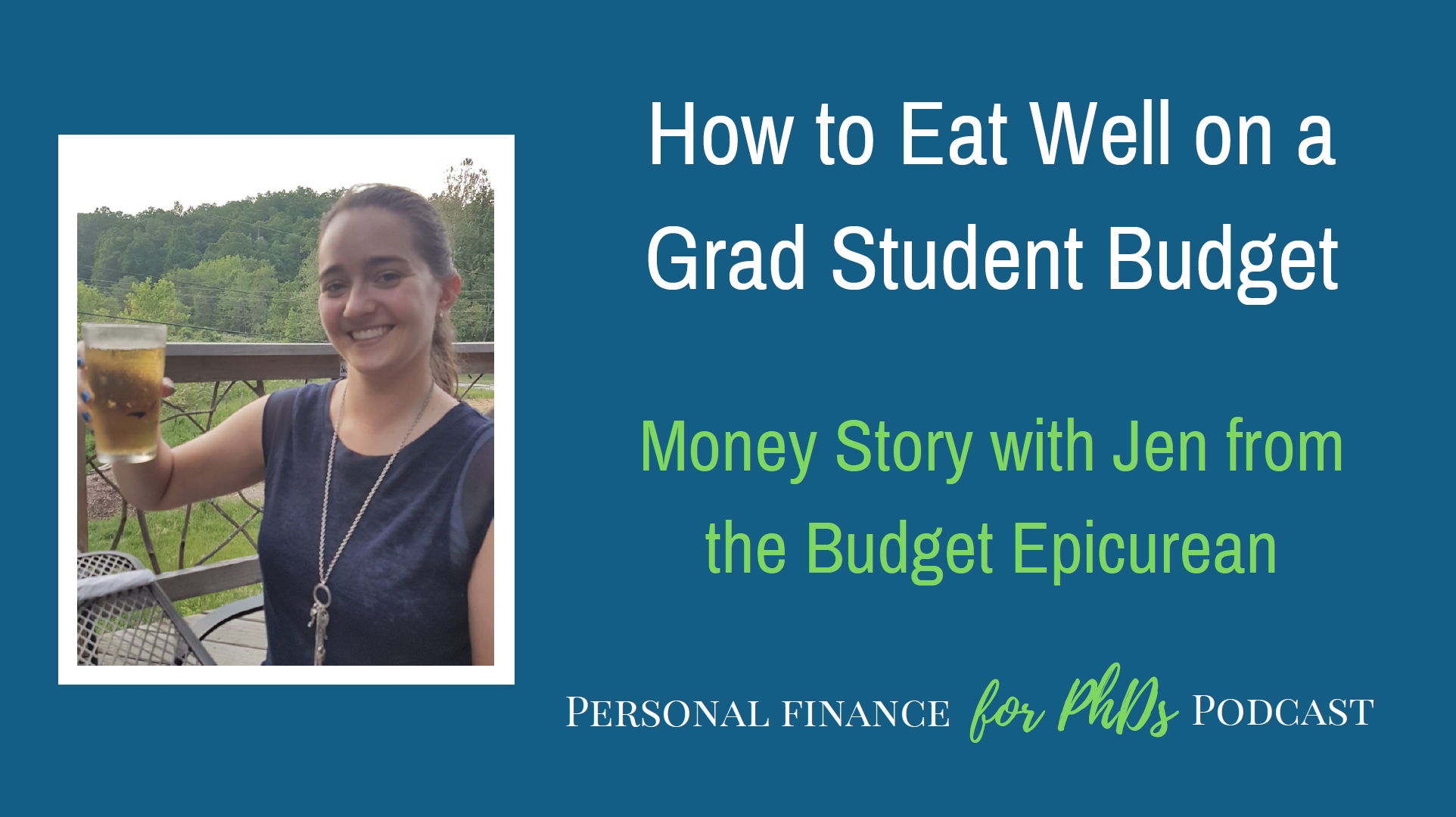

In this episode, Emily interviews Jen from the Budget Epicurean (formerly College-Approved Food) about her experience as a grad student. Jen finished a master’s and spent several years in a PhD program, but decided to leave before completing her dissertation. They discuss her reasons for leaving and the career she built and what role finances played in the decision. In the second half of the interview, Jen gives her best tips for eating well on a grad student budget, including curating go-to meals and ingredients, where to shop, how to track prices, and what kitchen appliances are the best bang for your buck.

Links Mentioned in This Episode

- The Budget Epicurean (Jen’s Blog)

- Budget Epicurean (Twitter)

- Meal Prepping Has Benefitted This Prof’s Time, Money, Health, and Stress Level (Money Story with Dr. Brielle Harbin)

- PF for PhDs Community

- The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich (Book by David Bach)

- Emily’s E-mail (for Book Giveaway Contest)

- PF for PhDs: Podcast Hub

- How Finances During Grad School Affected This PhD’s Career Path (Money Story with Dr. Scott Kennedy)

- The Academic Society (Emily’s Affiliate Link)

- Budget Bytes

- PF for PhDs: Subscribe to Mailing List

Teaser

00:00 Jen: I almost tripled my income within two years of leaving the program. It was very exciting to get those paychecks and say, oh wow, this is what real money feels like.

