savings

Accessible Funds

Living paycheck to paycheck is truly unsustainable. If you spend all the money that comes in and never build up any savings, you are unable to adapt when life throws you a curveball and it is almost impossible to plan for the future. Eventually, you will want or need to make a purchase that you did not anticipate. The expenditure could be for a true emergency, such as a health crisis, or simply a high-value purchase than you are able to cash flow, such as a laptop.

Building up accessible funds will likely reduce the anxiety you may feel about money. You can use the savings in the case of an emergency, for planned or anticipated purchases, to achieve goals, and to build wealth over time.

Further reading: In Defense of Savings Accounts

Compound Interest

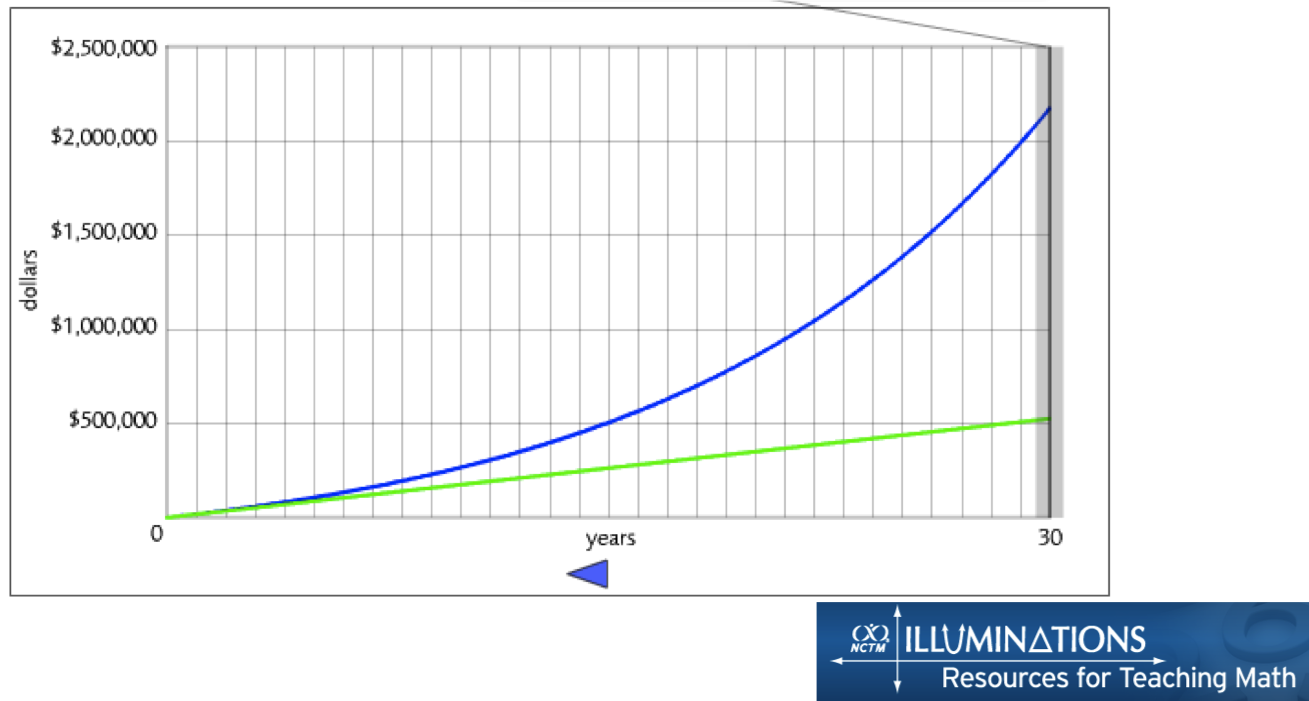

Even though it’s doubtful that Einstein ever said that compound interest is the most powerful force in the universe, it’s indisputable that it is an incredible tool that can work for or against you.

Compound Interest for Investing

When compound interest works in your favor, an asset that you own earns a return and increases in value. Then that increased asset earns a return and increases by even more. The growth is exponential.

