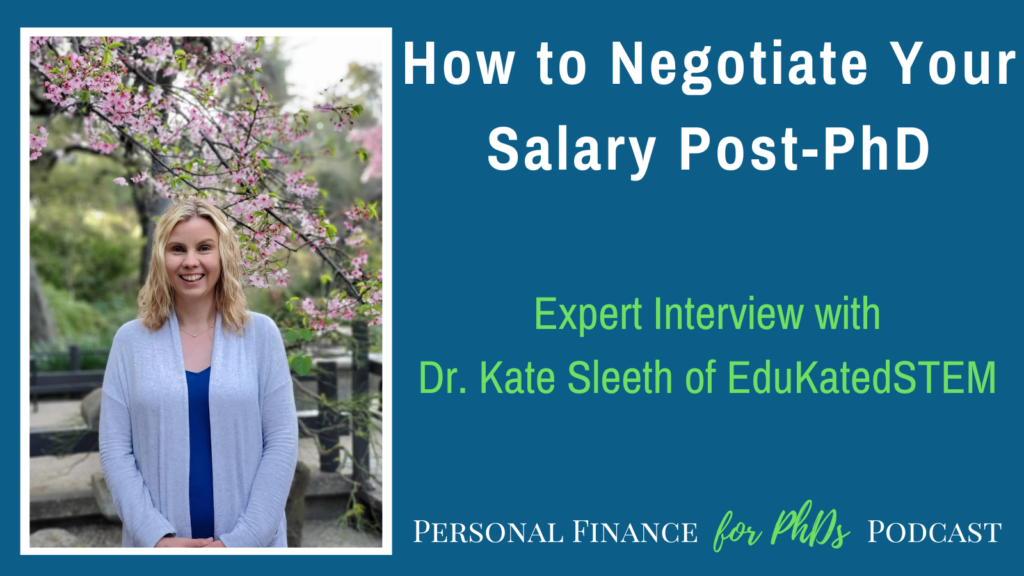

In this episode, Emily interviews Dr. Kate Sleeth, the founder of EduKatedSTEM, on salary negotiation for PhDs. They discuss why everyone should negotiate salary and why Kate regrets not negotiating in her first position in academia. Kate teaches how someone should calculate their minimum salary number before going into a negotiation, including the free tools to use. They wrap up with Kate’s best single tip regarding the negotiation process and her best financial advice, both of which are straightforward to implement.

Links mentioned in the Episode

- Dr. Kate Sleeth’s Website

- Dr. Kate Sleeth’s LinkedIn

- Dr. Kate Sleeth’s Bluesky

- Dr. Kate Sleeth’s Instagram

- Dr. Kate Sleeth’s YouTube Channel

- Dr. Kate Sleeth’s Twitter

- PF for PhDs Quarterly Estimated Tax Workshop

- Host a PF for PhDs Seminar at Your Institution

- Emily’s E-mail Address

- Free Salary Research Tools: Salary.com, Salary Expert, Payscale, MyPlan.com, PaycheckCity

- PF for PhDs Subscribe to Mailing List

- PF for PhDs Podcast Hub

Teaser

Kate (00:00): The negotiation begins when you apply. I don’t think a lot of people realize that, but there is always going to be a question, how much are you currently making? And how much do you hope to receive should you receive, you know, get this job. And so you need to know a number or something to put in that as you apply for the role. So you actually need to do your homework before you hit submit on the application.

Introduction

Emily (00:33): Welcome to the Personal Finance for PhDs Podcast: A Higher Education in Personal Finance. This podcast is for PhDs and PhDs-to-be who want to explore the hidden curriculum of finances to learn the best practices for money management, career advancement, and advocacy for yourself and others. I’m your host, Dr. Emily Roberts, a financial educator specializing in early-career PhDs and founder of Personal Finance for PhDs.