Introduction

00:17 Emily: Welcome to the Personal Finance for PhDs Podcast: A Higher Education in Personal Finance. I’m your host, Dr. Emily Roberts. This is Season 9, Episode 4, and today my guest is Jen from Budget Epicurean. Jen finished a master’s and spent several years in a PhD program but decided to leave before completing her dissertation. We discuss her reasons for leaving and the career she built, plus what role finances played in the decision. In the second half of the interview, Jen gives her best tips for eating well on a grad student budget, including curating go-to meals and ingredients, where to shop, how to track prices, and what kitchen appliances are the best bang for your buck. I have found through facilitating my workshop Hack Your Budget that early-career PhDs are highly interested in food spending. I poll the attendees about what budget category they most want to discuss, and food always comes out on top, plus the vast majority of the frugal tips submitted are related to food. I think this is because grocery spending is typically the largest variable expense category in a grad student or postdoc budget. It’s quite gratifying to try out a new frugal strategy and immediately see the effects on your spending. In fact, Season 4 Episode 13 with Dr. Brielle Harbin was devoted to the subject of meal planning, and I almost always interrogate my budget breakdown guests on their cooking and food shopping habits.

01:51 Emily: Keep in mind, though, that your frugal journey should not end or even necessarily start with food spending. I am a firm believer that you should re-evaluate your large, fixed expenses, such as housing and transportation, before any other categories. It may take a long time, a lot of research, and even some money up front to reduce your spending in one of those areas, but once you do make a reduction, that lower spending level is locked in indefinitely and requires no conscious action by you to maintain. That is the big advantage of reducing fixed expenses first. However, I also love the idea of using frugal strategies in the kitchen to start what I call a frugal stack, which is when you use variable expense reductions to leverage yourself into fixed expense reductions. If you would like to learn more about strategic frugality and frugal stacking, check out the Personal Finance for PhDs Community at PFforPhDs.community. I taught these strategies as part of two monthly challenges held near the end of 2020. I also devoted a chapter of my ebook The Wealthy PhD to frugality; it discusses the philosophy of frugality and gets into really nitty-gritty strategies for each one of your budget categories. I hope you will join us this month inside the Personal Finance for PhDs Community PFforPhDs.community.

Book Giveaway Contest

03:30 Emily: Now onto the book giveaway contest! In June 2021 I’m giving away one copy of The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich by David Bach, which is the Personal Finance for PhDs Community Book Club selection for August 2021. Everyone who enters the contest during June will have a chance to win a copy of this book. If you would like to enter the giveaway contest, please rate and review this podcast on Apple Podcasts, take a screenshot of your review, and email it to me at emily at PFforPhDs dot com. I’ll choose a winner at the end of June from all the entries. You can find full instructions at PFforPhDs.com/podcast. The podcast received a review recently titled “Preparation and survival!” The review reads: “Excellent resource to get prepared for graduate education and to navigate it. I think the specifics of your personal situation and institution will always vary. So some things you take with a grain of salt, however, the biggest asset of the pod is the variety of people interviewed. People from different backgrounds and programs and the amount of topics covered. Most of these topics are discussed behind closed doors and in private, but this podcast makes you remember you’re not alone and there are way more people out there navigating difficult situations like you.” Thank you to this reviewer, and I fully agree that the strength of this podcast lies with the guests! I really appreciate my guests being transparent about this taboo topic. Without further ado, here’s my interview with Jen from Budget Epicurean.

Will You Please Introduce Yourself Further?

05:10 Emily: I have joining me on the podcast today Jen from Budget Epicurean. And we kind of ran into each other on Twitter. And I realized that Jen would have a lot to say to us on the podcast. So that’s why I invited her on. And she is both a former grad student and, as you can tell by the name of her blog, Budget Epicurean, has a lot of content to offer us on managing a budget with respect to groceries, with respect to cooking, food spending. So we’re going to learn about both these things. Why did Jen leave her graduate program, and then what are the food tips that she can give us for, you know, eating well on a budget? So I’m really excited for this interview. Jen, will you please introduce yourself to the audience a little bit further?

05:59 Jen: Sure. Thanks Emily. Yeah. I was a graduate student for a very long time. My mom’s a nurse, my dad’s a chemist, so I’ve always been interested in science and knew from a young age that I wanted to go to grad school, get a PhD, run a lab. So that was kind of my path. And I got my undergraduate degree in biology and then I pursued a master’s degree right after, also in biology, and then got into a PhD program in genetics which was wonderful. I loved being in school and learning, but I realized after about a year of talking with the other graduate students, the other postdocs, and even some of my advisors who said funding kept getting tighter and tighter. Tenure-track jobs were almost non-existent anymore. And it just seemed like a big struggle. So it took me about two and a half years to decide, it was a really hard decision, but I did not complete the PhD program. And we can get more into that later. But throughout all this time, I was also blogging because I love food and cooking. So it started out in undergrad as College Approved Food, that most of it you can make in like a dorm room. And it’s just kind of grown from there and morphed over time into the Budget Epicurean as my personal cooking skills and interests expanded.

What Were Your Career Aspirations at the Start of Grad School?