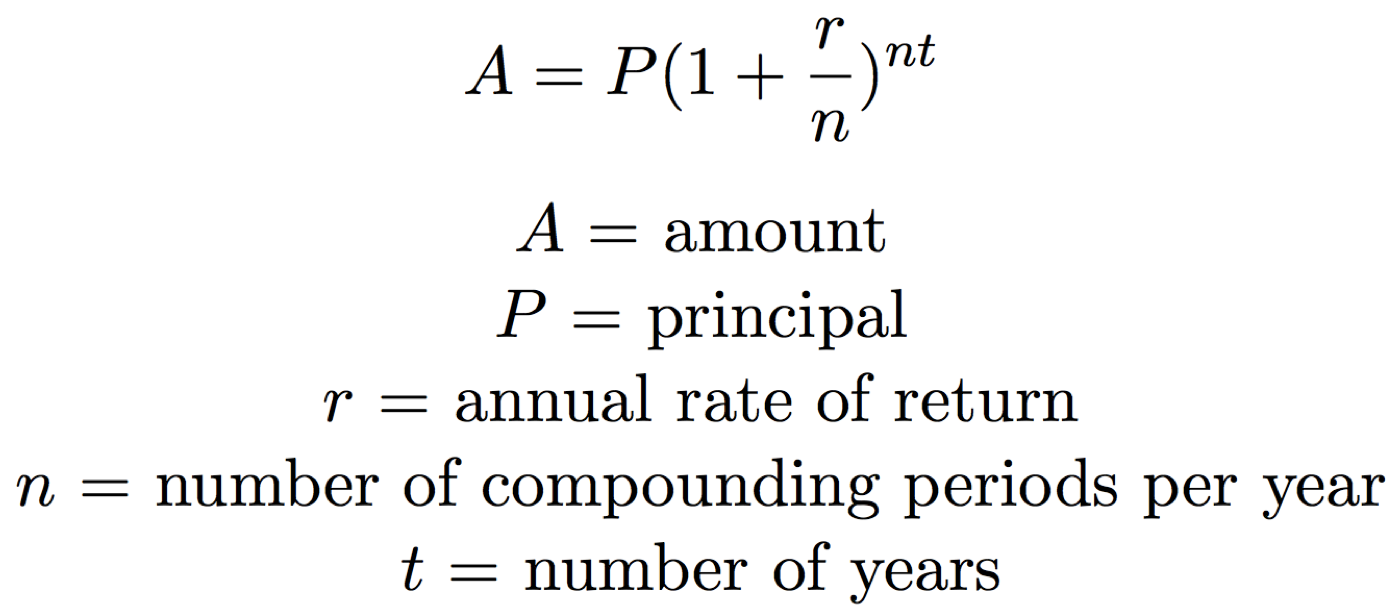

As an example, see how a one-time investment of $5,500 will grow over time if invested with an average rate of return of 8%. After 30 years, the investment balance has grown to over $60,000, with over half of that growth occurring in the last 10 years.