Emily (01:03): This is Season 22, Episode 2, and today my guest is Dr. Kate Sleeth, the founder of EduKatedSTEM. Our conversation revolves around salary negotiation for PhDs. We discuss why everyone should negotiate salary and why Kate regrets not negotiating in her first position in academia. Kate teaches how someone should calculate their minimum salary number before going into a negotiation, including the free tools to use. We wrap up with Kate’s best single tip regarding the negotiation process and her best financial advice, both of which are straightforward to implement.

Emily (01:42): Let’s talk fellowship taxes for a minute here. These action items are for you if you recently switched or will soon switch onto non-W-2 fellowship income as a grad student, postdoc, or postbac; you are a US citizen, resident, or resident for tax purposes; and you are not having income tax withheld from your stipend or salary. Action item #1: Fill out the Estimated Tax Worksheet on page 8 of IRS Form 1040-ES. This worksheet will estimate how much income tax you will owe in 2025 and tell you whether you are required to make manual tax payments on a quarterly basis. The next quarterly estimated tax due date is September 15, 2025. Action item #2: Whether you are required to make estimated tax payments or pay a lump sum at time tax, open a separate, named savings account for your future tax payments. Calculate the fraction of each paycheck that will ultimately go toward tax and set up an automated recurring transfer from your checking account to your tax savings account to prepare for that bill. This is what I call a system of self-withholding, and I suggest putting it in place starting with your very first fellowship paycheck so that you don’t get into a financial bind when the payment deadline arrives.

Emily (03:07): If you need some help with the Estimated Tax Worksheet or want to ask me a question, please consider joining my workshop, Quarterly Estimated Tax for Fellowship Recipients. It explains every line of the worksheet and answers the common questions that PhD trainees have about estimated tax. The workshop includes 1.75 hours of video content, a spreadsheet, and invitations to at least one live Q&A call each quarter this tax year. The next Q&A call is on Friday, September 12, 2025. If you want to purchase this workshop as an individual, go to PF for PhDs dot com slash Q E tax. You can find the show notes for this episode at PFforPhDs.com/s22e2/. Without further ado, here’s my interview with Dr. Kate Sleeth of EduKatedSTEM.

Will You Please Introduce Yourself Further?

Emily (04:12): I am delighted to have on the podcast today Dr. Kate Sleeth, the founder of EduKatedSTEM. And Kate and I actually met last spring, we’re recording this interview in August, 2025, but we met at the National Postdoctoral Association annual meeting in March, 2025. And I went to Kate’s talk on negotiation, and I knew immediately that she had to come on the podcast and share a number of her insights with you. Now, I wanna give you a warning that Kate and I could talk for hours about our subject today, which is negotiation of salaries. Um, but we’re not going to, because this is a brief podcast episode. So if you want more from Kate, she gives workshops. She can work with you as an individual. She has follow-up resources, so I’m gonna have her point to all that stuff later. So we’re just giving you a teaser into this topic today. So Kate, again, welcome to the podcast. Would you please give us some more background about your career and what EduKatedSTEM is?

Kate (05:07): Thanks, Emily. Thank you for having me. Uh, so I, uh, was a scientist. I was a biochemist. I have a PhD. Uh, my thesis was on, uh, DNA repair mechanisms, and I did three postdocs. So I’m a very experienced postdoc person, and, um, I have experience in both the UK and America. I moved to LA to do my third and final postdoc, and then I moved into a graduate school administration. So I went from a lower administrator all the way through to being the Associate Dean of Administration and student Development. And it was over that time that I got interested in giving, um, webinars, seminars, things like that on a variety of topics. Negotiation being the one that everybody is always excited about. Um, and EduKatedSTEM is an offshoot of that, that I thought I could help more people. So I have a YouTube channel where I put up advice on various things. Again, I have a series on negotiation up there, um, and I go in, as you said, I give, I give, um, talks at conferences and, uh, also, uh, universities, things like that. So I will be, uh, talking at SACNAS if everyone’s coming to SACNAS later in the year. Oddly enough, I’m not talking about negotiation at that one. Um, but I, uh, will be talking if people are at that meeting.