07:24 Emily: One thing I love about blogging, and I used to blog about personal finance, is that you have this wonderful record to look back on, you know, years later. When you can’t quite remember as well, you know, what was going on day-to-day, you have that blog. So it’s so fun that you were focused on food for all those many years and that you have the record of it. So I want to go back to, you know, when you started graduate school, you said you were basically going straight through, undergrad, master’s, into a PhD program. What were your career aspirations? Was it definitely to have a tenure-track job or, you know, was that the only thing you were there for, or what were you thinking when you started the PhD program?

08:00 Jen: So early on, I guess I just had this dream of having my own labs and writing papers and grants and, you know, like I’d cure cancer someday or some kind of fabulous scientific discovery. It just seemed so interesting and just a thing I wanted to do. And then the more I got into it, it’s kind of, they say, you know BS is bull crap, and then MS is more crap and then PhD is just piled higher and deeper. And the longer you go, the more narrow your focus gets on your field. So you know a lot about a little. And so my ideas of big discoveries kind of just became more like fixing this one little problem that we don’t know enough about. And I think that was the further I got, the more I saw people in the end goal as like a professor, as someone running a lab and saw what their lives were. They don’t actually do the science anymore. They’re lab managers and money managers and politicians almost to a point. So I think that’s where the kind of disillusionment started.

09:19 Emily: Yeah. I think, you know, I had a similar trajectory, I would say at the beginning of grad school, like came in wanting to run my own lab, not necessarily in academia, but just to be doing research. And I realized as you did that, once you’re at the top of that, you know, hierarchy of your own lab that you are not doing the day-to-day in the research. And so I then started thinking, oh my God, I actually sort of idealized a postdoc as like the perfect job. And of course there are, you know, staff scientists, those positions can exist, although they’re not super common in academia. So for me, it was never about like academia and like the tenure-track and so forth, but rather about doing research. That was until I got sick of doing research and decided never to do it again later on. But yeah, I’m just thinking about like, I’m sure you considered this because you took a lot of time for this decision, but what were the jobs that you maybe could have had without the PhD? And did you just still have that sense of like, no, I’m going to be overeducated by that point, according to what your interests were? Was that kind of how the decision was made? That even if you didn’t stay in academia, if you finished the PhD, you would still be pigeonholed so much?

10:30 Jen: Yes. I think that ultimately is why, because I did finish a master’s program before going into a PhD program, so not everybody does that. So I had the masters already, so I knew I was that like one level above a college degree, which was, you know, good financially-speaking and did lead to the career path I’m currently in. But not wanting to go the full PhD without wanting one of those “You need a PhD to do it” jobs. I was lucky we had a group that was called careers, alternate careers in science, something like that where once a month they brought in people. So I saw a couple of different options of people who, you know, were clinical scientists in pharma and they advise drug companies or clinical illustrators for textbooks and things like that. But none of those really spoke to me. So I kind of got into that thought process of, okay, well, if I finish the PhD, then there’s nothing really at the end of this tunnel, so I should stop now.

Role of Finances in the Decision to Leave Grad School

11:31 Emily: Yeah. Again, I see myself so much in this path because when I went through the same career exploration process, I did identify a career track that I was like, well, that sounds really cool, and I do need a PhD to do it. Or not need, but you know, it’s helpful. And so I decided to keep going kind of with that in mind. And of course after I finished my PhD, I started my business and it has nothing to do with that career track or anything. So it’s just so interesting, like that can make all the difference is really seeing a career that you’re interested in. Obviously, why would you finish it if you didn’t think there was a career on the other end that needed the degree and that, you know that you were super passionate about? So what role did finances play in this decision?

12:12 Jen: So, there are definitely pros and cons to going straight through. Sometimes I kind of wish I had just taken a few years off after undergrad or after the masters to try and get a career and see if I liked it and then go back. But I think it was also helpful that I had just come out of undergrad where, you know, you’re very used to living on a low income. So going into the master’s program, I think I made $12,500 per year. Which now seems completely absurd, but this was in Ohio and my rent was only $350 a month. So it was doable.

12:47 Emily: What year was that? Or years?

12:50 Jen: 2010 to 2012.

12:53 Emily: Okay.

12:54 Jen: I believe. And it was an attic. So I was literally just living in an uninsulated attic apartment in Ohio. So, you know, my electric bill was probably almost that. But then going into the PhD now I was making 20 something in Colorado. So this is circa 2012 to 2014, something like that. And it just was getting very difficult. I was starting to think about wanting a house someday. I met my future husband there. So we’re thinking about, you know, buying a house, having a family, getting married. And we were both graduate students at the time. So even combined, we were 40 ish. So it was just really difficult to save anything or feel like, you know, you could start doing those adult things as a grad student. So that’s one of the many things we discussed was, okay, if we want to buy a house, we need more income.

High Attrition Rate Amongst Grad School Cohort

13:53 Emily: And you mentioned to me when we were preparing for this interview, that most of your friends left grad school too. Was there a pretty high attrition rate from your cohort?

14:02 Jen: Yes. we had four start and, to my knowledge, only one is still in the program. And the year after us I believe they had the same, they had four people start and only one is still in the program. And now six, seven years later the one person who stayed is still not graduated and had switched labs twice already. So.