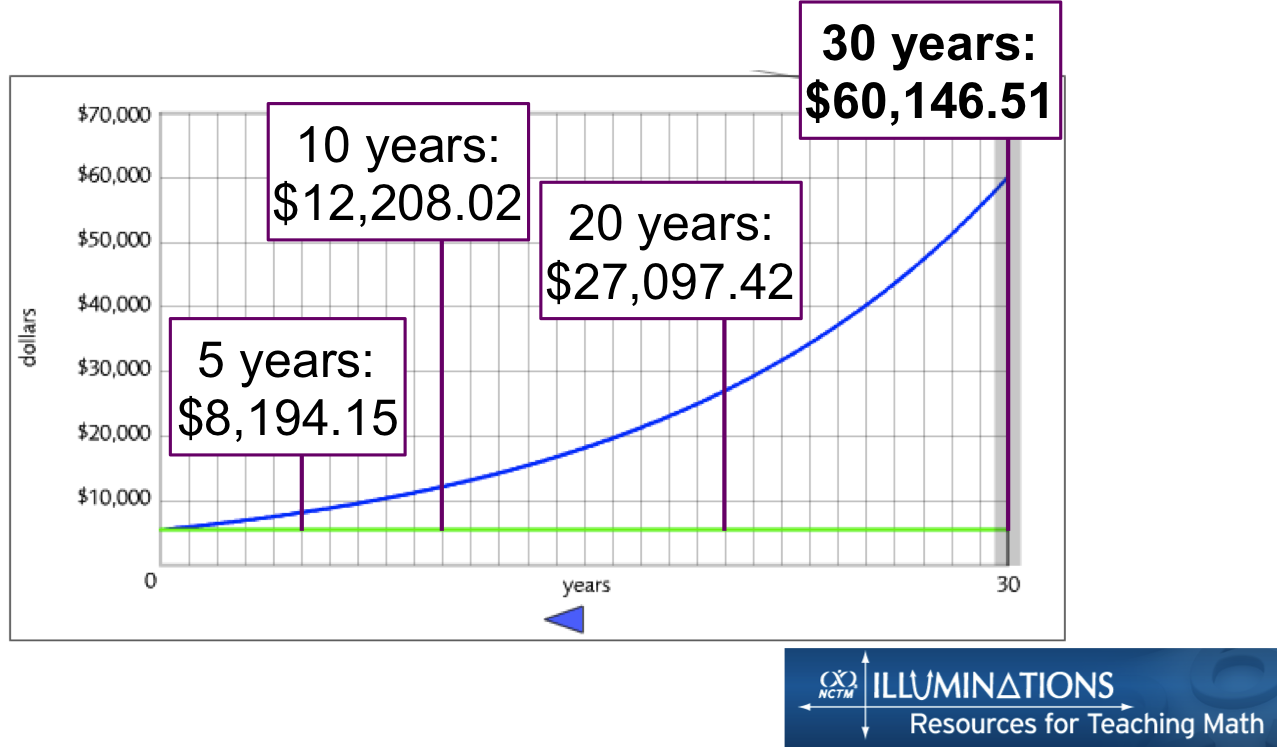

Investing on a regular basis is how Millennials are likely to provide for their own retirements now that pensions have all but disappeared and Social Security is uncertain. If you max out a 401(k) every year for 30 years with an 8% average rate of return, over 30 years you will have contributed $524,880 but your investment balance at the end will be $2,172,944.

You can create your own projects of the effect of compound interest using Illuminations.

GSF Reader Post: My Realistic Career Earnings Expectations Push Me to Save Aggressively

Compound Interest in Debt

Compound interest can work against you in the case of debt. When you owe a given amount at a certain interest rate, the amount you owe will also increase exponentially unless you make payments that more than keep up with the growth.

Compound Interest in Inflation Risk

One great reason to invest that most people don’t consider is inflation risk. The average historical inflation rate is around 3-4% per year. That means that every year your money goes 3-4% less far in terms of real purchasing power and the prices will double approximately every 20 years. If you don’t invest at a rate that at least keeps pace with inflation, the value of your money decreases with time. To build wealth through investing, you must earn a return that exceeds the average rate of inflation.

Emergency Funds

An emergency fund is an easily accessible amount of money that should be tapped for emergencies only. It is up to the individual to determine what kinds of expenses qualify as emergencies. Most people calculate an appropriate emergency fund size based on a certain number of months of expenses (generally three to twelve), which implies that it is for use in the case of unexpected income loss. Other people may use their emergency funds to pay deductibles on their auto, homeowner/renter’s, or health insurance or to make car or home repairs. Whatever the need ends up being, emergency funds are there to keep you from going into debt when something unexpected occurs.

The most widely agreed-upon place to stash an emergency fund is in a savings account. The argument against investing the money in a more volatile asset is that you don’t want to get hit when you’re down by having an emergency occur just when the market has taken a downturn. You would have to realize your losses and at the same time have less money available for your emergency. Some people keep their emergency funds at the same bank as their check or even as a large buffer in their checking accounts, but if you have any issues with dipping into the emergency fund inappropriately you should keep it at another institution so the money feels less accessible.

Further reading: Why You Need an Emergency Fund First

Long-Term Savings

Long-term savings are on a time horizon of at least five to ten years and should be invested to avoid interest rate risk in taxable investment accounts. An example of a long-term savings goal is children’s education funds, which can be invested in tax-advantaged vehicles.

Mid-Term Savings

Mid-term savings have a time horizon of a few years and are larger in scope than short-term savings. Examples of mid-term savings might be a car replacement fund or a down payment on a house. This money may be conservatively invested or kept in cash-equivalents depending on the timeline and the risk tolerance of the investor.