implement to directly increasing your savings rate. If that’s your top goal at the moment, right? So if you, as you were just saying with Spotify, for example, you know, you reduce it by $5, whatever it is, Hey, why don’t you pay yourself first $5? Because you were spending that anyway. So that’s the way you can kind of transition between these two systems, or save at the end of the month. Hey, my grocery budget was this, but I came in, you know, $10 lower because I’ve learned all these frugal things to do. Okay. Your $10 at the end of the month gets to go into your savings. Yes. I love that idea. Yeah. Did you have another habit?

A Note on Side Hustling

41:52 Rutendo: Well, technically it’s not a habit, I guess, because a habit would have to be things that you do consistently, but then to try and be on, this is the last thing under this question, to try and do like side hustle type of things. I don’t know if I could classify that as a habit or a thing. But also, I mean, obviously you have to consider how much time it takes away from your work, because, you know, first and foremost, you are a student. But if possible, you know, there are different ways. Some people do short-term consulting things. I know for me, the thing that has helped me right now is a short-term consulting gig which I know, you know, at the end of that will help me build up my savings so much faster than, you know, saving the little bits off of my paycheck and things like that.

42:34 Rutendo: And so to find out where your skills lie, if somebody wants help with like a couple of editing, copyrights, things like that, that you could take away just a couple of hours of your time to do. Not necessarily to make that become the focus, but only if possible. And this is something that sometimes is also really a sign of privilege as well, actually, rather than something I’d advise underprivileged students to do, because sometimes you have more things to deal with, honestly, than side hustling. So this is why I’m not saying this is necessarily a habit, but if you feel that you do have that privilege of time and space and mental capacity to do that, then do so. But don’t necessarily, please, if there’s something you can’t do feel obligated to.

43:16 Emily: Yeah, absolutely. I mean, you’re primarily in your degree program to get that degree. So I always say about side hustling, like, don’t do anything that’s going to jeopardize your progress toward that end goal. But if you have the capacity, it can be a really great supplement. And like you were saying, I think that sometimes graduate students you know, they end up devaluing what they’re capable of doing because they’re being paid such a low, you know, rate through their stipend or whatever. If you can do consulting, as you were just saying, or employ your skills in another non-academic capacity, especially, you might be able to command a fairly high pay rate, at least compared to what you’re getting through your primary work as a graduate student. And so don’t think that a side hustle is going to be 20 hours a week or 10 hours a week.

44:03 Emily: It could be, as you said, two hours a week and still make a really big impact on your budget. If you select it very carefully, really employing what makes you unique in the marketplace. Now I will say, because we’ve been talking a lot about international students in this interview, in the U.S., international students are extraordinarily limited in what they’re permitted to do in terms of making money outside of their primary position. That is, they really can’t do anything unless it’s been approved through like CPT, like OPT kind of situation. So I’m not encouraging international students to side hustle to work for money, but there might be ways that you can set up passive income sources that it’s not actually exchanging work for money, but other ways you might be able to make money. You mentioned cash back earlier. Credit card rewards are a thing.

44:51 Emily: They can be fairly lucrative. I’ve had a couple episodes in the past on that. So I’ll link them from the show notes. International students would not be able to do that day one arriving in the U.S. because you have to work on your credit score first. But after a year or two, that might be a possibility as like a passive income source. So you are going to have to be a little bit more creative in your thinking about side generating side income as an international student, but it is still possible. Maybe it’s worth looking into again, if you have the time and the energy to do so.

45:19 Rutendo: Precisely. Yes.

Best Financial Advice for Another Early-Career PhD

45:22 Emily: Okay. Rutendo, thank you so much for this wonderful interview. I think we’ve gotten so many insights out of it. I will ask you for one last one, which is what is your best financial advice for another early-career PhD? And that can be something that we’ve already touched on in the interview, or it can be something completely new.

45:39 Rutendo: I would say, we’ve already talked about this. If there’s a chance that you don’t have to pay for it, don’t. It doesn’t matter what it is. Just ask if there’s a chance that you don’t. Because it doesn’t matter how many times you track something, how many times you budget something, if you can get it from somewhere else, all these other habits, all these other things will be better as a result of you not necessarily having to go out of your way to do this. So that’s the biggest thing for me.

46:04 Emily: Absolutely. I think, you know, maybe a more broad category of term for this is just negotiation. Like you can kind of think about it that way, because you’re just sort of ferreting out, you’re feeling out, is there a possibility that someone else can foot this bill for me? Is there another creative way that I can get this paid for by someone else? I know in the U.S. we don’t have a strong culture of negotiation at all in terms of like sales or anything, but I know that other countries, it’s more of a common thing that you learn in your childhood. And so if that’s your, you know, personality, maybe you can think of it that way as just feeling out what are the possibilities here, financially? What are the parameters of this space? Yeah. And oftentimes that’ll be to your advantage. I mean, you’re not going to get anywhere by not asking. That’s for sure.

46:46 Rutendo: Definitely. And I mean, I do just want to say that, especially for underprivileged students, the one thing I do want to say about the reason I’m giving this advice and I put it, so plainly is because a lot of us it’s about our mindset. A lot of us were, you know, I mean, let me not say a lot of us, but then for me, the problem I had to get over was knowing that I had to work for certain things and then sort of feeling that I am not allowed to have certain things, just the social conditioning, right? That I’ve already come this far as like a Black African woman. Now I have to ask again, if they could pay for this conference. Now I have to ask again, but really just, there are people, you know, once I started talking to people that have been doing this for four years and some people for generations because the families had already navigated the system. This is actually what the system is the afford to support you, to become the best that you can be as a researcher, as a student, as whatever it is that you’re doing.

47:40 Rutendo: And so it’s not necessarily, I hope that a lot of people realize it’s not in sense of entitlement, but really just to understand that there are systems of support that might not be explicitly said, you know or stated that they are there, but they really are there for you. And to help you with your finances. And like you said, Emily, at the beginning of the interview, a lot of people are beginning to understand now that finances really impact underprivileged students’ experiences in these institutions. And they are open to that and open to discussion and negotiation. So.

48:12 Emily: That was so well put. Thank you so much for this interview, Rutendo. It was a pleasure to speak with you again.

48:16 Rutendo: Thank you so much. Thank you for having me. I appreciate it.

Outro

48:23 Emily: Listeners, thank you for joining me for this episode. Pfforphds.com/podcast is the hub for the Personal Finance for PhDs Podcast. On that page are links to all the episode show notes, which include full transcripts and videos of the interviews. There is also a form to volunteer to be interviewed on the podcast and instructions for entering the book giveaway contest and submitting a question for the Q&A segment. I’d love for you to check it out and get more involved. If you’ve been enjoying the podcast, here are four ways you can help it grow. One, subscribe to the podcast and rate and review it on Apple Podcasts, Stitcher, or whatever platform you use. If you leave a review, be sure to send it to me to share an episode you found particularly valuable on social media with an email listserv, or as a link from your website. Three, recommend me as a speaker to your university or association. My seminars cover the personal finance topics PhDs are most interested in like investing, debt repayment, and taxes. Four, subscribe to my mailing list at pfforphds.com/subscribe. Through that list, you’ll keep up with all the new content and special opportunities for Personal Finance for PhDs. See you in the next episode! And remember, you don’t have to have a PhD to succeed with personal finance, but it helps. The music is Stages of Awakening by Podington Bear from the free music archive and is shared under CC by NC. Podcast editing and show notes creation by Meryem Ok.