Everyone knows that they are supposed to save money, but not necessarily why. If you are accustomed to living paycheck-to-paycheck, you may not even realize how much peace of mind having savings can give you. In addition, investing your money properly for the long term is one of the best ways to build wealth.

The utility of accessible funds.

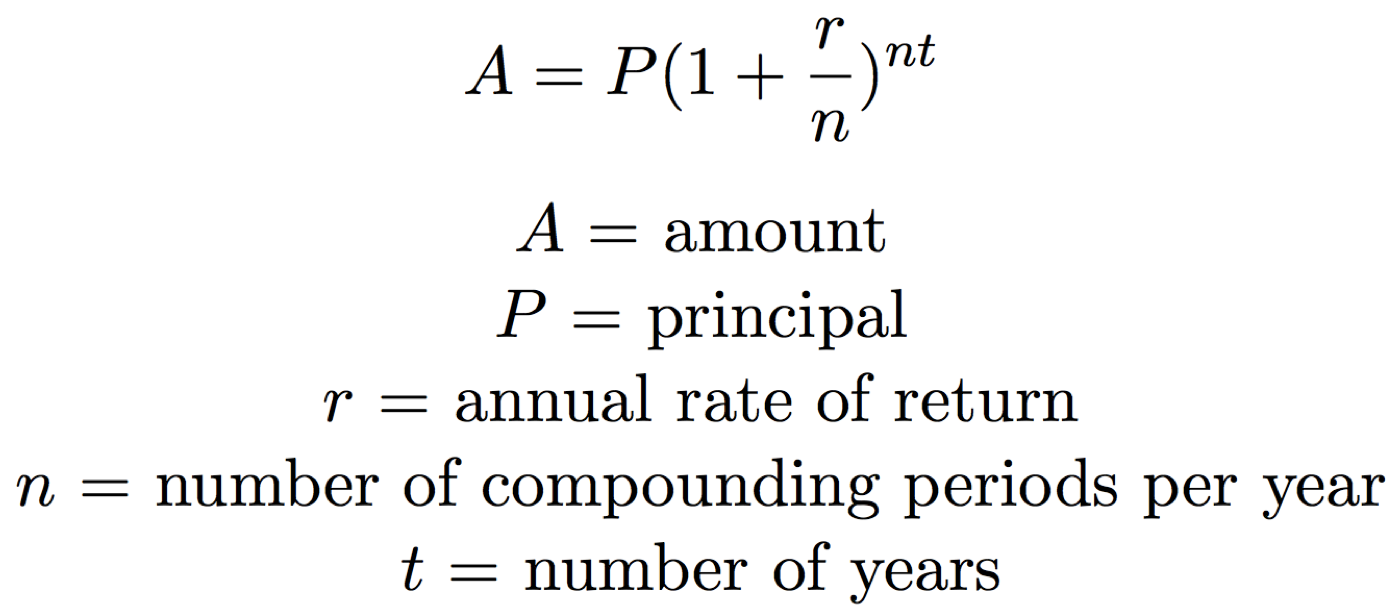

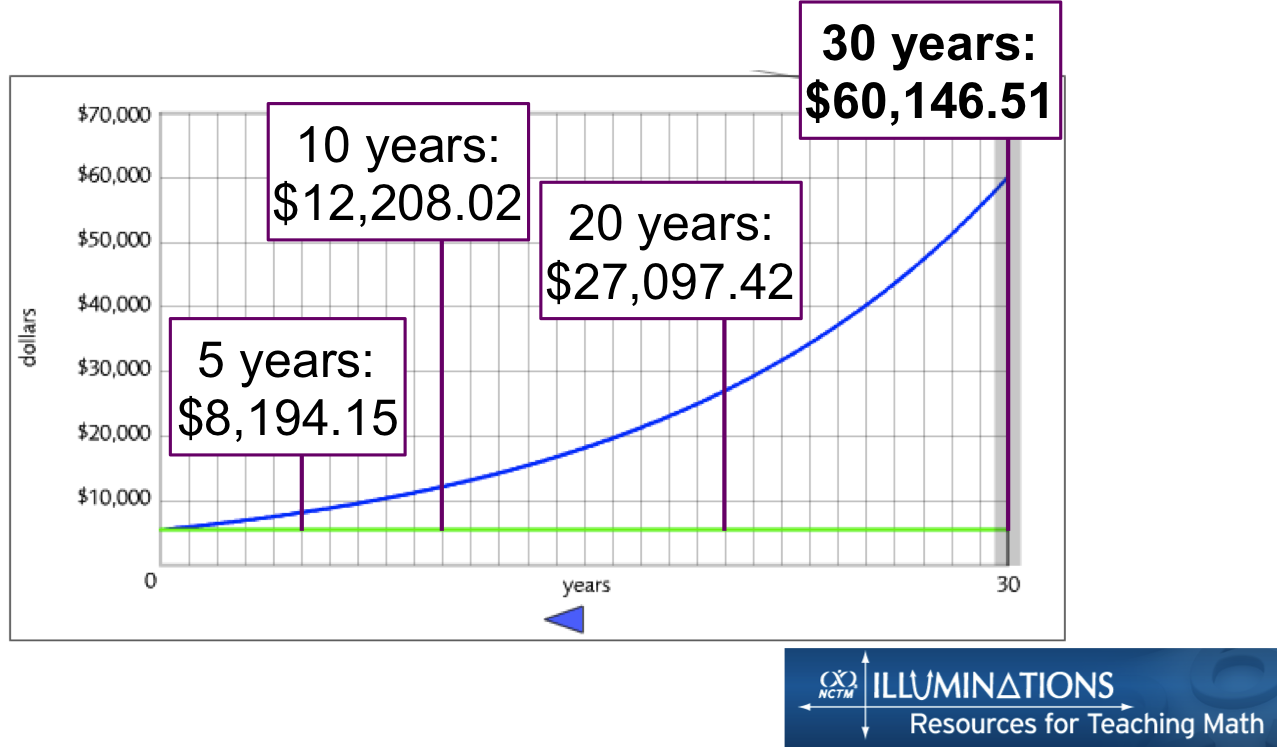

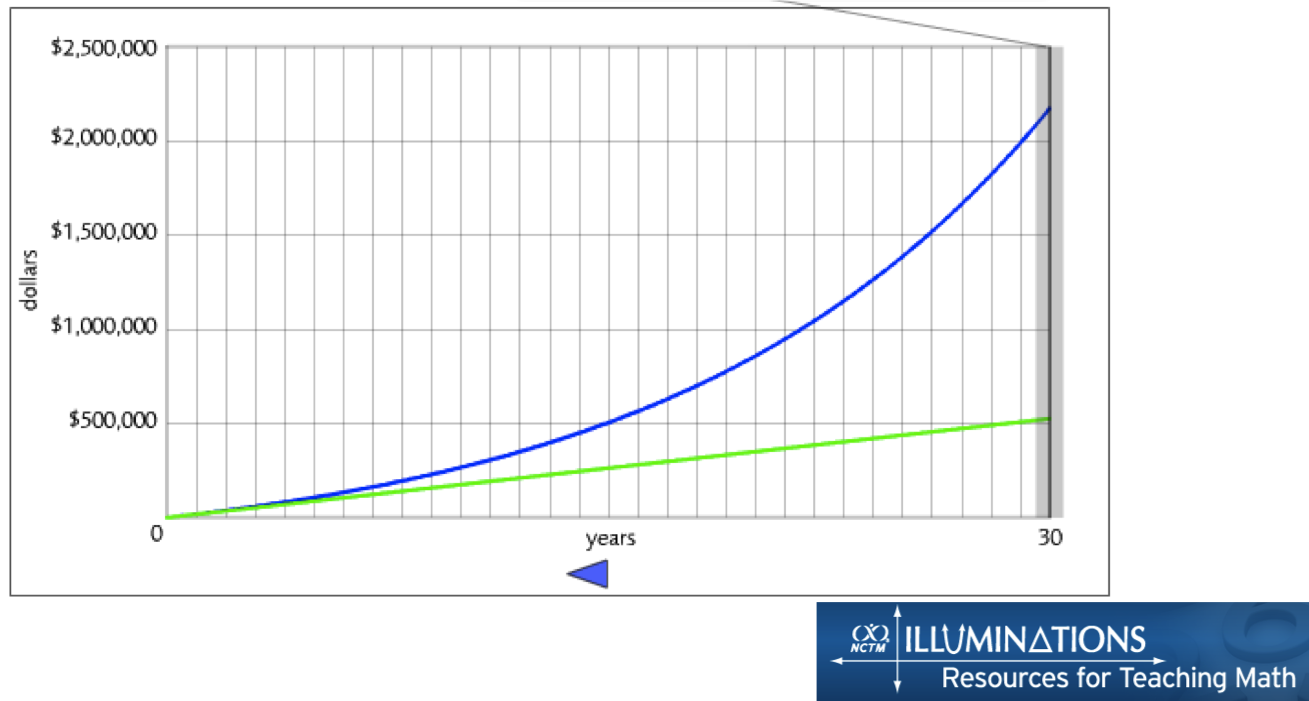

The power of compound interest.

Further reading: 2 Good Reasons to Start Investing Now, No Matter How Much Money You Have