14:28 Emily: And do you think that finances are playing a role with those decisions as well? I mean $20K a year, you know, 6, 7, 8 years ago in Colorado, not a low cost of living area, by any means. It sounds quite difficult, even as you said, in a two low-income, two low-income household combined, I still think that would be quite difficult. I’ve just been thinking a lot recently about the strain that we put–“we,” academia–puts on our young, our trainees, of the financial strain that we put on them and the effect it can have on our mental health, our career outlooks. Obviously the financial directly affecting that, even physical health because, you know, food security can be an issue. Housing security. So, yeah. Did you talk about that sort of thing with your cohort mates?

15:21 Jen: We didn’t really, I mean, we weren’t close enough to talk about the numbers and the details, right. But I know I’m the only one who stayed, I think a large part had to do with, he had a lot of family support. Family lived in the area, so he lived with them. So even though he was married and had a kid with another on the way there was, you know, no costs for housing, he had support to help watch the children, to support, to get food and things. So I think that probably helped him a lot, that, that low-income didn’t matter as much. He had that social safety net. One of the other girls who dropped out it was because she got pregnant along the way and got lucky that her husband got a pretty high-paying job about halfway through her first year. So they were comfortable enough that, you know, they said the amount that she was making wasn’t worth the stress it was putting on her. So she left and didn’t come back. So I think that if you don’t have that type of support or other income, it’s really hard to make it as a grad student.

16:22 Emily: Absolutely. It sounds like you, and you know, these other friends, you mentioned like you’re starting to kind of lift your heads up and say, what do I want the rest of my life to look like outside of my career, and what finances are needed to support that? And is grad school currently, or in the future, going to take me to that financial place that I want to get to? And you know, I’ve had a previous interview actually, we’ll link it in the show notes, with Dr. Scott Kennedy, where he talked about, you know, his aspirations initially to become a faculty member, you know, tenure-track, and just realizing as he started his family that a postdoc and, you know, an assistant professor position was not going to cut it for him and his wife and three kids and so forth.

Improved Finances and Current Career Trajectory

17:06 Emily: And so, I mean, so he changed career tracks and he’s very satisfied with that and is paid very well. But yeah, sometimes, you know, the decisions you make when you’re 22, 23, 24 years old, you’re not thinking super far, like you might be thinking decades ahead in your career, but not necessarily about how things might change in your personal life. And they can change very quickly when you’re in your twenties. And a lot of people are, you know, forming families and so forth. So yeah, I just, I find that really interesting. So, you know, what career have you had after leaving your PhD program and how are your finances looking now?

17:39 Jen: Yeah. So once I had made the decision that, yes, I did need to leave. I didn’t want to just jump ship, right. I didn’t want to have zero income. So I started looking at other options and as I said earlier, having the master’s already really helped because that gave me a leg up and a lot more options beyond just, you know, being a research tech, cleaning beakers at a university somewhere. Not that that’s a bad thing. But I think it was actually through one of the people who came to talk to us. It was someone who worked for pharma as the medical monitor for clinical trials at a pharma company. And so I started looking into clinical trials, which prior to then I hadn’t really thought about. Every drug that’s approved, that’s what they have to go through. And so I looked into, you know, how does that happen?

18:27 Jen: What are the different careers you could do on the pharma side, on the site side? And I just had good timing. I found an opportunity with a research group, very close to where I was and interviewed. And even though I had no research experience, clinical research experience, I had the master’s degree. And so I convinced them that I could learn quickly and they decided to go ahead and take a chance and hire me as a research associate. And I loved it. It was the first time I ever had patient interaction with people in a clinical setting. And it was just so much fun and it was a very eye opening moment of like, this is like the thing. This is the thing I want to do.

19:08 Emily: Wow. And it sounds actually like, you know, based on, you mentioned your parents’ careers earlier, that it’s kind of an interesting melding of the two, like still doing research, but having patient interactions, like probably, yeah. They probably both do each side of those things, right?

19:21 Jen: Yes, yes. It was perfect. So I still get to read scientific papers. I still get to browse Google Scholar. It’s just, you know, looking at the background of my drugs and standard of care and being on the cutting edge of research is so much fun. So yeah, it was a very good fit. And having the masters, I think is the thing that really pushed me into it. And then once you’re in clinical research and you have years of experience, then the whole world opens up to you. So I’ve switched companies several times, moved up in the ranks and now I’m in essentially a clinical coordinator management position. And so I think doing that was an excellent choice. I don’t know that I could have done that right out of undergrad. So ultimately I’m glad it all worked out the way it did. But I almost tripled my income within two years of leaving the program. Because I mean working full-time, I think I started at like 40. So just by getting a job, a 40-hour-a-week research assistant job, I had doubled my income there. And then after I had a year of experience, I went to a different company and then I was at like 58 or something like that. So yeah, it was very exciting to get those paychecks and say, oh, wow, this is what real money feels like.

20:43 Emily: Yeah. Incredible. And that’s the thing that, you know, I often talk the income jumps that can come along the PhD process, but guess what, if you’ve been living on a grad student stipend, almost any job is going to pay you quite a bit better than that. So yeah, I’m sure that did feel incredible.

