Even though it’s doubtful that Einstein ever said that compound interest is the most powerful force in the universe, it’s indisputable that it is an incredible tool that can work for or against you.

Compound Interest for Investing

When compound interest works in your favor, an asset that you own earns a return and increases in value. Then that increased asset earns a return and increases by even more. The growth is exponential.

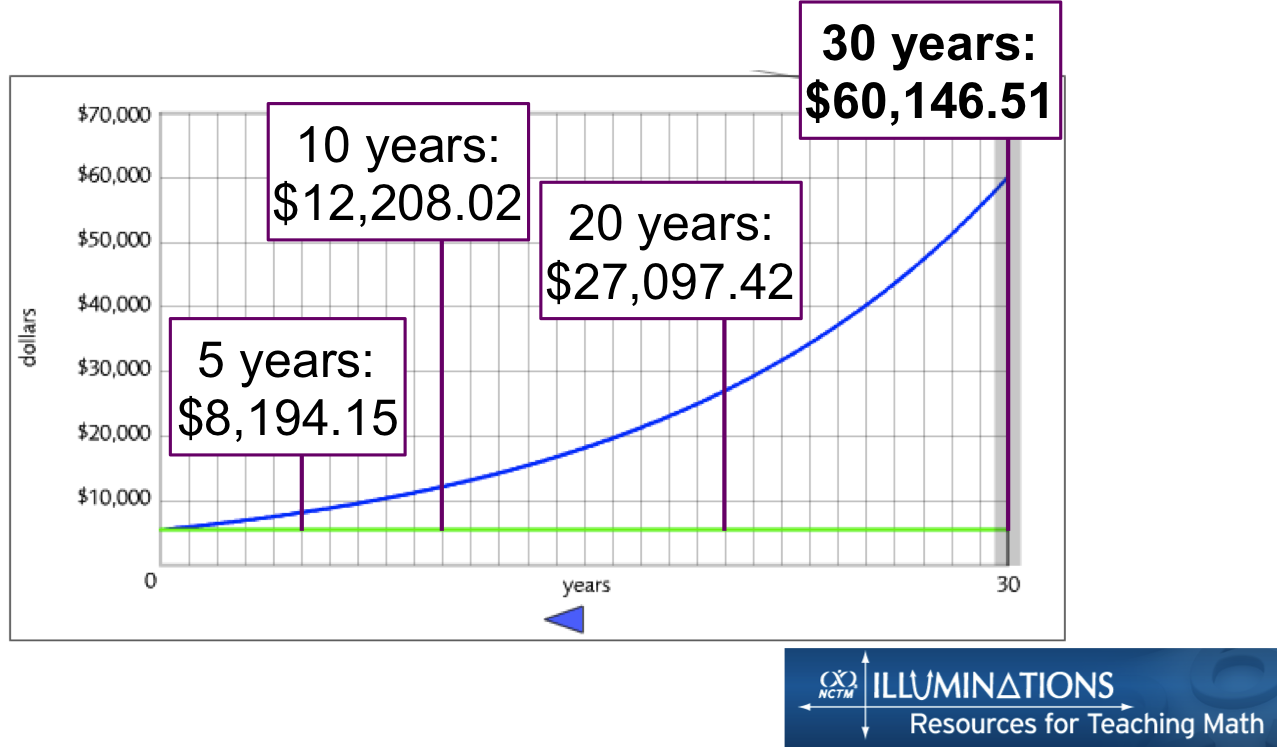

As an example, see how a one-time investment of $5,500 will grow over time if invested with an average rate of return of 8%. After 30 years, the investment balance has grown to over $60,000, with over half of that growth occurring in the last 10 years.