How Negotiation Became a Passion for Dr. Kate Sleeth

Emily (06:27): Beautiful. Thank you so much. And, um, let’s get more of like your sort of personal story into how this became a passion point for you when you first started teaching more and more about negotiation.

Kate (06:40): So negotiation is something that everybody needs to learn how to do, right? We all wanna make more money or have, um, better things to do with our job, whether that’s more days off or, um, the ability to work remotely at times, uh, and other things, you have to ask that during the negotiation if you hope to receive them. And so, whilst I was a postdoc and whilst I was a lower administrator, I saw a lot of people talk about negotiation. And it was always lots of acronyms and it was very theory based and they didn’t really tell you, this is how you do it. These are the tools that you use and this is how you structure it. And I thought, well, there has to be an easier way, a more straightforward way of explaining how to do the negotiation. So I read a few books around the topic.

Kate (07:30): I saw some, um, presentations that I thought did a little bit more than the average. You know, this is the BATNA, these are the acronyms. And I was like, no, I’m gonna make my own. And it’s completely tailored. What you saw, um, in the spring at the NPA was tailored to a postdoc audience, um, in the city that we were in. And so whenever I come to an institution, whether that’s over a webinar or in person, I talk about that location. So all of the examples I use are for either, depending on the audience, a postdoc, graduate student, whatever, at that location. And then I talk about jobs that they might want to go to, cities that they might want to move to. And it’s all relevant, all of the searches that I’ve done within the past week. So the information I’m showing is absolutely relevant at the time that I’m showing it.

Kate (08:23): Um, and realistically, I did not do well at my first negotiation. Obviously as a postdoc, you don’t negotiate, really, there isn’t a lot you can do. When I moved into the role as an administrator, I was on a visa and they said that they were going to support my green card application and ’cause of the expense of that they were gonna to reduce my salary because they would be paying for my green card. And that affected every single salary negotiation after that because obviously the lower you come in, um, the, the higher the increases you need to be to kind of bring you back to where you should be. Um, and in the end, they didn’t pay for my green card <laugh>. So learn from that, um, and negotiate appropriately because I could have said, no, I, I understand you’re gonna be paying for my green card, but I ought to be being paid a higher amount even with that because that definitely impacted every single salary negotiation and, um, promotion that I ever received.

Why Is Negotiation Important?

Emily (09:28): And your leading directly into where I wanted to go with this next part of the conversation, which is why should people negotiate? You’ve just given us one reason is that, that at least as long as you stay with the same organization, that level that you come in, go in on, is going to inform every single salary you receive at that organization for the rest of your time there. So that’s one reason. Let’s start off as high as <laugh> we reasonably can here, but what are some other reasons or motivations for negotiation?

Kate (09:57): Um, so obviously, yes, you obviously want more money. More money is always lovely, um, but it’s going to help people who come into your role after you leave because they always look at the previous person’s history. And if you negotiate a higher salary, the person after you will hopefully also get the highest salary. So if it’s hard for you to think, I need to negotiate from me personally, be altruistic and think about the people who are following you afterwards, you’re gonna have help them kind of give them a leg up.

Emily (10:30): I really loved when I heard you point that out. It wasn’t a a, a phrasing or an angle on that that I had quite heard of or thought about before. But I realized that, so I, when I speak about negotiation, which is not that often ’cause it’s not really my area of expertise, I do it more in the grad student realm because as you said, postdocs, it’s not that usual to negotiate graduate students. It’s even more unusual, yet some people do it. And this is one of the reasons why I think that people should at least try is because you’re communicating, you’re signaling to that person on the other side of the table from you. It is important that I, and people in my position are compensated appropriately. So please consider increasing my stipend. But really that bleeds over into your peers and the people who follow you. It just, you signaling that this is an important area that you value, that you, you know, you wanna be paid reasonably well. So I really love that point. Think about the person following you in the position after you, yeah, the budget for that position is gonna be expanded if you’re successful in your negotiation.