Commercial

21:02 Emily: Emily here for a brief interlude! This announcement is for prospective and first-year graduate students. My colleague, Dr. Toyin Alli of The Academic Society, offers a fantastic course just for you called Grad School Prep. The course teaches you Toyin’s 4-step Gradboss Method, which is to uncover grad school secrets, transform your mindset, uplevel your productivity, and master time management. I contributed a very comprehensive webinar to the course, titled “Set Yourself Up for Financial Success in Graduate School.” It explores the financial norms of grad school and the financial secrets of grad school. I also give you a plan for what to focus on in your finances in each season of the year that you apply to and into your first year of grad school. If this all sounds great to you, please register at theacademicsociety.com/emily for Toyin’s free masterclass on what to expect in your first semester of grad school and the three big mistakes that keep grad students stuck in a cycle of anxiety, overwhelm, and procrastination. You’ll also learn more about how to join Grad School Prep if you’d like to go a step further. Again, that’s the academic society dot com slash e m i l y for my affiliate link for the course. Now back to our interview.

Best Tips for Eating Well on a Budget

22:30 Emily: So let’s switch focuses now and talk about the food side of things, the subject of your blog. And so I’m going to kind of let you like drive this half of the conversation, but like, what are your best tips for us in terms of shopping, cooking, whatever it is, as I said earlier, eating well on a budget?

22:45 Jen: Yeah. So I’m also lucky there. My mom is a fantastic cook, and I grew up in a household that we were just very thrifty and frugal and creative. So I got to use all of those skills to feed myself, you know, better than ramen all throughout college. So my house was always the place to go for dinner parties and game nights. And I love hosting, so I had to find ways to, you know, feed six of my grad student friends without, you know, we can’t afford $60 worth of pizza every Friday. So I think one of my best tips is to just try new things. And eventually you will find some recipes that you like, and put those on repeat. So for your standard meals, I have tons of like cheap ingredient lists and less-than-five-ingredient meals on my blog. Things like stir-fried rice. That is just infinitely possible to mix it up. You can put beans in it, you can put whatever meats are on sale in it, and whatever vegetables. It’s good with canned or frozen seasonal produce. So find those couple of recipes that are very flexible, that you almost always like, it’s easy to cook, and that saves you tons of time and money. If you just say, okay, it’s Tuesday, I’m hungry. What can I make? And you just have these like three, five things that you just know you have on hand in the house.

24:10 Emily: One of the things that you just mentioned that I thought was really key was short ingredients lists. Because I know when I started cooking, and I did not have extensive cooking experience growing up or through college. I was always on like a meal plan, so I didn’t have to really cook outside of that much. So when I started with that, I was looking at whatever, I don’t know, standard recipe at that time books. And they would have like 10, 15 ingredients for like a recipe. And it would be cool and like taste good at the end, but the work that went into handling all those different ingredients, and also just the fact that I did not have a stocked kitchen and it would be like, oh, you know, three different spices for this one, you know, meal. And they’re like several dollars each and I had to pick them up and so forth.

24:55 Emily: I realized that it was the wrong approach, looking back at it, and now I cook much, much more simple meals, usually that have usually, you know, much shorter ingredients lists. And I think that’s really a key when you’re just starting out. And yeah, like I said, your pantry is not already stocked with, you know, the sort of esoteric like spices that some fancy recipe might call for. So I really love looking at yeah, five ingredients or less, like those kinds of recipes. And I also really like the idea of having some kind of generic base kind of meal that you can then tweak and alter with, depending on what you have on hand, or as you mentioned, what’s on sale. Something that’s flexible, like a stir fry. Do you have some other examples of that? I’m thinking like salad, you know, that works too.

25:39 Jen: Yeah, for sure. Salads are a great one. You can, you know, can a corn, can of black beans, suddenly it’s Tex-Mex. If you got, you know, walnuts, cranberries, some kind of cheese, salads are great to mix it up. Whatever proteins on sale. I love chickpeas or, you know, a little flank steak. You can get those for a couple bucks, slice it up. It makes a great salad. Soups are really great. If you’re a person who likes soups that’s always a good kitchen-sink meal. Like I don’t know that I could think of anything that you couldn’t throw in a soup and make it work. Casseroles are also great. Omelets, you would be surprised at the things you can put in an omelet and make it delicious. I’ve had like leftover French fries that normally taste terrible. Chop them up and throw them in an omelet. Now they’re basically hash browns. So yeah, I love meals like that. We still have them all the time.

Time Management Tips for Food Shopping and Cooking

26:30 Emily: And so what’s another kind of suggestion, maybe on the time management side of shopping and cooking, which I know can be a real challenge for graduate students?

26:40 Jen: For sure. So again, I would start with what you like, and then branch out a little bit from there. So a list is very helpful if you’re the type of person who likes lists to keep you focused and not spend eternity at the store. Plus it’ll keep you from, you know, just being confused in front of the spice rack, like there are 7,000 things. What do I get? Like, you look at your list, you know, I need like salt, pepper, cinnamon, that’s it. So having that also keeps you from spending money because grocery stores, you know, want you to spend more money than you intended and having a list can help not do that, although I still do.

Process for Making a Grocery List

27:23 Emily: And what about when you’re making that list? Like, what’s your process for that? Like, are you looking at the circulars that are produced by, you know, I don’t know how many different grocery stores you kind of cycle through, but is that, is that another strategy that you use, like shopping multiple stores? Like, let me know how you’re doing in terms of making a list, how you do that with your budget in mind.

