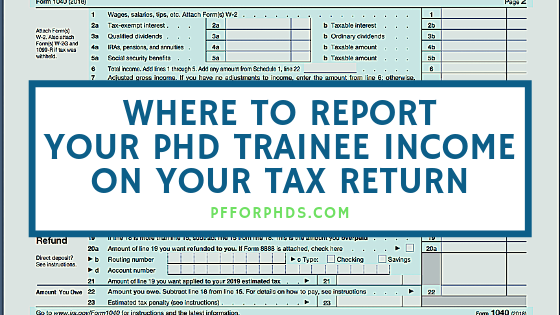

There are two broad categories of PhD trainee income: employee income and awarded income. Employee income is W-2 pay, whereas awarded income is any other regular type of income for a graduate student or postdoc, which might be reported on a Form 1098-T in Box 5, a Form 1099-MISC in Box 3, a Form 1099-NEC in Box 1, a Form 1099-G in Box 6, or a courtesy letter—or not reported at all. For US citizens, permanent residents, and residents for tax purposes (the intended audience for this article), employee and awarded income are reported in different lines of Form 1040.

This article was most recently updated on 12/18/2025. It is not tax, legal, or financial advice.

Where to Report Employee (i.e., W-2) Income

Employee income comes will be reported on a Form W-2. The terms used for employees at the postdoc level vary quite a lot, but at the graduate student level the positions are usually called assistantships (research, teaching, graduate, etc.).

Your gross yearly employee income will appear in Form W-2 Box 1, and the income tax that has been withheld from you pay will appear in Boxes 2 (federal), 17 (state), and 19 (local).

Form W-2 contains instructions for the employee (p. 7), which state: “Box 1. Enter this amount on the wages line of your tax return.”

The wages line of your tax return is Form 1040 Line 1a, which is labeled: “Total amount from Form(s) W-2, box 1.”

The Form 1040 instructions for Line 1a (p. 23) state: “Enter the total amount from Form(s) W-2, box 1. If a joint return, also include your spouse’s income from Form(s) W-2, box 1.”

Where to Report Awarded Income

Awarded income is not given in exchange for work as an employee, and therefore no W-2 is issued. At the graduate student level, awarded income is usually called scholarships, fellowships, and grants. The titles used for postdocs receiving awarded income vary, but they are not considered employees.

Awarded income will be officially reported to the student on a Form 1098-T in Box 5, on a Form 1099-MISC in Box 3, on a Form 1099-NEC in Box 1, or on a Form 1099-G in Box 6. It also might be unofficially reported on a courtesy letter or not appear on any documentation at all.

Further reading:

- Fellowship and Training Grant Tax Forms

- The Complete Guide to Quarterly Estimated Tax for Fellowship Recipients

Please note that you must calculate the taxable portion of your awarded income for the year; it is not necessarily the same as your stipend/salary. Unlike with a Form W-2, you do not necessarily report exactly the amount that appears on your tax form or courtesy letter. See How to Prepare Your Grad Student Tax Return for more details.

Publication 970 Chapter 1 discusses where to report the taxable portion of scholarships, fellowships, and grants:

Form 1040 or 1040-SR. If you file Form 1040 or 1040-SR, include any taxable amount reported to you in box 1 of Form W-2 in the total on line 1a. Include any taxable amount not reported to you in box 1 of Form W-2 on Schedule 1 (Form 1040), line 8r.

The Form 1040 Instructions for Schedule 1 Line 8r state:

Line 8r Scholarship and fellowship grants not reported on Form W-2. Enter the amount of scholarship and fellowship grants not reported on Form W-2. However, if you were a degree candidate, include on line 8r only the amounts you used for expenses other than tuition and course-related expenses. For example, amounts used for room, board, and travel must be reported on line 8r.