Kate (11:25): Mm-hmm <affirmative>. Yeah, it’s a key thing. And also it makes you feel more appreciated because if you don’t negotiate and you come in thinking that you’ve got a great salary and there’s other people who have maybe even the same title and role and position as you, and you find out they’re, I dunno, anywhere between five and 20,000 more than you, you’re not going to feel appreciated. And you know, the company didn’t do anything wrong. They obviously want to bring you in as cheaply as possible because they want to save money. It’s not necessarily a good thing, but it’s, it’s the reality of the situation. And so they are trying to negotiate you down. You want to try and negotiate your worth and show them the skills that you, you’re bringing to the table and therefore you earn hopefully more money. Um, but if you don’t do that at the beginning and you find out that other people are earning potentially significantly more than you, you’re not gonna feel appreciated. You may start looking for a different role somewhere else.

Emily (12:28): And that’s one of the reasons why actually like you, the job candidate, um, and also the employer, that’s actually an area where you two are aligned. You both want you to be happy in that role. And compensation is part of that because turnover is so expensive for companies. And so it’s really in their best interest to keep you happy with your compensation so that you have longevity there. Are there any other, uh, reasons for negotiation that you’d like to add?

Kate (12:54): So the other reason to negotiate is it’s just good practice. And it’s something that I talk about in my presentation. You negotiate all the time. It’s just not necessarily for a salary or for benefits. So even if you’re talking with someone about your plans for this evening, what restaurant you want to go to, what movie you want to see, you are negotiating hopefully to get what you want. And so it will definitely help. And you need to practice before you go in to get comfortable with the idea of asking for more money. And you’re not going to say that you are entitled to to more money or you deserve more money. You’re gonna be very polite about it and deferential, but you will make sure that the person that you’re talking to understands that you would appreciate to receive more money or benefits or whatever.

Kate (13:44): It’s, and you have to remember a lot of the time, the person that you’re negotiating with doesn’t necessarily have the power to make those decisions. So if you upset them, they are not going to go back to the person who does have the power and advocate on your behalf to get you more of whatever it is that you want. So it’s good practice, it will help you in everyday life if you can kind of keep cool and measured and just ask for what you want. Um, and I, I think even if you are talking about a part-time job, you know, you can always say, I was hoping for a little bit more money or however you want to phrase it, and you may, you may get it, you never know.

Emily (14:24): I think this is such an important point about you want, probably the person that needs to say that you’re negotiating with still has a chain of command. They have to run this up. And so you want them on your side, you wanna understand what their motivations are and you know, realize what you have in common and how it’s important that you can work together to get what you want, a higher salary or their benefits or whatever it’s going to be. But yeah, you want them to be your champion. So of course you have to do this in a very, um, socially aware kind of way. Um, so wonderful tip.

Emily (14:56): Um, the next thing that I wanna talk about, I, I’m skipping over something. Okay, so what was great about the talk of yours that I saw at NPA is that you were discussing how to understand, um, you know, typical compensation for various different types of jobs in different areas of the country. So like the salary research aspect of this. And this is a very important component of the negotiation process because um, you have to know what the positions typically pay, why you might be making more or less than what is average and and so forth. So it’s very important to understand the market and when you go into a negotiation, your basis for negotiation is what you’re bringing to the role.

Commercial

Emily (15:38): Emily here for a brief interlude. Would you like to learn directly from me on a personal finance topic, such as taxes, budgeting, investing, and goal-setting, each tailored specifically for graduate students and postdocs? I offer workshops on these topics and more in a variety of formats, and I’m now booking for the 2025-2026 academic year. If you would like to bring my content to your institution, would you please recommend me as a speaker or facilitator to your university, graduate school, graduate student association, or postdoc office? My seminars are usually slated as professional development or personal wellness. Ask the potential host to go to PFforPhDs.com/financial-education/ or simply email me at [email protected] to start the process. I really appreciate these recommendations, which are the best way for me to start a conversation with a potential host. The paid work I do with universities and institutes enables me to keep producing this podcast and all my other free resources. Thank you in advance if you decide to issue a recommendation! Now back to our interview.