27:42 Jen: Yeah. So I have a number in mind that I’m trying to hit every week, right? So let’s say you only want to spend 50 to $70 a week for one person. So you should definitely look at the circulars because stores have what they call loss leaders. So it’s usually whatever’s in season or they can get a lot of, and they want to use that to get you in the store. So like it’s wintertime and cabbage is on sale and Brussels sprouts are on sale. So they’re super, super cheap per pound. So you start with those things and say, okay, what can I make with those things? I can make soup. I can roast them as a side dish. I can put them in a casserole, and just come up with some ideas for meals. And so I would then make a list of, okay, I want this thing, this thing, this thing, they’re all on sale.

28:33 Jen: Check your pantry as well. So like, you know, I have some pasta noodles still, so I’m going to make pasta one night. So I don’t need to buy that, but, oh, I don’t have any sauce. I’ll put a jar of that on the list. So between what you need that’s not in the house and what’s on sale, you can then kind of build your meal ideas around that. And then when you’re at the store, you can look around because, you know, sometimes I’ll find deals that weren’t advertised in the circular, but they have, you know, there’s like a markdown on pineapple because it didn’t sell well enough or whatever. So I’ll pick up some of that too. So I think the idea of flexible meal plans is what works best for me. I’m not like, okay, Monday I will have oatmeal and then sandwiches. And then a tuna noodle casserole. It’s more like, I’ll probably make tuna noodle casserole this week.

Using a Price Book

29:23 Emily: Another strategy that I use. So, my husband always makes fun of me. I do not know the prices of things. I don’t like look at price when I’m shopping, especially in something like a grocery store. So it’s really important for me to kind of study the prices because it’s not something that I like naturally will just absorb. Like he just naturally absorbs that. He knows the last time we bought this, we paid this. The price I see in front of me is lower or higher. That helps me know when to buy it or not, or to skip it. But I actually have to use a price book. So especially when I am, so we recently moved to a new state. And so we were kind of like, well, we don’t know what the prices here are. So we started using a price book again.

30:02 Emily: It’s not something I do all the time, but just to check out, okay, well, this is what we’re paying over here, studying the receipts, basically. This is what we paid for this food at this store. This is what we paid for this food at this store. Okay, that price is the same every week. Okay, sometimes that price is lower and sometimes it’s higher. We need to like pay attention to when it goes to this level and then we can buy it. So the price book to me is really helpful as someone who does not naturally incline to, you know, notice the prices of food to know when something is a good deal or something is not a good deal. Because for me, if it’s not going to appear on the circular, unless I have that price book, I’m not going to know if it is a good price or not a good price.

30:37 Jen: Mhm, that is an excellent point. Absolutely. And I think I’m like, I must be like your husband. I just know in my brain like, oh, last time I bought Italian dressing, it was about 1.50 and it’s, you know, 10 for 10 while on sale. That’s a dollar. So I’ll just get three of them. Should last for, you know, until the next sale comes around. But if that’s not a thing you notice then a price book is definitely a good idea. And I would suggest a price per unit as well. Because sometimes they do get you there. You assume, you know, the big package, cheaper per ounce, but maybe it’s not, maybe you should get two of the one-pound bags instead of one of the two-pound bags. And that’s one way to know for sure.

Finding Your Go-To Stores

31:17 Emily: And one strategy that I just mentioned with that was shopping multiple stores. And so I’m wondering, you’ve lived in multiple places now, someplace for your undergrad, master’s, PhD, maybe you’ve moved since then. How have you found like your go-to stores in those new areas?

31:34 Jen: So I think it’s a lot of the mental price book thing. So we did move around a lot. We’ve lived in Colorado, Connecticut, and now we’re in North Carolina. And so when I go to a new place, I usually do go to all of the grocery store options at least once just to see, you know, what’s the layout, what do the prices look like? How far is it from home? And then I kind of choose the best one based on prices and now a little convenience, because we have that wiggle room in our budget to sometimes pay a little bit more just because it’s closer. But yeah, so I would definitely recommend going to the stores, just checking things out, write down in your price book the things you commonly buy. So that’s another way that you’ll know your eating habits like, oh, I always buy chicken and spinach and milk and bread.

32:20 Jen: So those are the things you’re buying every week, even if you’re only saving 10 cents, 20 cents every week, that’s going to add up. So I usually go to our Harris Teeter because they have pretty good prices. They have regular rotating sales on things we use all the time. Then I supplement once a month, once every other month with Aldi, which is one of my favorite discount grocers. And they’re expanding, they’re in most of America by now. So they just have great super cheap prices on your common everyday staples, like canned tomatoes, canned beans. So those are my two I use most frequently.

33:01 Emily: I’m glad you mentioned that you were in North Carolina. I did not know that. I did grad school in North Carolina at Duke. And so actually when my husband and I first got married, the closest grocery store to where we lived was a Harris Teeter. So we were doing a hundred percent of our shopping at Harris Teeter, which I do not think was a good idea, especially because we were not, again, paying attention to the sales cycles and so forth. It was just, it was all about the convenience of that being like super, super close. So after we started paying attention, after I started paying attention a little bit more to the grocery prices, we mixed in Kroger in North Carolina and Costco and Aldi. And so we would not definitely hit up, you know, Kroger and Costco and Aldi every week, but it would maybe be kind of on a two-week rotation.