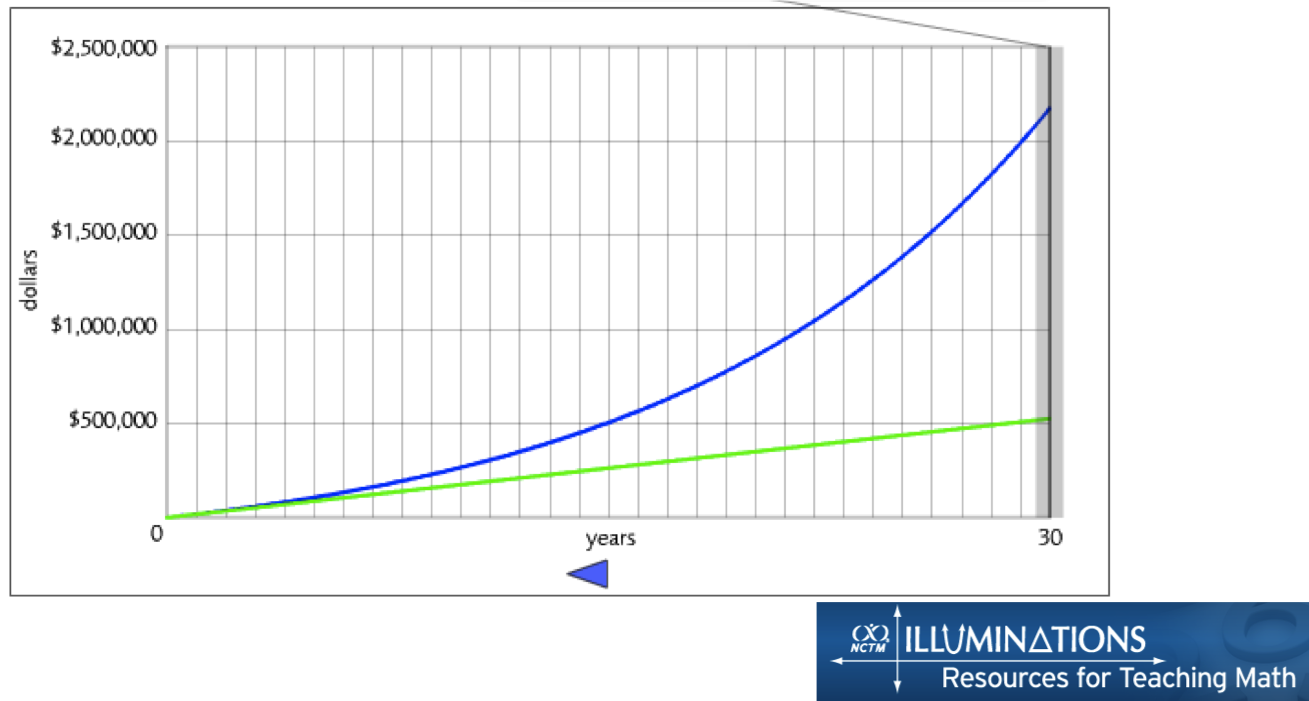

Investing on a regular basis is how Millennials are likely to provide for their own retirements now that pensions have all but disappeared and Social Security is uncertain. If you max out a 401(k) every year for 30 years with an 8% average rate of return, over 30 years you will have contributed $524,880 but your investment balance at the end will be $2,172,944.

You can create your own projects of the effect of compound interest using Illuminations.

GSF Reader Post: My Realistic Career Earnings Expectations Push Me to Save Aggressively

Compound Interest in Debt

Compound interest can work against you in the case of debt. When you owe a given amount at a certain interest rate, the amount you owe will also increase exponentially unless you make payments that more than keep up with the growth.

Compound Interest in Inflation Risk

One great reason to invest that most people don’t consider is inflation risk. The average historical inflation rate is around 3-4% per year. That means that every year your money goes 3-4% less far in terms of real purchasing power and the prices will double approximately every 20 years. If you don’t invest at a rate that at least keeps pace with inflation, the value of your money decreases with time. To build wealth through investing, you must earn a return that exceeds the average rate of inflation.