Identifying Your Personal Minimum Salary Number

Emily (16:57): However, there is a back part of this calculation. That’s what we’re going to talk about in the interview next, which is how much do I as a job candidate actually want and need to make irrespective of what the job type pays you as a person have a number that you would like to make and you know, hopefully that job will typically pay you more than that personal number that you need, but you at least need to know the number because when you go into that negotiation process, you need to know what number we are not gonna go below. For sure. So in your talk you discuss the salary research that is so important. We’re skipping over it right now. We’re not doing it in this interview. Where we’re gonna focus on instead is that personal part of it, understanding what your number is. So can you tell us more about how you teach people that part of the process? How do they come up with their own personal minimum salary number?

Kate (17:48): So a lot of the time it’s on your budget. So I always encourage the first thing you do before you apply for a job, before you have a major life change. So a marriage, a divorce, getting a pet, getting um, uh, you know, having children. Make sure you know how much money you need to survive. So I have a budget, you can go in and download it and um, I want you to be brutal, brutally honest about what you spend, because I’ve done this with undergrads and they are potentially spending their parents’ cash. So they are less realistic about how much money they would like to earn. Like I’ve done this and they’ve come out and said I need to make a starting salary of at least $150,000 because I can’t give up <laugh> um, you know, my food delivery costs, I go out multiple times a week and all of these other things. And I’m just looking at them thinking, wow, as an, as a recent undergraduate with your, with your degree, you are hoping to make 150,000. Like you need a decent reality check. So go through, you know, your rent and all of those things know exactly how much you need to survive and that is the number that you cannot possibly go beneath because if you don’t make that, you can’t pay all of your bills, you can’t pay back any debt that you might have, that is absolutely the lowest that you can go. But you might not decide that that is the lowest that you are willing to take. So during your, um, your research and whenever you apply for a job, you are gonna do some research. There are many different websites that you can use. My personal favorite, um, tends to be salary.com, but there are others out there.

Kate (19:41): I’ll just mention some. Um, you have Indeed, obviously you have salary.com, which is what I use all the time. Salary Expert, Payscale, MyPlan.com. And then if you are thinking about moving location, you then need to do a cost of living comparison. And again, lots of those websites also have it. Salary.com has it. That’s what I use. And what you do is you put in where you are currently living, the salary that the job might have where you’re currently living and then you know, I’m thinking about moving to insert city and it will literally come back and, and it will tell you, you know, the city that you’re considering moving to is either more or less expensive than where you’re, so if it’s more expensive, it will tell you you need to make this much money in order to maintain the standard of life that you’ve currently got.

Kate (20:35): And obviously if you’re going to somewhere that is cheaper, then you’ll have a better standard of living. But that is definitely something to consider because I live in Los Angeles and if you, you move to LA you can definitely get sticker shock because everything here is so much more expensive. I think there’s only San Francisco and New York that are definitely more expensive to live in. Uh, but there’s some cities that are also somewhat close. But I always use moving to LA as my example because everyone is always like, Ooh, yes, you know, you can have the job, but usually the the increase in salary may or may not be equivalent to what you need to maintain your standard of living if you move here. And that’s just something that you need to consider because if you are taking a promotion, if you’re moving somewhere you hope you have more money, you have a better quality of life, that you can have more savings.

Emily (21:34): Absolutely. You always have to put those numbers in the context of the local cost of living. I totally agree. Um, and I actually wanted to expand a little bit more on what you just said about well maybe you actually want to increase your lifestyle <laugh> as you move along in your career. And I especially think about this in the transitions from, you know, graduate student to postdoc, from postdoc to having a proper permanent post PhD job maybe as you receive promotions later on. Um, because I think where you started was absolutely correct. Let’s take what we’re currently spending, you know, multiply that by that by some factor, you know, depending on where you’re moving, that’s a minimum. Well, okay, but who wants to live that grad student lifestyle forever and ever? Probably no one. And I do think it’s appropriate as you make more money to increase your lifestyle, not mindlessly inflate your lifestyle, but add in some specific things that are really important to you. Like you mentioned, you know, family formation, maybe you wanna buy a home. These things are expensive and you may want them later in your life. So I would say when you’re building that budget, you know, start where you are, but then also add in those line items or those increases for what you want in your next stage of life. Um, and one other small point there is your tax burden will change as you move along in your career. Specifically as a graduate student, you’re not paying social security and medicare tax. You will be paying those later on if you have a proper W2 job. Um, your student loans may go from being in deferment to being in repayment and you have to factor that into, so there are some expenses that just naturally come in when you change stages. So I just wanted to point that out too, like take that minimum number, but why don’t we add on to that minimum number too <laugh>.