33:45 Emily: And yeah, another kind of vote for Aldi. I recently moved from Seattle to Southern California. There were not any Aldis in Seattle, I don’t think, that I was aware of, but there is one really close to where we live now. And so I’ve been, like, as soon as we got here and we were like, oh my gosh, there’s an Aldi again, like we are so excited to be able to go back to Aldi. So yeah, definitely that’s where we do, like, our kind of primary shopping, I would say. And then sort of supplement it with like a regular, you know, grocery supermarket kind of situation.

Tips for Meal Prepping

34:11 Emily: I asked earlier about time management and I was thinking about like, I don’t know, meal prep or like bulk cooking, batch cooking. Do you have any tips around that for someone who maybe is just cooking for themselves and has a busy schedule? I know when I was in graduate school, a big problem for me was staying on campus till, you know, post-six, post-7:00 PM and coming home hungry. And what do you do in that situation?

34:36 Jen: Yeah, absolutely. So I think as a grad student, if you don’t eat leftovers, you should start now. I think I only met one person who refused to eat leftovers and they spent way too much money on food. But that is the best way to just make sure you always have something ready. So I would say, seek out things that freeze well. Things like pasta bakes and soups and chilies, and even some casseroles, and you can make those things in bulk. And honestly for one person, that’s not very difficult. You make one pan of, you know, like a rotini bake or lasagna, and you can eat some then, have some for tomorrow, and then freeze the other half. And that’s 2, 3, 4 more meals for you. So you can start out with cheap Tupperware or even Ziploc bags. The way I do it now is not necessarily cooking whole meals, but I batch prep when I make ingredients.

35:33 Jen: So say I’m making rice for stir fry and burritos this week, and I need like a cup or two cups of rice. Well, I can cook like six or eight cups all at the same time and freeze it in Ziploc baggies. And then next time I need rice, I don’t have to cook it. It’s already made, I just pull it out of the freezer, stick it in the microwave. And that saves me 40 minutes of not having to boil rice next week. So if you’re making things like that, I would say definitely batch it and freeze it if you can.

Go-To Kitchen Appliances

36:05 Emily: And also with, you know, someone budget-conscious in mind, what are your go-to like kitchen tools or small appliances that you would say are good for facilitating the kind of things we’ve been talking about?

36:19 Jen: Yeah, for sure. It’s a little hard looking back now, now that I have the luxury of so many things in my kitchen. But I would say if you can only get one thing right now, probably a pressure cooker is my absolute favorite accessory right now. And the newer ones that are super fancy and have a million things that can do are great, but you don’t need a super fancy one. Like I have an ancient pressure cooker from my grandma and it gets the job done. But that will definitely save you time. You can cook something like a roast from frozen in 30, 40 minutes. It’s amazing. So that helps you maximize your freezer usage of foods like that, and it’ll save you money because you can make your own dried beans. My biggest problem with dried beans was that they take so long. You’ve got to soak it overnight, put it in a Crock-Pot for hours. You can take dry beans, stick it in the pressure cooker, and 40 minutes later, you’re good to go. So the price per pound of dried beans is way better than canned, and a pressure cooker makes them almost as convenient. So that would be my top one right there.

37:35 Emily: That’s a good tip. I’m like pulling out my Amazon like wishlist, like, oh, I need to add one. Because I don’t have a pressure cooker right now. Oh yeah. That sounds really. Because I have far too many times left, you know, some meat or something frozen until way too late and have to kind of scramble and remake the plan. So I mentioned, I don’t have a pressure cooker, but the appliance that I used most when I was in graduate school, and I think it was something like $40 when I received it, was a slow cooker. And I really liked that too, because it was so easy to cook in bulk, again for one person or two people. Like you can cook one meal in a slow cooker and it’s going to last you all week pretty much in terms of like taking it for lunches or whatever.

“Leftovers” Avoid the Takeout Trap

38:13 Emily: So that was my, like, when I started using that, it like completely changed my like cooking life. It made things so much easier. And I really, like we mentioned about like, you know, freezing meals and having things ready also, you know, leftovers. I don’t even like the word leftovers. I love eating leftovers, but I don’t like calling them leftovers. I feel like it’s really pejorative. Like they’re like an afterthought. No, you intentionally created food than you needed, you know, initially. And you had a plan to eat it like over time. I love that because yeah, I think a big sort of trap is being hungry and not having anything really easy to go to at that moment. Especially as I mentioned, like coming home from lab late, I remember when I was blogging at some point and I mentioned something about cooking.

38:56 Emily: Like, you know, not eating out, basically. Like not eating out for convenience. I remember I got a comment from a grad student like, well, what do you do? Because you know, when you get home from lab, like you have to be, it’s late. Like you’ve got to be hungry. And I was just like, oh, I realize I never cook at that time. I always had something already ready to go in the fridge and the freezer because yeah, I came upon that situation over and over again. And I would be tempted to grab takeout on my way home if I didn’t know that there was something there waiting for me that was appealing.