Kate (23:11): So there’s another free tool that you can use, which is called PaycheckCity.com. And I would encourage you to go and look at it and you can put in how much the salary that you are going to hopefully be making is. And it will tell you these are the taxes that will be coming out. You can literally change the state that you are in and you can say whether you’ve got family or not. And it will tell you what your final take home pay is going to be, which is something that I don’t think a lot of people realize. I know that the first time I got taxed I was like, ooh, ooh, I don’t like that. I don’t like that at all. Um, but it’s something that, that has to be paid. So I always say go to salary.com and do your, um, the salary that you want, the cost of living comparison, and then head over to PaycheckCity and figure out exactly what your take home pay is gonna be.

Emily (24:06): Yes, <laugh>. Exactly. I moved, um, post-graduate school, moved to Washington State, which is a zero income tax state, and then to California, which I have not found to be overly burdensome, but is a higher income tax state. So very, very worth, you know, those considerations as you’re moving to different locales. Um, excellent, excellent. Thank you so much for pointing to those tools. I think those are gonna be super helpful for our audience who you know is in these various stages. Um, okay, we’re gonna get back to negotiation now. I want you to give us just one tip about the negotiation process. ’cause I know you could give a whole presentation on this, but let’s just leave our listeners with one concrete takeaway.

Negotiation Begins Before You Submit Your Application

Kate (24:46): So I think you need to realize that the negotiation begins when you apply. I don’t think a lot of people realize that, but there is always going to be a question, how much are you currently making and how much do you hope to receive should you receive, you know, get this job. And so you need to know a number or something to put in that as you apply for the role. So you actually need to do your homework before you hit submit on the application. And I don’t think a lot of people know that. I always advise that if you can write something in that, then you write something like salary commensurate to my skills. Uh, but most HR people don’t like that because you’re not giving them a number and some application systems actually force you to insert a number. And so I always say you could always insert a range if you can do that, but you need to know what that range is. So I can do these searches very, very quickly and I always think if it takes 10, 15 minutes of your time to then make a knowledgeable application at the beginning and it will then help you potentially earn, I don’t know, five, 10, $20,000 more, how much is that 10 minutes worth to you? Because it’s necessary if you’re going to be successful at the negotiation.

Emily (26:05): Very good point. And that research has to happen at some point in the process anyway. You’re just getting a jump on it when you do the application part. And I totally think for those different, um, suggestions, like if you can enter text <laugh>, enter text, if you can enter a range, enter a range, well if they force you into a number, you know, it has to be in the range that they’re thinking to, right? So it’s gotta be in there. So that’s an excellent tip. And I know from, I guess my study of negotiation overall is like, um, nobody wants to throw out their first number <laugh>, so they’re kind of forcing you to do it. So any way you can get out of it, get out of it, but if you have to do it, you need to know what’s reasonable. So thank you so much. Um, where can people follow up with you, learn more from you book you, where can they find you and follow up resources?