39:25 Jen: Yeah, absolutely. And, the Crock-Pot would be my second for sure. They probably are a little bit more affordable, but yeah, you can make a lasagna in a Crock-Pot. You can make a huge batch of chili or soup or casserole or cook a whole chicken and shred it up and save it for later. So yeah, just having a bag or a Tupperware you can pull out of the freezer, the refrigerator, whatever, you know, it’s eight 30 at night. You just need something before bed. That is definitely a huge time saver, huge money saver.

Find What’s Cheap Per Pound Near YOU

39:55 Emily: Do you have any other tips around budget, budget, cooking, shopping, eating?

40:00 Jen: I would say just look, I mean, there are so many resources on things that are generally cheap per pound. Take those lists, but compare them to what’s near you. Just because the internet says eggs are cheap, that might not be the case where you live. Just because, you know, carrots are supposed to be cheap, maybe they’re not in Canada, I don’t know. But find the things near you that actually are cheap per pound and just keep trying different ways to make them until you find one you like. Because if you can make your average cost per pound lower, that’s going to make your cost per meal lower. And that’s going to be much friendlier to your budget.

40:38 Emily: I have to say, I’ve been doing this recently with cabbage. I’ve been on the website, like Budget Bytes, a lot recently and noticing a lot of cabbage recipes coming up on there. So I was like, okay, I need to find a way, because I never ate cabbage earlier in my life, but yeah, that’s the one I’ve been experimenting with recently. Haven’t quite found the thing that we love yet that’s made of cabbage, but maybe I’ll try one or two more before I give up.

Best Financial Advice for Another Early-Career PhD

41:01 Emily: Okay. Well Jen, thank you so much for giving this wonderful interview. As I ask all my guests at the close of our interviews, what is your best financial advice for another early-career PhD?

41:13 Jen: I would say, learn all you can about investing, but then do it. I spent far too many years just reading, reading, reading, but never actually opened an IRA or a Roth. I had a savings account, you know, but it wasn’t much. And even if all you can do is $10 a month, you know, at least I would have had something building, because time is your biggest ally and don’t let it slip away. Just do it. Open it. That’s what I told my sister. She’s six years younger than me, and she probably already has more than me in her retirement account. So just do it.

41:51 Emily: Yeah, that is perfect advice. I see the same thing with many, many people who come to me, come to my material that they know kind of what they’re supposed to do. They’ve been reading about it, but that step of getting off the sidelines and doing it is really where they get kind of held up and tripped up. And I guess my message to like that same audience is like, you don’t have to be perfect from the start. You don’t have to have the perfect investing strategy figured out. It’s much better to get started imperfectly and figure it out as you go along than do everything perfect right from the start. However, the start is two, three years later than it could have been if you had just been willing to, you know, take the leap. So I’m really glad you mentioned that, it’s yeah, a very, very common problem.

42:35 Emily: I don’t know. Maybe it’s a PhD thing, like a grad student thing, like wanting to do the research and wanting to be right and wanting to not mess up. And I certainly understand that. I actually did mess up when I first opened my IRA and didn’t catch my mistake for like a year, but you know what, I’m glad I started when I did, even though I didn’t do it right at the start. And I’ll mention actually for anyone who’s, you know, hearing themselves in that situation. I have a challenge inside the Personal Finance for PhDs community that is specifically about opening an IRA. So if you join the Community, PFforPhDs.Community, you can go to that challenge and find a six, I think it might be seven, actually, seven-step process. This is exactly how you open an IRA. This is what you need to do, the decisions you need to make at these different points.

43:17 Emily: This is how you research it. It points to resources I’ve created that are inside the Community. So it just, for exactly that problem, people getting off the sidelines. And so it just provides a little bit of accountability, too. Like you kind of go in there and you call me and say, okay, I’m taking the challenge. I’m going to do it. And then by the end of the month, I’m going to be asking you, did you finish? Did you go through all the steps? So thank you so much. Thank you so much, Jen, for this interview. And it’s been great talking with you and hearing about your journey and hearing these great grocery budgeting tips. Thanks.

43:46 Jen: Yeah. Thanks so much, Emily!

Outro

43:48 Emily: Listeners, thank you for joining me for this episode! pfforphds.com/podcast/ is the hub for the Personal Finance for PhDs podcast. On that page are links to all the episodes’ show notes, which include full transcripts and videos of the interviews. There is also a form to volunteer to be interviewed on the podcast and instructions for entering the book giveaway contest. I’d love for you to check it out and get more involved! If you’ve been enjoying the podcast, here are 4 ways you can help it grow: 1. Subscribe to the podcast and rate and review it on Apple Podcasts, Stitcher, or whatever platform you use. If you leave a review, be sure to send it to me! 2. Share an episode you found particularly valuable on social media, with an email list-serv, or as a link from your website. 3. Recommend me as a speaker to your university or association. My seminars cover the personal finance topics PhDs are most interested in, like investing, debt repayment, and effective budgeting. I also license pre-recorded workshops on taxes. 4. Subscribe to my mailing list at PFforPhDs.com/subscribe/. Through that list, you’ll keep up with all the new content and special opportunities for Personal Finance for PhDs. See you in the next episode, and remember: You don’t have to have a PhD to succeed with personal finance… but it helps! The music is “Stages of Awakening” by Podington Bear from the Free Music Archive and is shared under CC by NC. Podcast editing and show notes creation by Meryem Ok.