Connect with Dr. Kate Sleeth

Kate (26:48): So I have a website which is EduKatedSTEM.com, and it’s with a K EduKatedSTEM. Um, I’m on YouTube under the same handle. I’m on Instagram, um, blue sky, Twitter, all of those good things. If you want to specifically get the things that I do for negotiation, um, I’m happy to come in and obviously present at your location, but if you are kind of stuck and like, oh my gosh, I’m about to negotiate, I just need some help right now, obviously I will advise you in person, but you can go and download my budget template, my negotiation, um, little kind of worksheets, which I think is is very short. I’ve taken, you know, many books and I’ve smashed it down. And so I think it’s 15 pages of just the highlights that you absolutely need. And there’s also a video of me giving the presentation that I give, um, and that’s available for a whole $5 on Patreon. So pretty darn cheap. Um, if you, if you want that,

Best Financial Advice for Another Early-Career PhD

Emily (27:53): Hmm. If you actually applied, uh, 1% of what you learned, you would, um, make that over in orders of magnitude, I’m sure. Um, excellent. Kate, thank you so much. And I’m gonna ask you the question that I ask of all of my guests, which is, what is your best financial advice for an early career PhD? And that can be something that we’ve touched on in the interview already, or it could be something completely new.

Kate (28:16): So I’m going to give you, um, the advice that my husband will appreciate <laugh>, because when I met him, I was a postdoc and a financial advisor. So his first question was, how much money are you saving? And I chuckled and said, I’m a postdoc living in LA clearly not a lot if at all. And he was horrified. And so he started getting me to put just a little way a a little sum every paycheck. And then if I got a pay increase, once I started moving into, uh, the administrative roles, every time I got a pay increase, a portion of that went into savings. So I did get a little bit more spending money, but not the whole lot. And that made it much easier. And within a very short period of time, my savings had bloomed. Uh, so not only was I putting into my, um, 401, is it called a 401k, right? That’s what you call it in America. Um, so I hadn’t been doing that and he was utterly horrified. And so I started putting money in my 401, and then in addition I also started putting money into savings. And it just, it just helps. It’s, it, what’s the, I can’t think what the word is, compounds it. The, the amount compounds so you get more money. So the earlier you start, the more money you have at the end. And I can’t believe that that is the advice, advice that I’m giving because he would be so happy <laugh>. But it’s, it’s a really important thing. And as a postdoc, I just didn’t think I earned enough money to do that. And he just sat me down and was like, at some point, you’re gonna be old and you are going to need money. Thank you honey. Very blunt. Um, and so yes, it kind of hurts the first few months and then you get used to it and then it’s really hard not to touch that money because you’re like, Ooh, I really want that thing and I’ve got the cash right here. Um, but you are thinking about your future self and your future self. Well, thank you. When you’re older and you have a cushion.

Emily (30:20): Absolutely. I mean, it’s excellent advice and I, I like hearing it from you as like, I mean, obviously you’re teaching negotiation, but not as a natural personal finance person, right? Like, you learn this from the person who became your husband and you implemented it in a time when you didn’t think you could. And I think that’s so common before we start saving in an intentional way. We always think it’s impossible. I thought the same thing. So, but it’s like, well, like he said, at some point you just have to do it because your future self needs this money. So just get started and like you said, in a small way and as you progress through your career, as we’ve been talking about, you negotiate for more, you put part of that raise, you know, increase your savings rate, part of is spend on lifestyle. Perfect. Perfect. Everybody’s happy. So I love that advice. Kate, thank you so much for coming on the podcast. It was a pleasure to meet you at NPA and I’m so glad we got to record this, uh, conversation from my audience.

Kate (31:09): Thank you for having me, Emily.

Outro

Emily (31:21): Listeners, thank you for joining me for this episode! I have a gift for you! You know that final question I ask of all my guests regarding their best financial advice? My team has collected short summaries of all the answers ever given on the podcast into a document that is updated with each new episode release. You can gain access to it by registering for my mailing list at PFforPhDs.com/advice/. Would you like to access transcripts or videos of each episode? I link the show notes for each episode from PFforPhDs.com/podcast/. See you in the next episode, and remember: You don’t have to have a PhD to succeed with personal finance… but it helps! Nothing you hear on this podcast should be taken as financial, tax, or legal advice for any individual. The music is “Stages of Awakening” by Podington Bear from the Free Music Archive and is shared under CC by NC. Podcast editing by me and show notes creation by Dr. Jill Hoffman.